Region:Middle East

Author(s):Shubham

Product Code:KRAA8861

Pages:94

Published On:November 2025

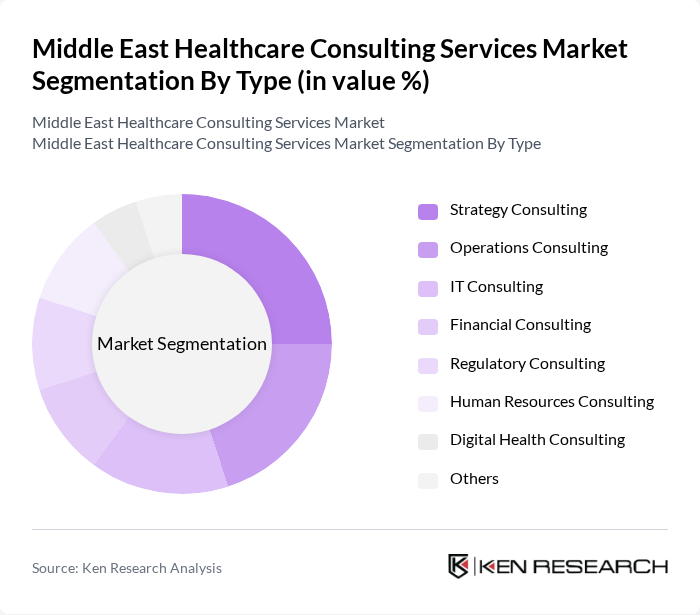

By Type:The market is segmented into various types of consulting services, including Strategy Consulting, Operations Consulting, IT Consulting, Financial Consulting, Regulatory Consulting, Human Resources Consulting, Digital Health Consulting, and Others. Each segment addresses the diverse needs of healthcare organizations, from strategic planning and operational optimization to digital transformation and regulatory compliance .

The Strategy Consulting segment is currently dominating the market due to the increasing need for healthcare organizations to develop long-term strategies that align with national health policies and evolving market demands. This segment focuses on high-level decision-making, helping organizations navigate complex healthcare landscapes, implement value-based care models, and optimize operational efficiency. The growing emphasis on patient-centered approaches and digital transformation is driving demand for strategic expertise, making this segment a critical area for consulting firms .

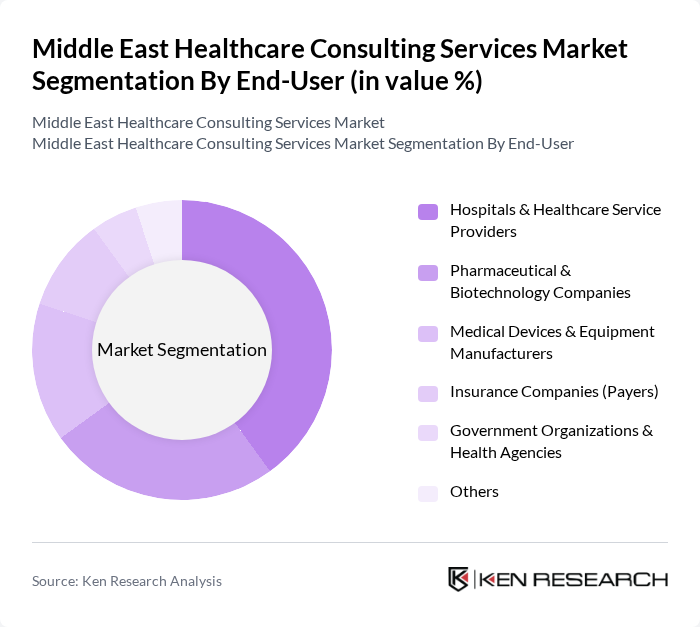

By End-User:The market is segmented by end-users, including Hospitals & Healthcare Service Providers, Pharmaceutical & Biotechnology Companies, Medical Devices & Equipment Manufacturers, Insurance Companies (Payers), Government Organizations & Health Agencies, and Others. Each segment has unique consulting needs based on operational challenges, digital transformation requirements, and regulatory compliance .

The Hospitals & Healthcare Service Providers segment is the largest end-user in the market, driven by the increasing demand for healthcare services, operational efficiency, and digital transformation. Hospitals are seeking consulting services to improve patient care, implement telehealth and health IT solutions, streamline operations, and comply with evolving regulatory standards. The focus on enhancing healthcare delivery and patient outcomes continues to propel this segment’s growth, making it a key area for consulting firms .

The Middle East Healthcare Consulting Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as McKinsey & Company, Boston Consulting Group (BCG), Deloitte Consulting, PwC Middle East (PricewaterhouseCoopers), Accenture Middle East, KPMG Lower Gulf, EY (Ernst & Young) Middle East, Roland Berger Middle East, IQVIA Middle East, Frost & Sullivan Middle East, Huron Consulting Group, ZS Associates, LEK Consulting, AlixPartners, GE Healthcare Partners, Siemens Healthineers Consulting, Wipro Limited (Healthcare Consulting Division), Arab Health (Informa Markets), Aon Middle East, Mott MacDonald Middle East (Healthcare Advisory) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East healthcare consulting services market appears promising, driven by ongoing technological advancements and a shift towards value-based care. As healthcare providers increasingly adopt data analytics and artificial intelligence, consulting firms will play a crucial role in facilitating these transitions. Furthermore, the emphasis on patient-centered care is expected to reshape service delivery models, creating new avenues for consulting firms to enhance operational efficiencies and improve patient outcomes in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Strategy Consulting Operations Consulting IT Consulting Financial Consulting Regulatory Consulting Human Resources Consulting Digital Health Consulting Others |

| By End-User | Hospitals & Healthcare Service Providers Pharmaceutical & Biotechnology Companies Medical Devices & Equipment Manufacturers Insurance Companies (Payers) Government Organizations & Health Agencies Others |

| By Service Model | Project-Based Consulting Retainer-Based Consulting On-Demand Consulting Virtual/Remote Consulting Others |

| By Geographic Focus | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Bahrain, Oman) Levant Region (Jordan, Lebanon, etc.) North Africa (Egypt, Morocco, etc.) Others |

| By Client Size | Large Enterprises Medium Enterprises Small Enterprises Startups Others |

| By Consulting Focus Area | Clinical Operations Financial Management IT Systems Integration & Digital Transformation Regulatory Compliance & Accreditation Market Access & Commercial Strategy Human Capital & Workforce Planning Sustainability & ESG Consulting Others |

| By Duration of Engagement | Short-Term Engagements Long-Term Engagements Project-Based Engagements Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Healthcare Facilities | 100 | Hospital Administrators, Health Policy Makers |

| Private Healthcare Providers | 80 | Clinic Managers, Medical Directors |

| Pharmaceutical Distribution | 60 | Pharmacy Managers, Supply Chain Coordinators |

| Health Insurance Companies | 50 | Underwriters, Claims Managers |

| Telehealth Services | 70 | Telemedicine Coordinators, IT Managers |

The Middle East Healthcare Consulting Services Market is valued at approximately USD 525 million, reflecting a significant growth driven by increasing demand for healthcare services, operational efficiency needs, and the complexity of healthcare regulations.