Region:Middle East

Author(s):Rebecca

Product Code:KRAC2551

Pages:97

Published On:October 2025

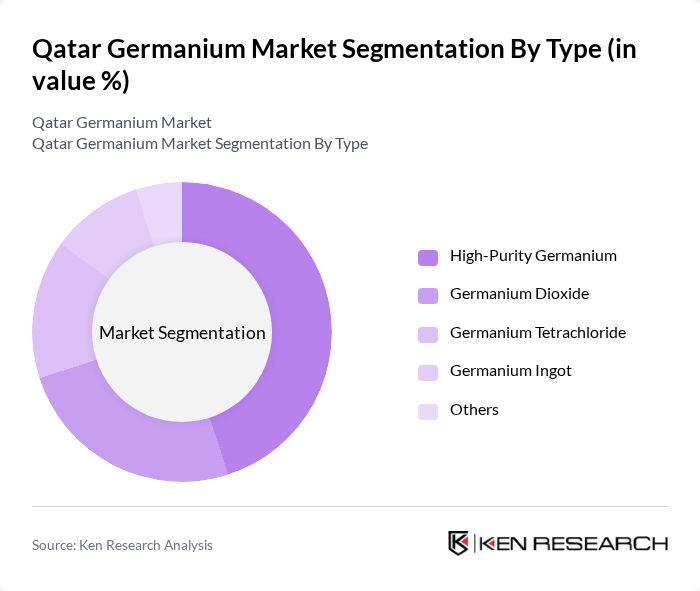

By Type:The market is segmented into various types, including High-Purity Germanium, Germanium Dioxide, Germanium Tetrachloride, Germanium Ingot, and Others. High-Purity Germanium is the leading sub-segment due to its extensive use in semiconductor applications, which are critical for the electronics industry. The demand for high-purity materials is driven by technological advancements and the increasing miniaturization of electronic devices. Germanium Dioxide and Germanium Tetrachloride also hold significant market shares, primarily due to their applications in fiber optics and chemical processes.

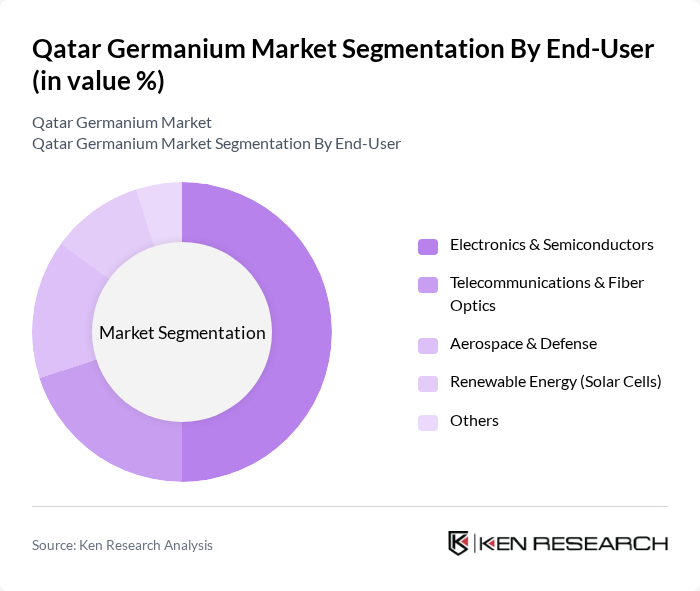

By End-User:The end-user segmentation includes Electronics & Semiconductors, Telecommunications & Fiber Optics, Aerospace & Defense, Renewable Energy (Solar Cells), and Others. The Electronics & Semiconductors segment dominates the market, driven by the increasing demand for high-performance electronic devices and components. Telecommunications & Fiber Optics also play a crucial role, as germanium is essential for manufacturing fiber optic cables and components. The Renewable Energy segment is growing rapidly due to the rising adoption of solar technologies that utilize germanium-based materials.

The Qatar Germanium Market is characterized by a dynamic mix of regional and international players. Leading participants such as Umicore, Teck Resources Limited, Yunnan Tin Company Limited, AXT Inc., Coherent Corp. (formerly II-VI Incorporated), Japan Synthetic Rubber Co., Ltd. (JSR Corporation), American Elements, Indium Corporation, 5N Plus Inc., DOWA Holdings Co., Ltd., JSC Germanium, PPM Pure Metals GmbH, Photonic Sense GmbH, China Germanium Co., Ltd., Umicore Specialty Materials Qatar LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the germanium market in Qatar appears promising, driven by the increasing integration of advanced technologies in various sectors. As the demand for high-performance electronics and renewable energy solutions continues to rise, the market is likely to experience robust growth. Additionally, the focus on sustainable mining practices and the adoption of innovative manufacturing techniques will enhance operational efficiencies, positioning Qatar as a key player in the global germanium supply chain.

| Segment | Sub-Segments |

|---|---|

| By Type | High-Purity Germanium Germanium Dioxide Germanium Tetrachloride Germanium Ingot Others |

| By End-User | Electronics & Semiconductors Telecommunications & Fiber Optics Aerospace & Defense Renewable Energy (Solar Cells) Others |

| By Application | Fiber Optics Infrared Optics & Thermal Imaging Solar Cells (Photovoltaics) PET (Polyethylene Terephthalate) Catalysts Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Others |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electronics Manufacturing | 120 | Product Managers, Supply Chain Analysts |

| Solar Energy Applications | 90 | Project Managers, Technical Directors |

| Optoelectronics Sector | 70 | Research Scientists, Development Engineers |

| Telecommunications Equipment | 60 | Procurement Managers, Operations Directors |

| Specialty Alloys and Coatings | 50 | Quality Control Managers, Production Supervisors |

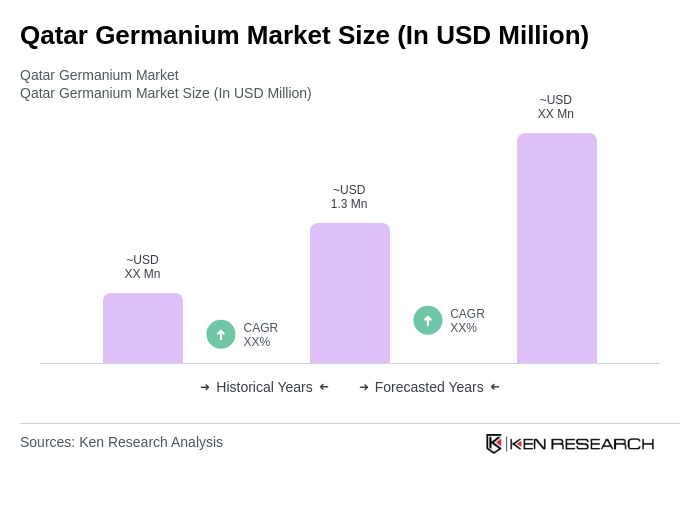

The Qatar Germanium Market is valued at approximately USD 1.3 million, reflecting a five-year historical analysis. This valuation is influenced by the growing demand for high-purity germanium in electronics, semiconductors, and renewable energy technologies.