Region:Middle East

Author(s):Rebecca

Product Code:KRAD2903

Pages:88

Published On:November 2025

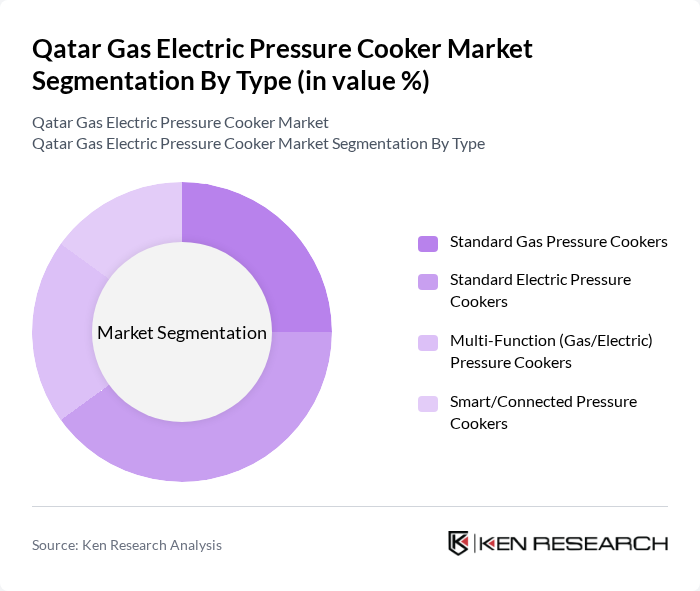

By Type:The market is segmented into four main types: Standard Gas Pressure Cookers, Standard Electric Pressure Cookers, Multi-Function (Gas/Electric) Pressure Cookers, and Smart/Connected Pressure Cookers. Among these, Standard Electric Pressure Cookers are gaining significant traction due to their ease of use and energy efficiency. The trend towards smart cooking solutions is also on the rise, with Smart/Connected Pressure Cookers appealing to tech-savvy consumers. Multi-function models are increasingly preferred for their versatility in both gas and electric cooking environments .

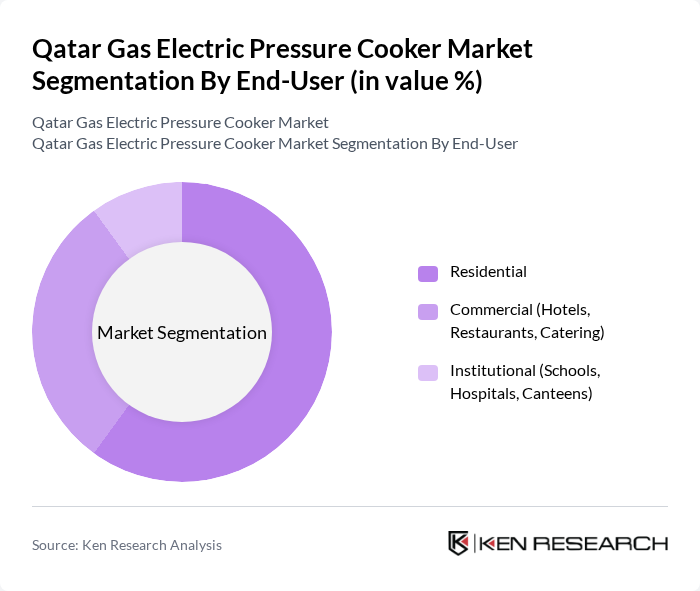

By End-User:The market is categorized into Residential, Commercial (Hotels, Restaurants, Catering), and Institutional (Schools, Hospitals, Canteens) segments. The Residential segment is the largest, driven by the growing trend of home cooking and the increasing number of households investing in modern kitchen appliances. Commercial establishments are also adopting electric pressure cookers for their efficiency and speed in food preparation, particularly in response to rising labor costs and the need for rapid service in hotels and restaurants .

The Qatar Gas Electric Pressure Cooker Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips (Koninklijke Philips N.V.), Tefal (Groupe SEB), Instant Pot (Instant Brands Inc.), Black+Decker (Stanley Black & Decker, Inc.), Cuisinart (Conair Corporation), Prestige (TTK Prestige Ltd.), Morphy Richards (Glen Dimplex Group), Panasonic (Panasonic Corporation), Breville (Breville Group Limited), Zojirushi (Zojirushi Corporation), Hamilton Beach (Hamilton Beach Brands Holding Company), Crock-Pot (Newell Brands Inc.), Aroma Housewares (Aroma Housewares Company), Russell Hobbs (Spectrum Brands Holdings, Inc.), Kenwood (Kenwood Limited, De'Longhi Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the gas electric pressure cooker market in Qatar appears promising, driven by technological advancements and changing consumer preferences. As more households embrace smart home technologies, the integration of IoT features in cooking appliances is expected to gain traction. Additionally, the increasing focus on sustainability will likely push manufacturers to innovate eco-friendly products, aligning with global trends. These factors will create a conducive environment for market growth, enhancing the overall consumer experience in the kitchen.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard Gas Pressure Cookers Standard Electric Pressure Cookers Multi-Function (Gas/Electric) Pressure Cookers Smart/Connected Pressure Cookers |

| By End-User | Residential Commercial (Hotels, Restaurants, Catering) Institutional (Schools, Hospitals, Canteens) |

| By Material | Stainless Steel Aluminum Non-Stick Coated Others (Composite, Ceramic-Coated) |

| By Capacity | Less than 3 Liters to 5 Liters More than 5 Liters |

| By Distribution Channel | Online Retail (E-commerce Platforms) Offline Retail (Hypermarkets, Specialty Stores) Direct Sales (Brand Stores, Distributors) |

| By Brand | Local Qatari Brands International Brands Private Labels |

| By Price Range | Budget Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Household Electric Pressure Cooker Users | 150 | Homeowners, Cooking Enthusiasts |

| Retailers of Kitchen Appliances | 40 | Store Managers, Sales Representatives |

| Professional Chefs and Culinary Experts | 50 | Restaurant Owners, Culinary Instructors |

| Market Analysts and Industry Experts | 40 | Market Researchers, Industry Consultants |

| Consumers Interested in Kitchen Innovations | 80 | Tech-Savvy Home Cooks, Food Bloggers |

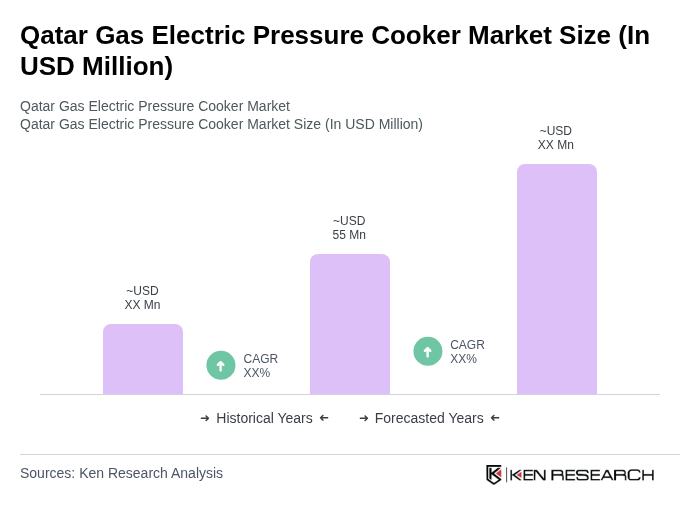

The Qatar Gas Electric Pressure Cooker Market is valued at approximately USD 55 million, reflecting a growing demand for convenient and energy-efficient cooking solutions, particularly during the pandemic and amidst rising home cooking trends.