Region:Asia

Author(s):Geetanshi

Product Code:KRAD4083

Pages:97

Published On:December 2025

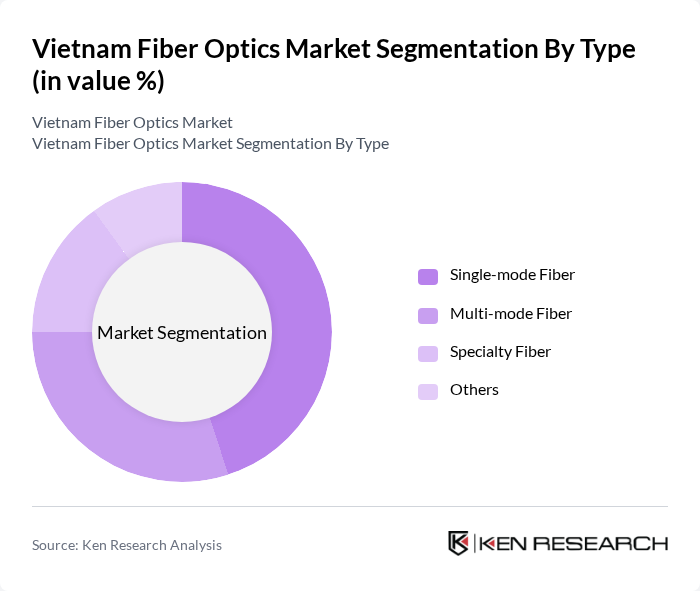

By Type:The fiber optics market can be segmented into four main types: Single-mode Fiber, Multi-mode Fiber, Specialty Fiber, and Others. Each type serves different applications and industries, with Single-mode Fiber being preferred for long-distance communication due to its low attenuation and high bandwidth capabilities. Multi-mode Fiber is commonly used in local area networks, while Specialty Fiber caters to niche applications such as sensing and medical uses.

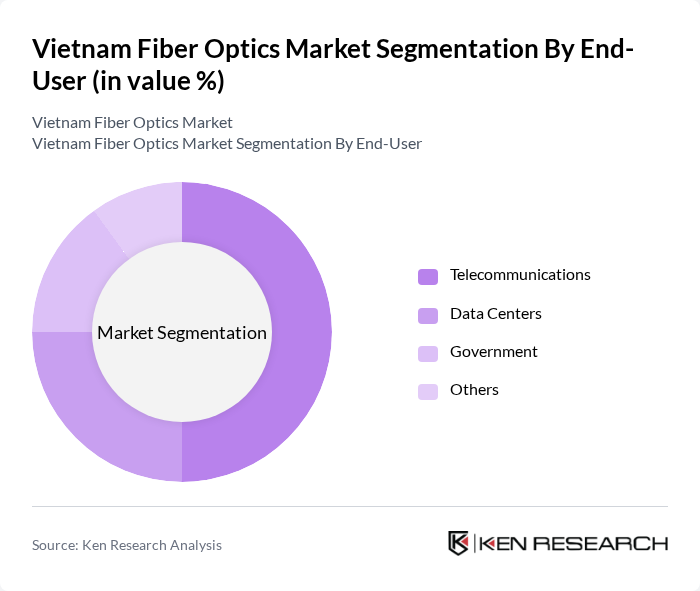

By End-User:The end-user segmentation includes Telecommunications, Data Centers, Government, and Others. Telecommunications is the leading segment, driven by the increasing demand for high-speed internet and mobile data services. Data Centers are also significant consumers of fiber optics, as they require robust connectivity solutions to support cloud services and data storage. Government initiatives further bolster the market through infrastructure investments.

The Vietnam Fiber Optics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Viettel Group, FPT Telecom, VNPT, CMC Telecom, Mobifone, SCTV, HPT Telecom, NetNam, Bkav Corporation, Viettel IDC, VNG Corporation, VTC Digital, CMC Corporation, Hanel, Saigon Newport Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam fiber optics market appears promising, driven by ongoing investments in telecommunications infrastructure and government support for digital initiatives. As the demand for high-speed internet continues to rise, particularly in urban areas, fiber optic technology will play a crucial role in meeting these needs. Additionally, the integration of advanced technologies such as AI and IoT will further enhance network capabilities, paving the way for innovative applications and services that leverage high-speed connectivity.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-mode Fiber Multi-mode Fiber Specialty Fiber Others |

| By End-User | Telecommunications Data Centers Government Others |

| By Application | Broadband Connectivity Cable Television Industrial Automation Others |

| By Installation Type | Indoor Installation Outdoor Installation Aerial Installation Others |

| By Network Type | Passive Optical Networks (PON) Active Optical Networks Others |

| By Region | Northern Vietnam Southern Vietnam Central Vietnam Others |

| By Service Type | Installation Services Maintenance Services Consulting Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Service Providers | 85 | Network Operations Managers, Technical Directors |

| Fiber Optic Cable Manufacturers | 65 | Production Managers, Quality Assurance Heads |

| Installation and Maintenance Contractors | 75 | Project Managers, Field Technicians |

| Government Regulatory Bodies | 45 | Policy Makers, Regulatory Affairs Specialists |

| End-User Industries (e.g., IT, Education) | 80 | IT Managers, Facility Managers |

The Vietnam Fiber Optics Market is valued at approximately USD 1.2 billion, driven by the increasing demand for high-speed internet and the expansion of telecommunications infrastructure across the country.