Bahrain Footwear Market Overview

- The Bahrain Footwear Market is valued at USD 115 million, based on a five-year historical analysis. This growth is primarily driven by increasing consumer demand for diverse footwear options, influenced by fashion trends and lifestyle changes. The market has seen a rise in disposable income, leading to higher spending on footwear, particularly in urban areas.

- Key cities such as Manama and Muharraq dominate the market due to their urbanization and concentration of retail outlets. These cities serve as commercial hubs, attracting both local and international brands, which enhances competition and variety in the footwear market. The presence of a young, fashion-conscious population further drives demand in these regions.

- The Environmental Standards for Industry Regulation, 2022 issued by the Supreme Council for Environment requires footwear manufacturers to comply with waste management thresholds and adopt sustainable materials in production processes, with licensing contingent on environmental impact assessments.

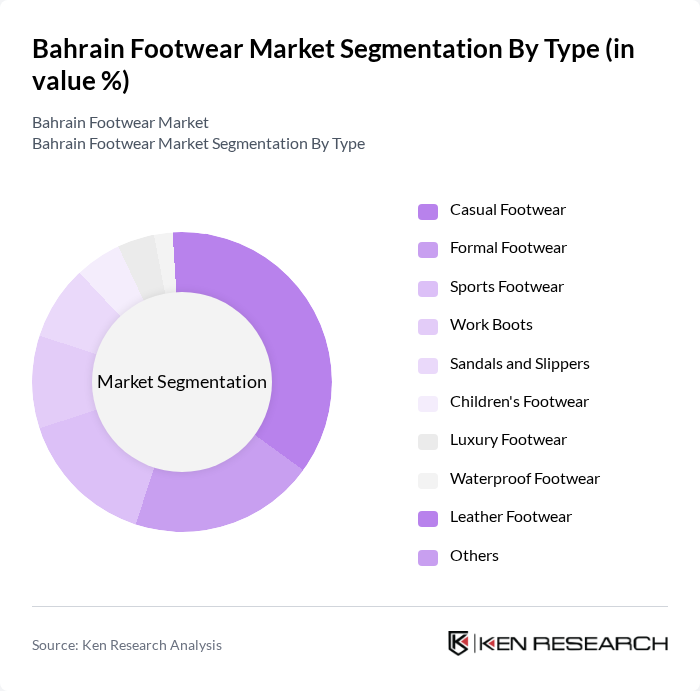

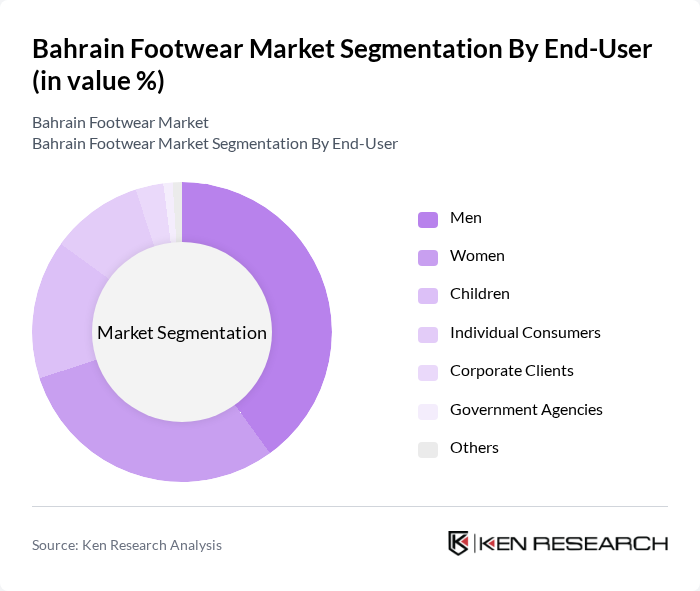

Bahrain Footwear Market Segmentation

By Type:The footwear market can be segmented into various types, including casual footwear, formal footwear, sports footwear, work boots, sandals and slippers, children's footwear, luxury footwear, waterproof footwear, leather footwear, and others. Among these, casual footwear has emerged as the dominant segment due to its versatility and comfort, appealing to a broad consumer base. The increasing trend of athleisure and casual dressing has further propelled the demand for this category.

By End-User:The end-user segmentation includes men, women, children, individual consumers, corporate clients, government agencies, and others. The men's segment is currently leading the market, driven by a growing interest in fashion and footwear among men. Additionally, the increasing participation of men in sports and fitness activities has boosted the demand for sports footwear, contributing to the overall growth of this segment.

Bahrain Footwear Market Competitive Landscape

The Bahrain Footwear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Adidas, Nike, Puma, Skechers, Bata, Clarks, New Balance, ASICS, Vans, Reebok, Converse, Hush Puppies, Crocs, Timberland, Dr. Martens contribute to innovation, geographic expansion, and service delivery in this space.

Bahrain Footwear Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The average disposable income in Bahrain is projected to reach approximately BHD 1,600 per month in future, reflecting a 7% increase from 2023. This rise in disposable income enables consumers to spend more on non-essential items, including footwear. As purchasing power increases, consumers are more likely to invest in quality and fashionable footwear, driving demand in the market. This trend is supported by the overall economic growth in Bahrain, which is expected to grow by 4% in future.

- Rising Fashion Consciousness:The fashion retail sector in Bahrain is anticipated to grow by 7% in future, driven by a younger demographic increasingly influenced by global fashion trends. This growing fashion consciousness is leading consumers to seek stylish and trendy footwear options. The proliferation of social media platforms has further amplified this trend, as consumers are exposed to diverse styles and brands. Consequently, footwear brands that align with contemporary fashion trends are likely to see increased sales and market share.

- Growth in E-commerce Platforms:E-commerce sales in Bahrain are projected to reach BHD 360 million in future, marking a 20% increase from 2023. The convenience of online shopping, coupled with the rise of mobile commerce, is reshaping consumer purchasing behavior. As more consumers turn to online platforms for their shopping needs, footwear brands that invest in robust e-commerce strategies will benefit from increased visibility and sales. This shift is further supported by improved internet penetration, which is expected to reach 99.5% in future.

Market Challenges

- Intense Competition:The Bahrain footwear market is characterized by a high level of competition, with over 160 brands vying for market share. This saturation leads to price wars and reduced profit margins for manufacturers and retailers. Established international brands dominate the market, making it challenging for local players to compete effectively. As a result, companies must differentiate their offerings through unique designs or superior quality to maintain a competitive edge in this crowded marketplace.

- Fluctuating Raw Material Prices:The footwear industry in Bahrain faces challenges due to the volatility of raw material prices, particularly leather and synthetic materials. In future, the price of leather is expected to rise by 12% due to supply chain disruptions and increased demand from other sectors. This fluctuation can significantly impact production costs, forcing manufacturers to either absorb the costs or pass them on to consumers, which may affect sales and profitability in a price-sensitive market.

Bahrain Footwear Market Future Outlook

The Bahrain footwear market is poised for significant transformation in the coming years, driven by evolving consumer preferences and technological advancements. The shift towards online shopping is expected to continue, with brands enhancing their digital presence to capture a larger audience. Additionally, sustainability will play a crucial role, as consumers increasingly favor eco-friendly products. Companies that adapt to these trends and invest in innovative designs and sustainable practices will likely thrive in this dynamic market landscape, ensuring long-term growth and profitability.

Market Opportunities

- Growth in Sustainable Footwear:The demand for sustainable footwear is on the rise, with an estimated market value of BHD 60 million in future. Consumers are increasingly prioritizing eco-friendly materials and ethical production practices. Brands that focus on sustainability can tap into this growing segment, appealing to environmentally conscious consumers and enhancing their brand image in the competitive market.

- Increasing Demand for Sports Footwear:The sports footwear segment is projected to grow to BHD 80 million in future, driven by a rising interest in fitness and outdoor activities among Bahrain's youth. This trend presents a lucrative opportunity for brands to develop specialized products catering to this demographic. By leveraging partnerships with local fitness influencers, companies can effectively market their offerings and capture a larger share of this expanding market.