Region:Middle East

Author(s):Rebecca

Product Code:KRAD7476

Pages:93

Published On:December 2025

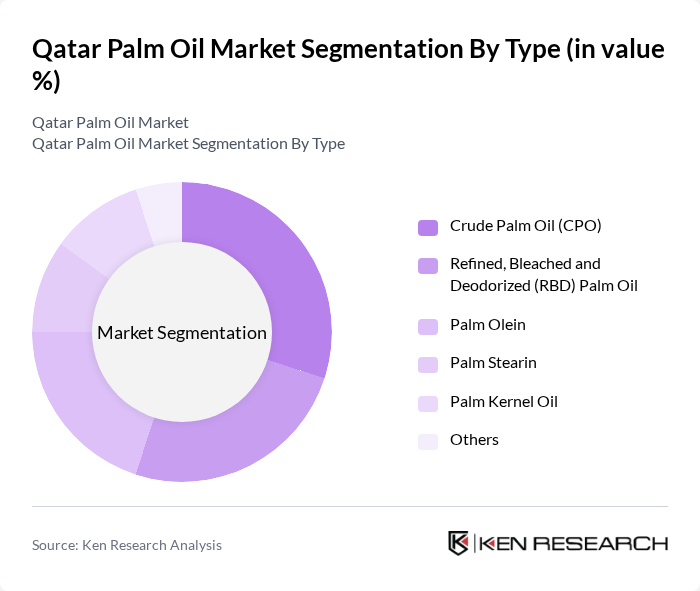

By Type:The market is segmented into various types of palm oil products, including Crude Palm Oil (CPO), Refined, Bleached and Deodorized (RBD) Palm Oil, Palm Olein, Palm Stearin, Palm Kernel Oil, and Others. Each type serves distinct purposes in culinary and industrial applications, with specific consumer preferences influencing their demand.

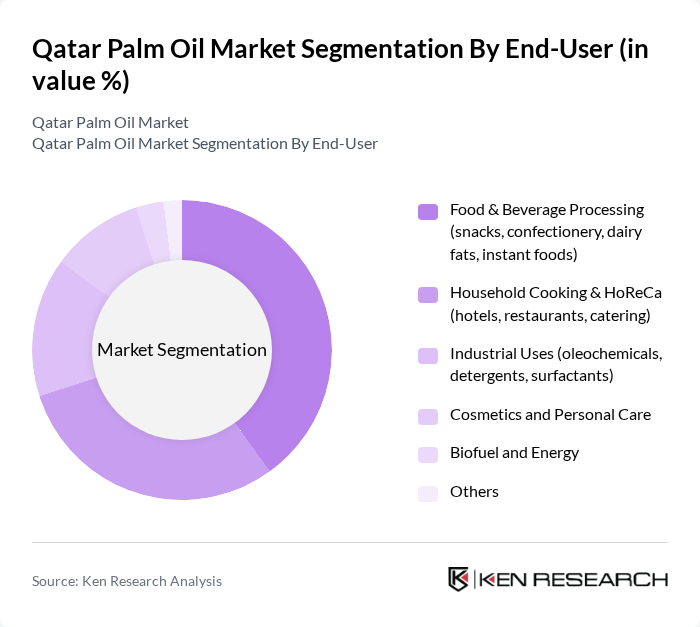

By End-User:The end-user segmentation includes Food & Beverage Processing, Household Cooking & HoReCa, Industrial Uses, Cosmetics and Personal Care, Biofuel and Energy, and Others. The food and beverage sector is the largest consumer of palm oil, driven by its widespread use in cooking and food production.

The Qatar Palm Oil Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Flour Mills (Doha), Hassad Food Company Q.S.C., Widam Food Company Q.P.S.C., Baladna Food Industries Q.P.S.C., Al Meera Consumer Goods Company Q.P.S.C., LuLu Group International (Qatar Operations), Carrefour Qatar (Majid Al Futtaim Retail), GAC Qatar (palm oil and edible oil logistics), Milaha Maritime & Logistics (Qatar Navigation Q.P.S.C.), Wilmar International Limited (regional supplier to Qatar), Cargill, Incorporated (regional supplier to Qatar), Sime Darby Plantation Berhad (Middle East supply into Qatar), Kuala Lumpur Kepong Berhad (KLK) (exporter to GCC including Qatar), Musim Mas Holdings Pte. Ltd., Golden Agri-Resources Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the palm oil market in Qatar appears promising, driven by increasing health consciousness and a shift towards sustainable practices. As the food processing industry continues to expand, the demand for palm oil is expected to rise, particularly for organic and sustainably sourced products. Additionally, technological advancements in processing methods will likely enhance efficiency and product quality, positioning Qatar as a competitive player in the regional palm oil market.

| Segment | Sub-Segments |

|---|---|

| By Type | Crude Palm Oil (CPO) Refined, Bleached and Deodorized (RBD) Palm Oil Palm Olein Palm Stearin Palm Kernel Oil Others |

| By End-User | Food & Beverage Processing (snacks, confectionery, dairy fats, instant foods) Household Cooking & HoReCa (hotels, restaurants, catering) Industrial Uses (oleochemicals, detergents, surfactants) Cosmetics and Personal Care Biofuel and Energy Others |

| By Distribution Channel | Business-to-Business (importers, traders, bulk distributors) Supermarkets/Hypermarkets Convenience Stores & Grocery Retail Online Retail & E-commerce Others |

| By Packaging Type | Bulk Industrial Packaging (drums, flexitanks, IBCs) Retail Bottles (PET, glass) Pouches and Sachets Institutional Packs (cans, tins) Eco-Friendly & Recyclable Packaging Others |

| By Quality/Certification | RSPO-Certified Sustainable Palm Oil Non-Certified / Conventional Organic Halal-Certified Others |

| By Application | Edible Oils & Cooking Oil Bakery & Confectionery Fats Margarine and Shortening Processed & Packaged Foods Industrial & Oleochemical Applications Others |

| By Market Structure | Organized Sector (branded, formal retail and B2B) Unorganized Sector (small traders and informal channels) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Manufacturing Sector | 100 | Production Managers, Quality Assurance Officers |

| Retail Distribution Channels | 80 | Supply Chain Managers, Category Buyers |

| Agricultural Producers | 60 | Farm Owners, Agricultural Consultants |

| Government Regulatory Bodies | 50 | Policy Makers, Environmental Officers |

| Consumer Insights | 90 | End Consumers, Health and Nutrition Experts |

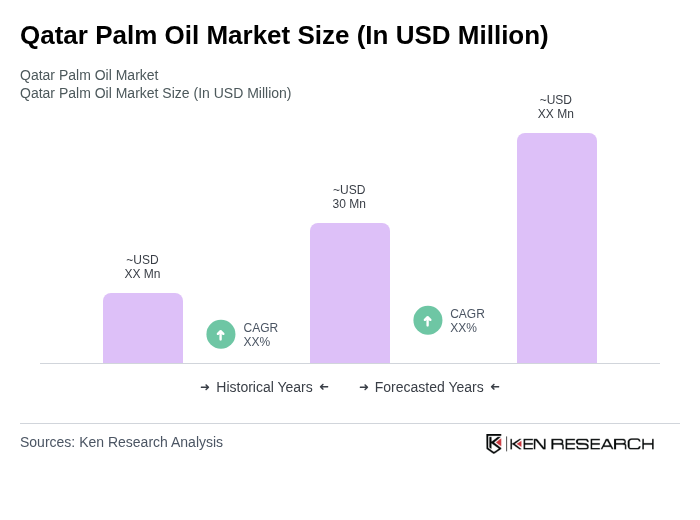

The Qatar Palm Oil Market is valued at approximately USD 30 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for palm oil in food processing, household cooking, and industrial applications.