Region:Middle East

Author(s):Rebecca

Product Code:KRAD7447

Pages:86

Published On:December 2025

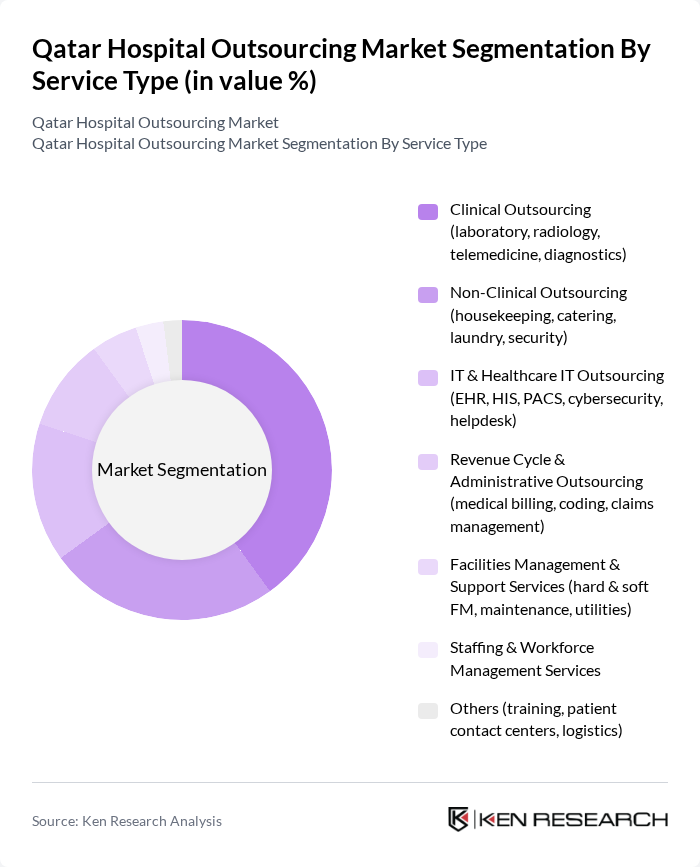

By Service Type:The service type segmentation includes various categories such as clinical outsourcing, non-clinical outsourcing, IT & healthcare IT outsourcing, revenue cycle & administrative outsourcing, facilities management & support services, staffing & workforce management services, and others. Among these, clinical outsourcing is currently the leading sub-segment due to the increasing demand for specialized medical services and the growing trend of telemedicine. Non-clinical outsourcing is also gaining traction as hospitals seek to reduce operational costs and improve efficiency.

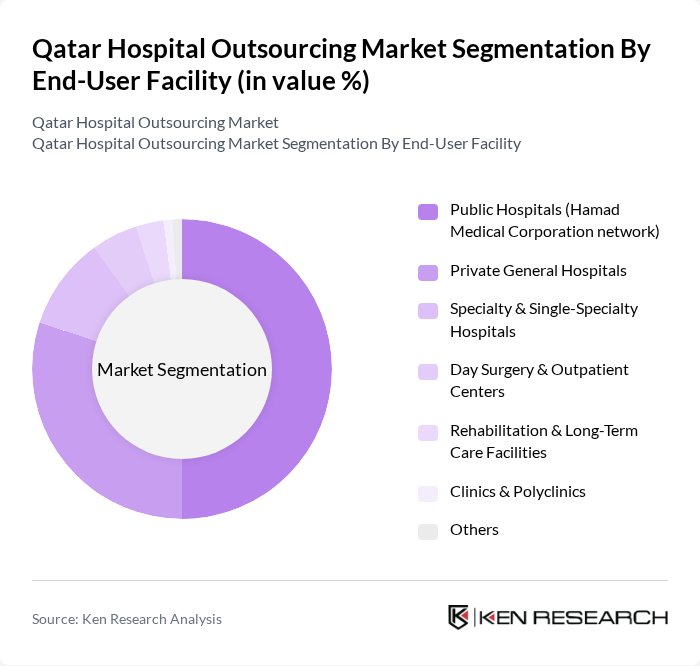

By End-User Facility:The end-user facility segmentation encompasses public hospitals, private general hospitals, specialty & single-specialty hospitals, day surgery & outpatient centers, rehabilitation & long-term care facilities, clinics & polyclinics, and others. Public hospitals, particularly those under the Hamad Medical Corporation network, dominate this segment due to their extensive patient base and government support. Private general hospitals are also significant players, driven by the increasing number of expatriates seeking quality healthcare services.

The Qatar Hospital Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hamad Medical Corporation, Sidra Medicine, Aspetar Orthopaedic and Sports Medicine Hospital, Aster DM Healthcare (Aster Hospital, Aster Medical Centers Qatar), Al Ahli Hospital, Doha Clinic Hospital, Al Emadi Hospital, Turkish Hospital (Qatar Turkish Hospital), The View Hospital (an affiliate of Cedars-Sinai), Seha Healthcare (Seha Qatar), Naseem Healthcare (Naseem Al Rabeeh Medical Group), Elegancia Healthcare (Barzan Holdings Group), OCS Qatar (OCS Group for facilities & support services), Sodexo Qatar Services, Serco Middle East (Qatar healthcare and FM contracts) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar hospital outsourcing market appears promising, driven by ongoing technological advancements and a growing emphasis on patient-centered care. As healthcare providers increasingly adopt value-based care models, the demand for specialized services is expected to rise. Additionally, the integration of AI and data analytics will enhance operational efficiency, enabling hospitals to deliver high-quality care while managing costs effectively. This evolving landscape presents significant opportunities for growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Clinical Outsourcing (laboratory, radiology, telemedicine, diagnostics) Non-Clinical Outsourcing (housekeeping, catering, laundry, security) IT & Healthcare IT Outsourcing (EHR, HIS, PACS, cybersecurity, helpdesk) Revenue Cycle & Administrative Outsourcing (medical billing, coding, claims management) Facilities Management & Support Services (hard & soft FM, maintenance, utilities) Staffing & Workforce Management Services Others (training, patient contact centers, logistics) |

| By End-User Facility | Public Hospitals (Hamad Medical Corporation network) Private General Hospitals Specialty & Single-Specialty Hospitals Day Surgery & Outpatient Centers Rehabilitation & Long-Term Care Facilities Clinics & Polyclinics Others |

| By Service Delivery Model | Full Outsourcing (comprehensive multi-function contracts) Partial/Selective Outsourcing Project-Based & Short-Term Outsourcing Managed Services & Long-Term Management Contracts |

| By Contracting Entity | Government & Public Sector Contracts Private Hospital Group Contracts PPP & Joint-Venture Outsourcing Contracts Others |

| By Technology Intensity | Low-Technology Services (basic FM and soft services) Medium-Technology Services (standard IT, basic HCIT) High-Technology Services (advanced HCIT, AI, analytics, telehealth) Others |

| By Provider Type | Local Qatar-Based Service Providers Regional GCC Service Providers Global Multinational Outsourcing Providers Joint Ventures & Consortiums |

| By Hospital Size | Large Tertiary & Quaternary Care Hospitals Medium-Size General Hospitals Small Hospitals & Specialized Centers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Outsourcing Services | 120 | Hospital Administrators, Clinical Directors |

| Non-Clinical Support Services | 100 | Procurement Managers, Facility Managers |

| Telemedicine and Remote Care Solutions | 80 | IT Managers, Telehealth Coordinators |

| Healthcare Staffing Solutions | 110 | HR Managers, Staffing Coordinators |

| Healthcare IT Outsourcing | 90 | Chief Information Officers, IT Directors |

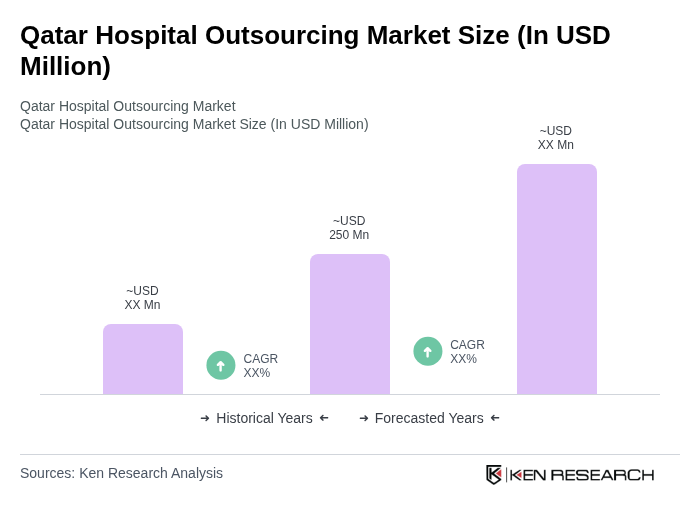

The Qatar Hospital Outsourcing Market is valued at approximately USD 250 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for specialized healthcare services and government initiatives aimed at enhancing operational efficiency in healthcare infrastructure.