Region:Asia

Author(s):Shubham

Product Code:KRAC0718

Pages:83

Published On:August 2025

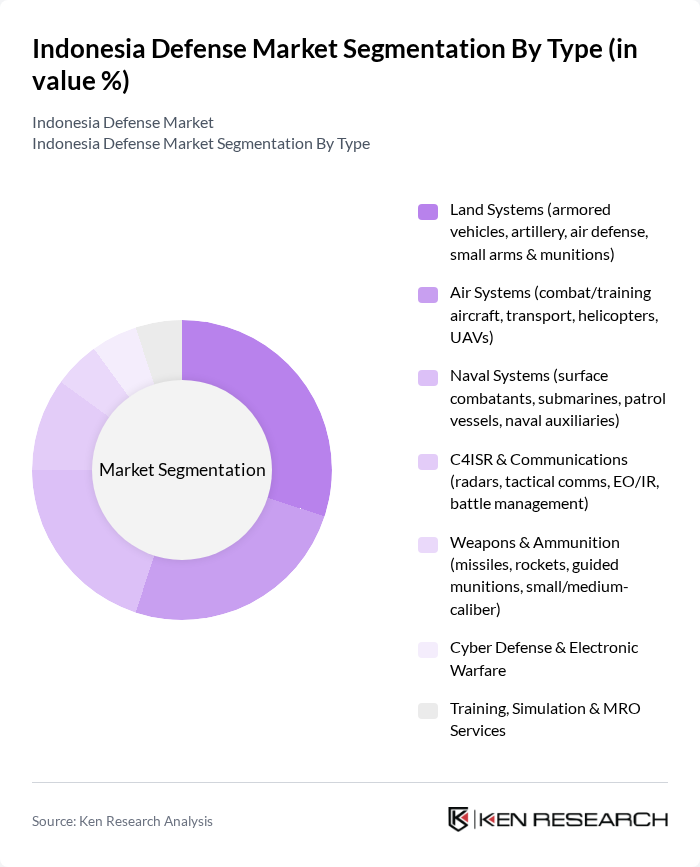

By Type:The defense market in Indonesia can be segmented into various types, including land systems, air systems, naval systems, C4ISR & communications, weapons & ammunition, cyber defense & electronic warfare, and training, simulation & MRO services. Each of these segments plays a crucial role in enhancing the operational capabilities of the Indonesian military.

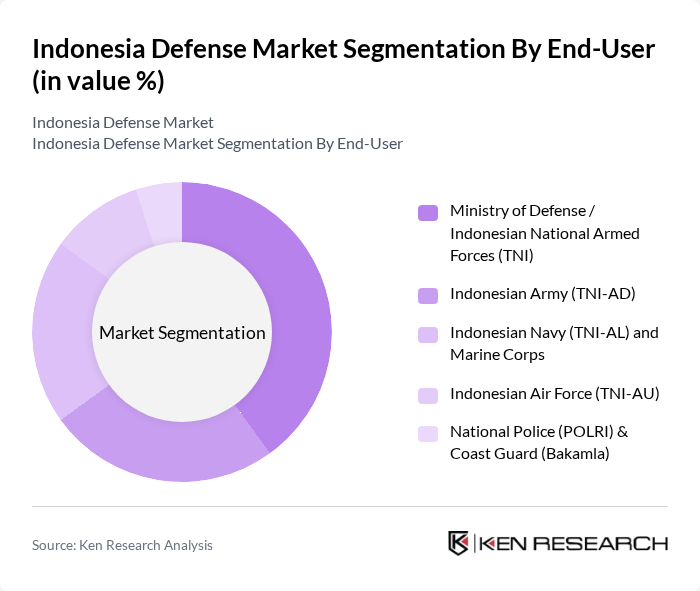

By End-User:The end-user segmentation of the defense market includes the Ministry of Defense, Indonesian Army, Indonesian Navy, Indonesian Air Force, and National Police & Coast Guard. Each of these entities has distinct requirements and priorities, influencing their procurement strategies and the types of defense systems they invest in.

The Indonesia Defense Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Pindad (Persero), PT Dirgantara Indonesia (Persero), PT PAL Indonesia (Persero), PT Len Industri (Persero), PT Dahana (Persero), PT Hariff Daya Tunggal Engineering, PT Infoglobal Teknologi Semesta, PT Lundin Industry Invest (North Sea Boats), PT Sari Bahari, PT KPI (Krakatau Posco) & PT Krakatau Steel (Persero) Tbk, PT Tespa Teknologi Indonesia, Thales Group, Lockheed Martin Corporation, Boeing Defense, Space & Security, Airbus Defence and Space, Naval Group, Rheinmetall AG, BAE Systems plc contribute to innovation, geographic expansion, and service delivery in this space.

The Indonesia defense market is poised for significant transformation as the government continues to prioritize military modernization and regional security. With a projected defense budget increase to IDR 150 trillion (USD 10.5 billion) in future, investments in advanced technologies and strategic partnerships will likely enhance operational capabilities. Additionally, the focus on cybersecurity and asymmetric warfare will shape defense strategies, ensuring that Indonesia remains resilient against emerging threats while fostering a robust domestic defense industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Land Systems (armored vehicles, artillery, air defense, small arms & munitions) Air Systems (combat/training aircraft, transport, helicopters, UAVs) Naval Systems (surface combatants, submarines, patrol vessels, naval auxiliaries) C4ISR & Communications (radars, tactical comms, EO/IR, battle management) Weapons & Ammunition (missiles, rockets, guided munitions, small/medium-caliber) Cyber Defense & Electronic Warfare Training, Simulation & MRO Services |

| By End-User | Ministry of Defense / Indonesian National Armed Forces (TNI) Indonesian Army (TNI-AD) Indonesian Navy (TNI-AL) and Marine Corps Indonesian Air Force (TNI-AU) National Police (POLRI) & Coast Guard (Bakamla) |

| By Application | Combat Operations Intelligence, Surveillance, Reconnaissance (ISR) & Border/Maritime Security Logistics, Maintenance & Support Training & Force Development |

| By Procurement Type | Direct Foreign Procurement (G2G/FMS, offsets, ToT) Domestic Procurement (state-owned enterprises and local vendors) Joint Development/Offsets & Public-Private Partnerships |

| By Funding Source | State Budget (APBN) & Multi-Year Contracts Export Credit/Loans & International Financing Private/Commercial Financing & Leasing |

| By Distribution Channel | Direct Government Tenders OEM–SOE Partnerships and System Integrators Authorized Agents/Distributors |

| By Policy Support | Local Content (TKDN) & Technology Transfer (ToT) Industrial Participation & Offset Programs R&D Grants and State-Backed Innovation Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Procurement Processes | 100 | Procurement Officers, Defense Analysts |

| Local Defense Contractors | 80 | Business Development Managers, Operations Directors |

| International Defense Partnerships | 60 | Foreign Affairs Specialists, Defense Attachés |

| Military Equipment Needs Assessment | 75 | Military Strategists, Equipment Managers |

| Defense Policy Impact Analysis | 50 | Policy Makers, Defense Economists |

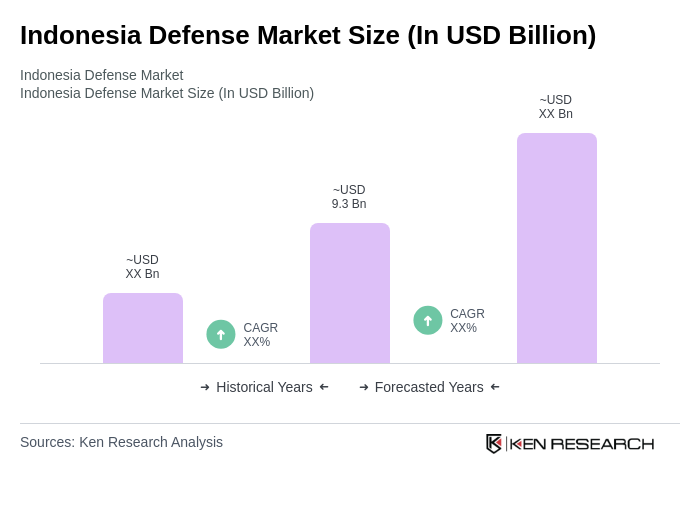

The Indonesia Defense Market is valued at approximately USD 9.3 billion, reflecting a steady growth driven by increased defense budgets, regional security concerns, and modernization efforts of the Indonesian National Armed Forces (TNI).