Region:Asia

Author(s):Shubham

Product Code:KRAB3788

Pages:87

Published On:October 2025

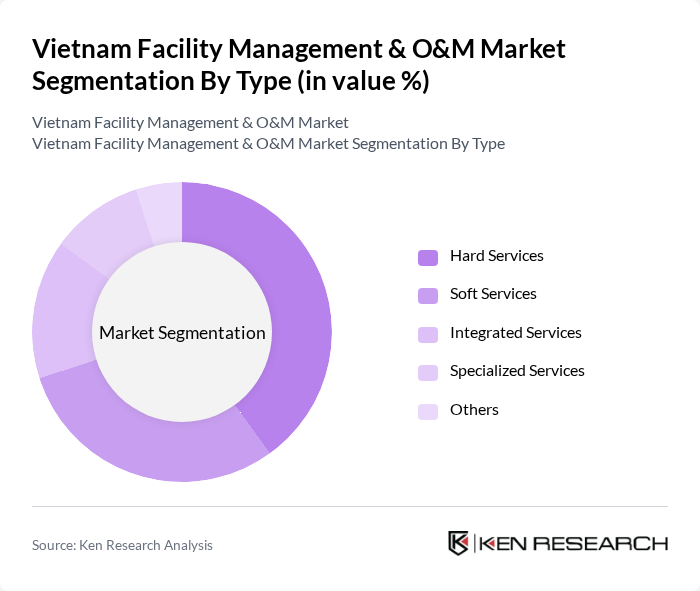

By Type:The market is segmented into various types of services, including Hard Services, Soft Services, Integrated Services, Specialized Services, and Others. Each of these segments plays a crucial role in addressing the diverse needs of clients across different sectors.

The Hard Services segment is currently dominating the market, accounting for a significant portion of the overall revenue. This dominance can be attributed to the essential nature of maintenance and repair services required for buildings and facilities, which are critical for operational continuity. As businesses increasingly focus on maintaining their assets and ensuring safety compliance, the demand for hard services, including mechanical, electrical, and plumbing maintenance, continues to rise. Additionally, the trend towards outsourcing these services to specialized providers is further propelling growth in this segment.

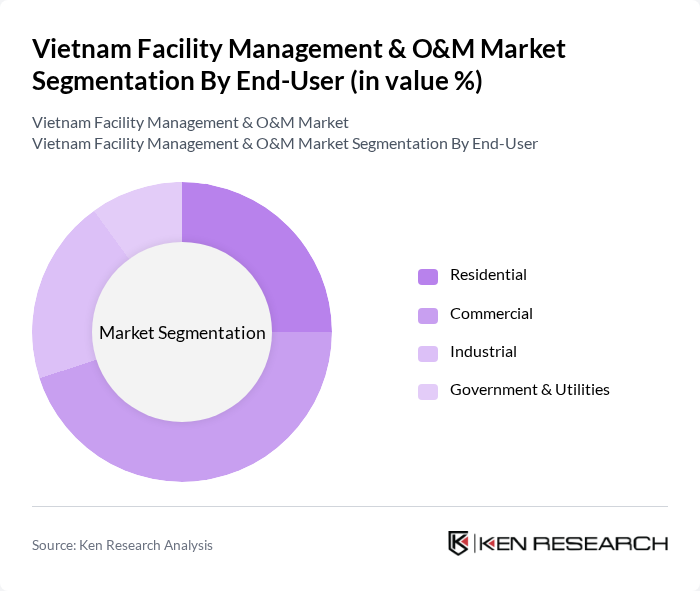

By End-User:The market is segmented based on end-users, including Residential, Commercial, Industrial, and Government & Utilities. Each end-user category has distinct requirements and preferences for facility management services.

The Commercial segment is the leading end-user category, driven by the rapid growth of office spaces, retail establishments, and mixed-use developments in urban areas. As businesses seek to enhance their operational efficiency and focus on core activities, they increasingly rely on professional facility management services to handle maintenance, security, and cleaning. This trend is particularly pronounced in major cities where the concentration of commercial activities necessitates high-quality facility management solutions to meet the demands of tenants and customers.

The Vietnam Facility Management & O&M Market is characterized by a dynamic mix of regional and international players. Leading participants such as JLL Vietnam, CBRE Vietnam, Savills Vietnam, Cushman & Wakefield Vietnam, ISS Facility Services Vietnam, Sodexo Vietnam, G4S Vietnam, Apleona Vietnam, VFM Group, HBI Group, VinaCapital, An Phat Holdings, Viettel Group, FPT Group, CMC Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam facility management market appears promising, driven by urbanization, technological advancements, and increasing demand for outsourced services. As the government continues to invest in infrastructure and smart city initiatives, facility management companies will need to adapt to evolving market needs. The integration of sustainable practices and smart technologies will be crucial for companies aiming to enhance operational efficiency and meet regulatory requirements, positioning them favorably in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Integrated Services Specialized Services Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Office Buildings Retail Spaces Healthcare Facilities Educational Institutions Others |

| By Service Model | Outsourced Services In-House Services Hybrid Model |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Government Subsidies Tax Exemptions Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Facility Management | 100 | Facility Managers, Operations Directors |

| Healthcare Facility Operations | 80 | Healthcare Administrators, Maintenance Supervisors |

| Educational Institution Management | 70 | Campus Facility Managers, Administrative Heads |

| Industrial Facility Maintenance | 90 | Plant Managers, Safety Officers |

| Residential Property Management | 60 | Property Managers, Community Directors |

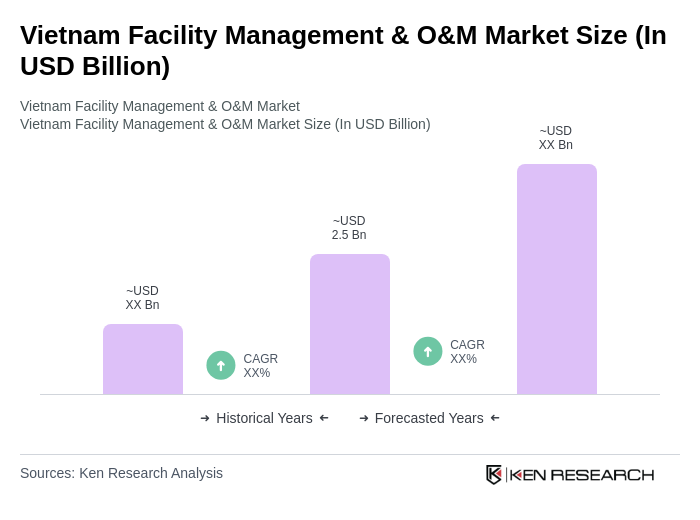

The Vietnam Facility Management & O&M Market is valued at approximately USD 2.5 billion, driven by urbanization, foreign investment, and the demand for professional services across commercial, residential, and industrial sectors.