Qatar Commercial Lighting Market Overview

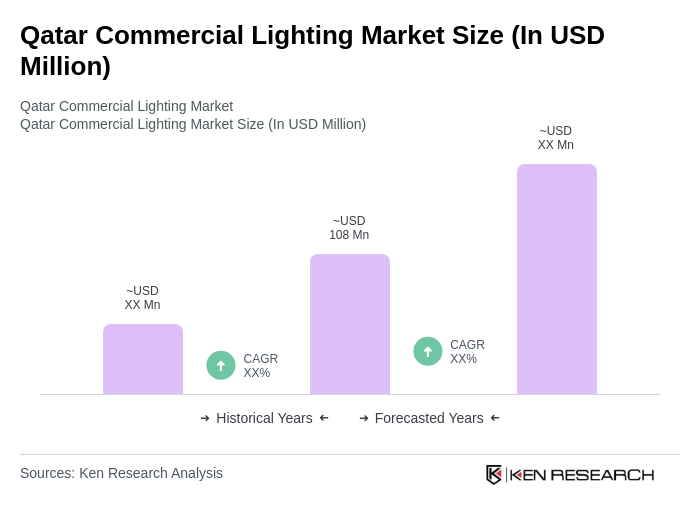

- The Qatar Commercial Lighting Market is valued at approximately USD 108 million, based on a five-year historical analysis. This growth is primarily driven by rapid urbanization, infrastructural development, and a marked shift toward energy-efficient lighting solutions. The increasing demand for smart lighting technologies—such as IoT-enabled and app-controlled systems—and the government’s focus on sustainability initiatives are accelerating market expansion. Customers in Qatar strongly prefer LED and smart lighting due to energy efficiency, long lifespan, and the convenience of digital control, reflecting broader regional and global trends toward automation, sensor-based lighting, and integration with smart building systems.

- Doha remains the dominant city in the Qatar Commercial Lighting Market, owing to its status as the capital and the center of economic activity. The city’s ongoing infrastructure projects, including commercial buildings, public spaces, and major events venues, significantly drive demand for advanced lighting solutions. Other notable areas experiencing growth include Al Rayyan and Lusail, where new commercial developments and urban expansion are creating additional opportunities for lighting providers.

- The Qatar General Electricity & Water Corporation (Kahramaa) has enforced the Qatar Energy Efficiency Standards and Labeling Program, which includes mandatory energy performance standards for lighting products in commercial buildings. These standards, updated periodically, require new commercial constructions to use energy-efficient lighting, with a focus on LED technology, to meet national targets for reduced energy consumption. Compliance is verified through product labeling and certification, and the program is part of Qatar’s broader National Energy Efficiency Program aimed at lowering the country’s carbon footprint.

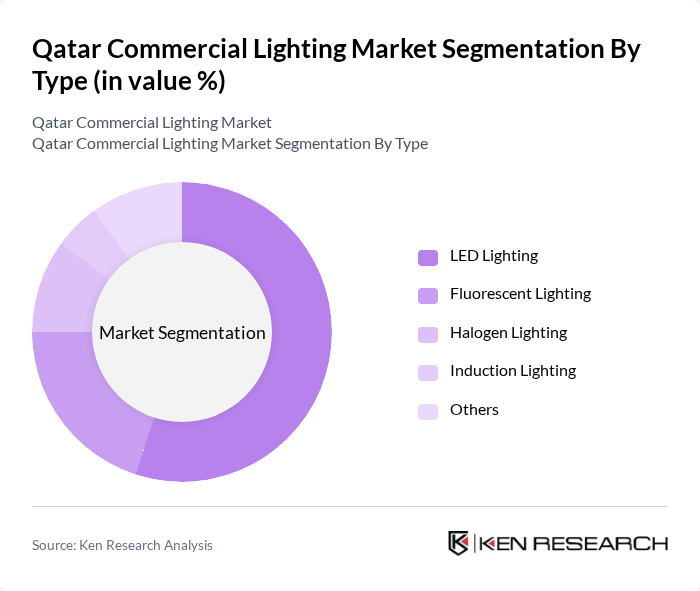

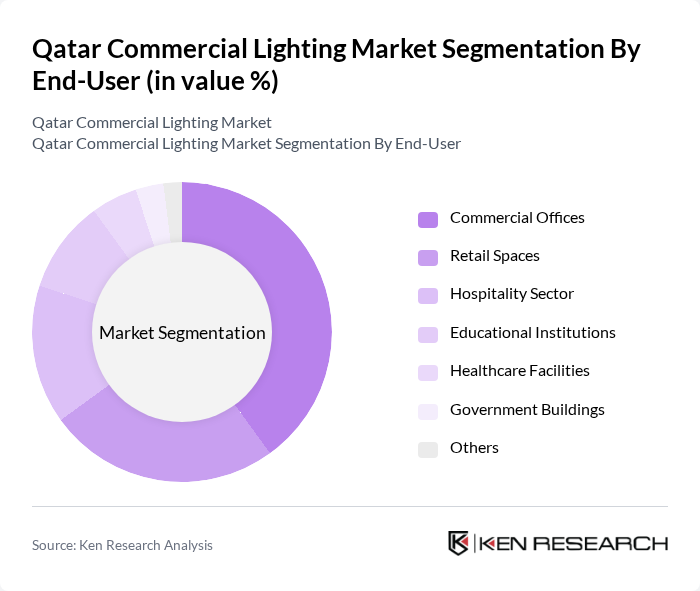

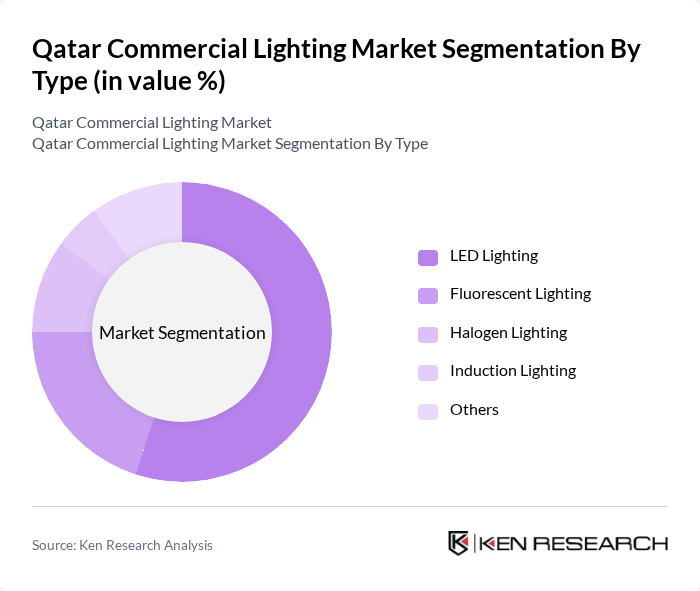

Qatar Commercial Lighting Market Segmentation

By Type:The market is segmented into LED Lighting, Fluorescent Lighting, Halogen Lighting, Induction Lighting, and Others. LED Lighting dominates due to its superior energy efficiency, longer lifespan, and declining costs, making it the preferred choice for commercial applications. The shift toward sustainability and energy conservation has accelerated LED adoption across sectors, with smart lighting solutions gaining traction in high-value projects. Fluorescent and halogen lighting still hold residual shares, primarily in legacy installations, but are being phased out in favor of more efficient alternatives.

By End-User:The end-user segmentation includes Commercial Offices, Retail Spaces, Hospitality Sector, Educational Institutions, Healthcare Facilities, Government Buildings, and Others. Commercial Offices lead the market, driven by the proliferation of office spaces and the demand for modern, productivity-enhancing lighting. Retail Spaces are also significant, as businesses invest in lighting to improve customer experience and visual merchandising. The Hospitality Sector, Educational Institutions, and Healthcare Facilities are adopting advanced lighting for ambiance, safety, and operational efficiency, while Government Buildings focus on compliance with national energy standards.

Qatar Commercial Lighting Market Competitive Landscape

The Qatar Commercial Lighting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Signify N.V. (formerly Philips Lighting), Osram Licht AG, GE Lighting (a Savant company), Cree Lighting (now part of IDEAL INDUSTRIES, Inc.), Zumtobel Group AG, Acuity Brands, Inc., Eaton Corporation, Hubbell Incorporated, Legrand S.A., Lutron Electronics Co., Inc., Panasonic Corporation, Schneider Electric SE, Samsung Electronics Co., Ltd., Toshiba Corporation, Al Mana Lighting (local distributor and solutions provider), Qatar Lighting Company (local manufacturer and integrator), Al Muftah Group (local distributor and service provider) contribute to innovation, geographic expansion, and service delivery in this space.

Qatar Commercial Lighting Market Industry Analysis

Growth Drivers

- Increasing Urbanization:Qatar's urban population is projected to reach approximately 2.9 million in the future, driven by rapid urbanization. This growth necessitates enhanced commercial lighting solutions to support infrastructure development. The government has allocated around $220 billion for urban projects, including smart city initiatives, which will significantly boost demand for advanced lighting systems. As urban areas expand, the need for efficient and aesthetically pleasing lighting solutions becomes paramount, further propelling market growth.

- Government Infrastructure Projects:The Qatari government is investing heavily in infrastructure, with over $120 billion earmarked for projects leading up to the future FIFA World Cup and beyond. This includes the construction of new commercial spaces, roads, and public facilities, all requiring modern lighting solutions. The focus on sustainable and energy-efficient lighting aligns with Qatar's National Vision 2030, which aims to enhance the quality of life and promote economic diversification, thereby driving market demand.

- Rising Demand for Energy Efficiency:Qatar's commitment to reducing energy consumption is evident, with a target to decrease energy use by 35% in the future. This has led to a surge in demand for energy-efficient lighting solutions, particularly LED technology, which consumes up to 80% less energy than traditional lighting. The government’s initiatives, such as the Qatar Green Building Council, promote energy-efficient practices, further stimulating the commercial lighting market as businesses seek to comply with these standards.

Market Challenges

- High Initial Investment Costs:The transition to advanced lighting solutions, particularly LEDs and smart systems, often involves significant upfront costs. For instance, the installation of a comprehensive LED system in commercial buildings can exceed $60,000, which may deter smaller businesses from upgrading. This financial barrier is compounded by the need for specialized installation and maintenance, making it a critical challenge for market penetration and growth in Qatar's commercial lighting sector.

- Regulatory Compliance Issues:Navigating the regulatory landscape in Qatar can be complex, particularly concerning energy efficiency standards and safety regulations. Compliance with local laws, such as the Qatar Construction Specifications, requires businesses to invest time and resources in understanding and adhering to these regulations. Failure to comply can result in penalties and project delays, posing a significant challenge for companies looking to enter or expand within the commercial lighting market.

Qatar Commercial Lighting Market Future Outlook

The Qatar commercial lighting market is poised for significant transformation, driven by technological advancements and a strong focus on sustainability. As urbanization continues, the integration of smart lighting solutions will enhance energy efficiency and user experience. Additionally, the government's commitment to green building initiatives will further stimulate demand for innovative lighting technologies. With a growing emphasis on aesthetic design and functionality, the market is expected to evolve, presenting new opportunities for businesses to innovate and meet consumer needs effectively.

Market Opportunities

- Expansion of Smart City Initiatives:Qatar's investment in smart city projects, estimated at $60 billion, presents a significant opportunity for commercial lighting providers. These initiatives will require advanced lighting systems integrated with IoT technology, enhancing energy management and operational efficiency. Companies that can offer innovative solutions tailored to smart city frameworks will likely capture substantial market share.

- Growth in Green Building Projects:With Qatar's focus on sustainable development, the green building sector is expected to grow significantly, with over 1,200 green building projects anticipated in the future. This growth will drive demand for energy-efficient lighting solutions that comply with sustainability standards. Companies that align their products with green building certifications will find lucrative opportunities in this expanding market segment.