Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9158

Pages:98

Published On:November 2025

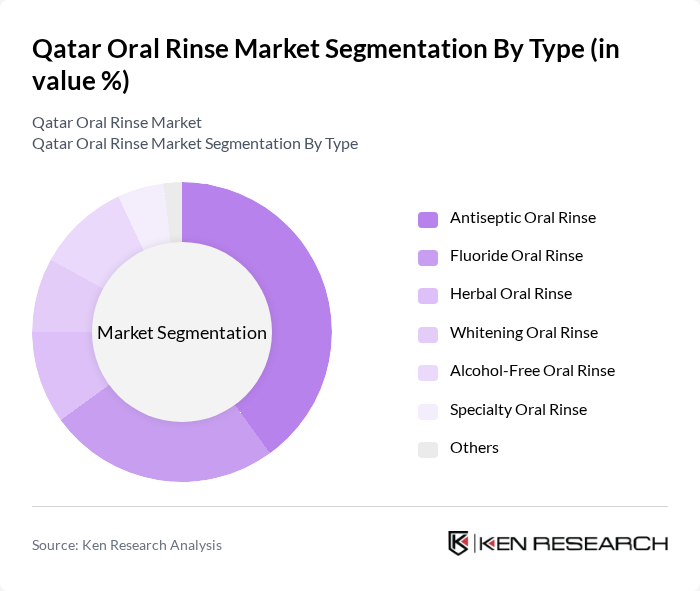

By Type:The oral rinse market can be segmented into various types, including antiseptic, fluoride, herbal, whitening, alcohol-free, specialty, and others. Among these, antiseptic oral rinses are currently leading the market due to their effectiveness in reducing oral bacteria and preventing gum diseases. The increasing prevalence of dental issues and the growing trend of preventive oral care are driving consumer preference towards antiseptic formulations. Fluoride oral rinses also hold a significant share, particularly among families with children, as they are known to strengthen tooth enamel and prevent cavities.

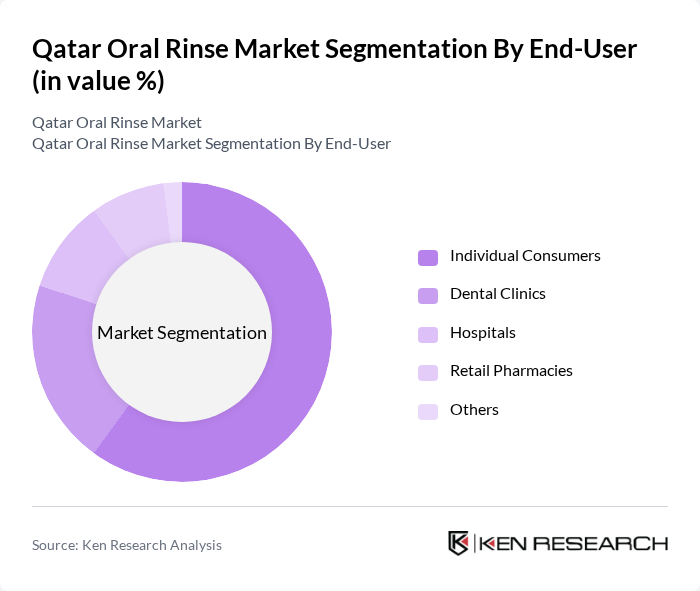

By End-User:The end-user segmentation includes individual consumers, dental clinics, hospitals, retail pharmacies, and others. Individual consumers dominate the market, driven by the increasing focus on personal health and hygiene. The rise in awareness regarding oral health, coupled with the availability of a wide range of products in retail pharmacies and online platforms, has led to a surge in demand from this segment. Dental clinics also play a crucial role, as they recommend specific oral rinses to patients, further influencing consumer choices. The expansion of digital health platforms and tele-dentistry services has further increased product recommendations and usage among end-users.

The Qatar Oral Rinse Market is characterized by a dynamic mix of regional and international players. Leading participants such as Colgate-Palmolive Company, Procter & Gamble Co., Johnson & Johnson, Unilever PLC, GlaxoSmithKline PLC, Henkel AG & Co. KGaA, Church & Dwight Co., Inc., Reckitt Benckiser Group PLC, Listerine (Johnson & Johnson), Oral-B (Procter & Gamble), Tom's of Maine (Colgate-Palmolive), Biotene (GlaxoSmithKline), Crest (Procter & Gamble), ACT (Chattem, Inc.), TheraBreath (Bristol-Myers Squibb) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar oral rinse market appears promising, driven by evolving consumer preferences and increasing health consciousness. As the population becomes more aware of the benefits of oral hygiene, demand for innovative and specialized products is expected to rise. Additionally, the integration of technology in marketing and distribution channels will likely enhance consumer engagement, leading to a more dynamic market landscape. Companies that adapt to these trends will be well-positioned for growth in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Antiseptic Oral Rinse Fluoride Oral Rinse Herbal Oral Rinse Whitening Oral Rinse Alcohol-Free Oral Rinse Specialty Oral Rinse Others |

| By End-User | Individual Consumers Dental Clinics Hospitals Retail Pharmacies Others |

| By Packaging Type | Bottles Sachets Pouches Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Pharmacies Convenience Stores Others |

| By Price Range | Economy Mid-Range Premium Others |

| By Ingredient Type | Chemical Ingredients Natural Ingredients Others |

| By Brand Type | National Brands Private Labels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Oral Rinse | 120 | General Consumers, Health-Conscious Individuals |

| Retail Insights on Oral Care Products | 60 | Pharmacy Managers, Supermarket Buyers |

| Dental Professional Perspectives | 40 | Dentists, Dental Hygienists |

| Market Trends in Oral Hygiene | 50 | Market Analysts, Health Researchers |

| Consumer Attitudes towards Brand Loyalty | 70 | Brand Loyal Consumers, New Users |

The Qatar Oral Rinse Market is valued at approximately USD 25 million, reflecting a significant growth trend driven by increased awareness of oral hygiene, rising disposable incomes, and a growing population focused on preventive healthcare.