Region:Middle East

Author(s):Dev

Product Code:KRAD3313

Pages:95

Published On:November 2025

Market.png)

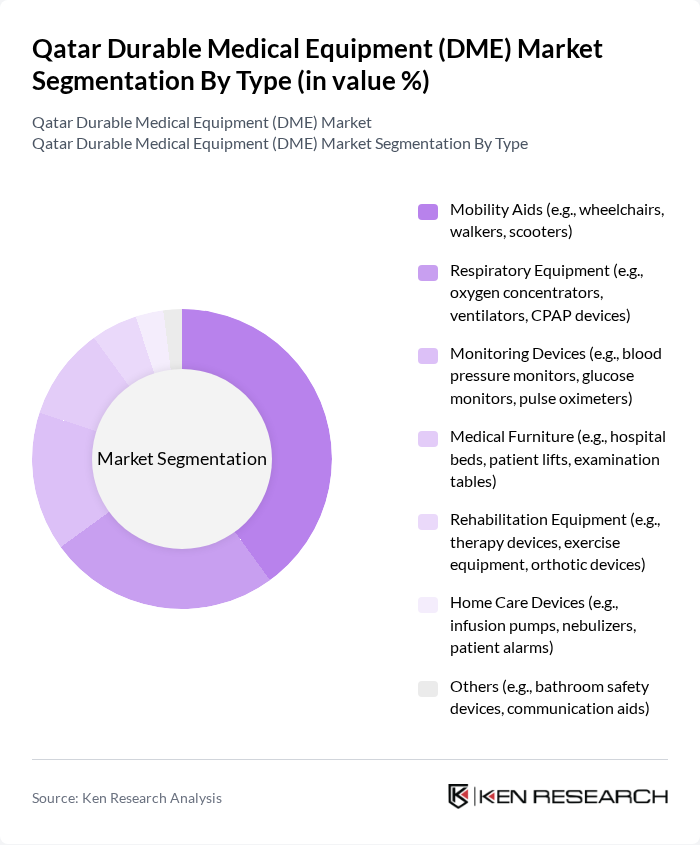

By Type:The DME market can be segmented into various types, including Mobility Aids, Respiratory Equipment, Monitoring Devices, Medical Furniture, Rehabilitation Equipment, Home Care Devices, and Others. Among these, Mobility Aids and Respiratory Equipment are particularly significant due to the increasing number of elderly individuals and patients with respiratory conditions. The demand for these products is driven by the need for improved mobility and respiratory support, which are essential for enhancing the quality of life for patients. The market is also witnessing rising demand for monitoring devices and home care solutions, reflecting a shift toward decentralized and patient-centric care .

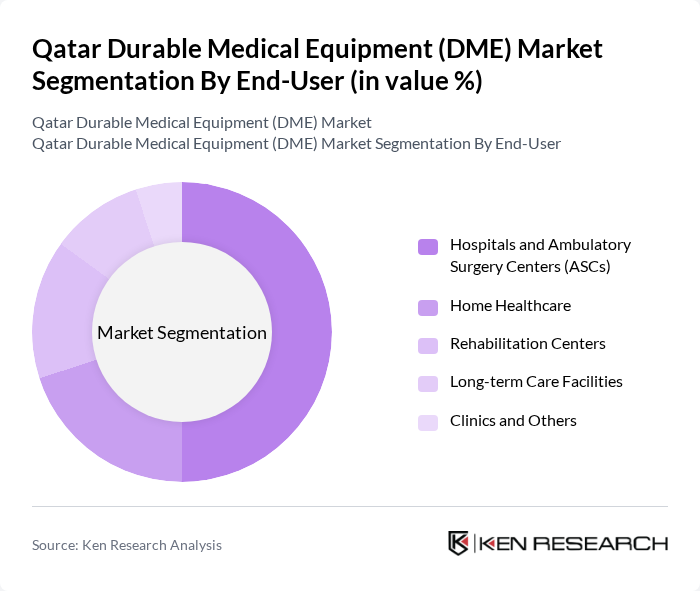

By End-User:The DME market is segmented by end-users, including Hospitals and Ambulatory Surgery Centers (ASCs), Home Healthcare, Rehabilitation Centers, Long-term Care Facilities, and Clinics. Hospitals and ASCs dominate the market due to their high demand for advanced medical equipment to support a wide range of medical procedures. The increasing number of surgeries and outpatient services in these facilities drives the need for durable medical equipment, ensuring patient safety and effective treatment. Home healthcare is also a rapidly growing segment, supported by government initiatives and the adoption of telemedicine and remote monitoring solutions .

The Qatar Durable Medical Equipment (DME) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic, Philips Healthcare, Siemens Healthineers, GE Healthcare, Baxter International, Hillrom (now part of Baxter), Invacare Corporation, Arjo, Stryker Corporation, 3M Health Care, B. Braun Melsungen AG, Terumo Corporation, Smith & Nephew, Fresenius Medical Care, Cardinal Health, Ali Bin Ali Medical (Qatar), Al Danah Medical Company (Qatar), Al Faisal Holding (Qatar) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the DME market in Qatar appears promising, driven by the increasing demand for home healthcare solutions and the integration of advanced technologies. As the healthcare system evolves, there will be a greater emphasis on patient-centric care, leading to innovations in product design and functionality. Additionally, partnerships between DME manufacturers and healthcare providers are expected to enhance service delivery, ensuring that patients receive timely access to necessary medical equipment and support.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobility Aids (e.g., wheelchairs, walkers, scooters) Respiratory Equipment (e.g., oxygen concentrators, ventilators, CPAP devices) Monitoring Devices (e.g., blood pressure monitors, glucose monitors, pulse oximeters) Medical Furniture (e.g., hospital beds, patient lifts, examination tables) Rehabilitation Equipment (e.g., therapy devices, exercise equipment, orthotic devices) Home Care Devices (e.g., infusion pumps, nebulizers, patient alarms) Others (e.g., bathroom safety devices, communication aids) |

| By End-User | Hospitals and Ambulatory Surgery Centers (ASCs) Home Healthcare Rehabilitation Centers Long-term Care Facilities Clinics and Others |

| By Distribution Channel | Direct Sales Online Retail Medical Supply Stores Wholesalers/Distributors Others |

| By Application | Chronic Disease Management Post-operative Care Elderly Care Disability Support Others |

| By Technology | Manual Equipment Electrically Powered Equipment Smart Medical Devices (IoT-enabled, connected devices) Others |

| By Region | Doha Al Rayyan Umm Salal Al Wakrah Others |

| By Policy Support | Subsidies for Medical Equipment Tax Incentives for Healthcare Providers Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 60 | Procurement Managers, Supply Chain Coordinators |

| Home Healthcare Providers | 50 | Home Care Managers, Patient Care Coordinators |

| Medical Equipment Retailers | 40 | Store Managers, Sales Representatives |

| Patient Advocacy Groups | 40 | Patient Advocates, Community Health Workers |

| Insurance Companies | 40 | Claims Managers, Policy Underwriters |

The Qatar Durable Medical Equipment (DME) market is valued at approximately USD 1.1 billion, reflecting significant growth driven by an aging population, chronic diseases, and advancements in medical technology.