Region:Middle East

Author(s):Shubham

Product Code:KRAB6202

Pages:93

Published On:October 2025

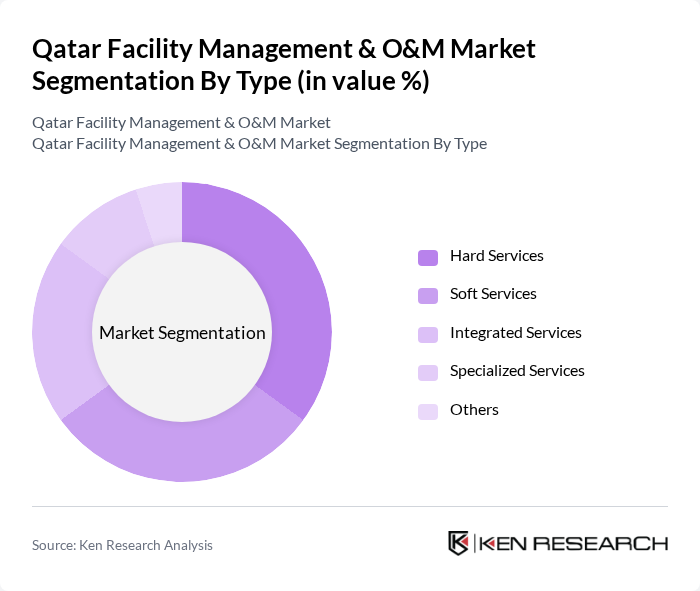

By Type:The market is segmented into various types, including Hard Services, Soft Services, Integrated Services, Specialized Services, and Others. Each of these segments plays a crucial role in the overall facility management landscape, catering to different operational needs and client requirements.

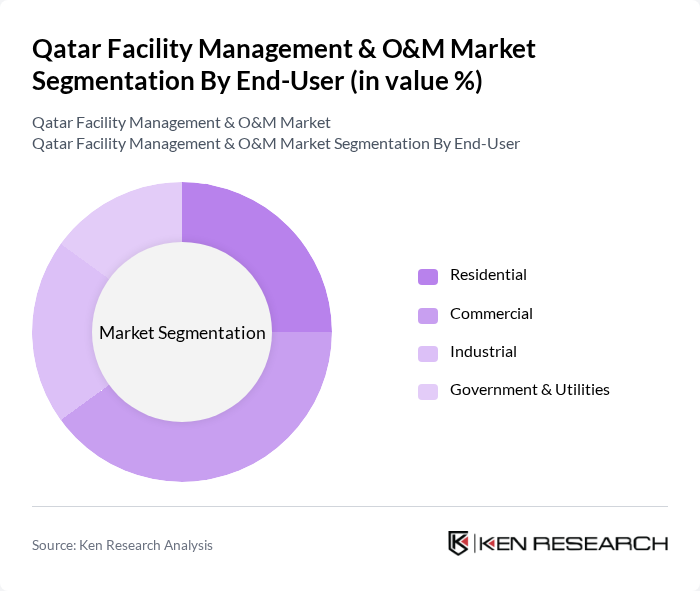

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. Each segment has distinct requirements and contributes differently to the overall market dynamics.

The Qatar Facility Management & O&M Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatari Diar, Qatar Cool, Al-Futtaim Engineering, Imdaad, Farnek Services, EFS Facilities Services, Al Jazeera Facilities Management, Al Habtoor Group, Serco Group, ISS Facility Services, G4S Qatar, Mace Group, CBRE Group, JLL (Jones Lang LaSalle), Cushman & Wakefield contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar facility management and O&M market appears promising, driven by ongoing urbanization and government initiatives aimed at enhancing infrastructure. As the country prepares for major events like the FIFA World Cup in the future, investments in smart technologies and sustainable practices are expected to accelerate. Additionally, the integration of IoT and AI in facility management will likely streamline operations, improve efficiency, and enhance service delivery, positioning the sector for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Integrated Services Specialized Services Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Service Model | Outsourced In-House Hybrid |

| By Sector | Healthcare Education Retail Hospitality |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Contract Type | Fixed-Price Contracts Time and Material Contracts Performance-Based Contracts |

| By Duration | Short-Term Contracts Long-Term Contracts Project-Based Contracts |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Real Estate Management | 100 | Facility Managers, Property Developers |

| Healthcare Facility Operations | 80 | Operations Directors, Maintenance Supervisors |

| Hospitality Sector Services | 70 | Hotel Managers, Service Quality Directors |

| Educational Institution Maintenance | 60 | Campus Facility Managers, Administrative Heads |

| Government Infrastructure Projects | 90 | Project Managers, Compliance Officers |

The Qatar Facility Management & O&M Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by urbanization, infrastructure development, and the demand for efficient operational management across various sectors.