Region:Middle East

Author(s):Rebecca

Product Code:KRAC3235

Pages:98

Published On:October 2025

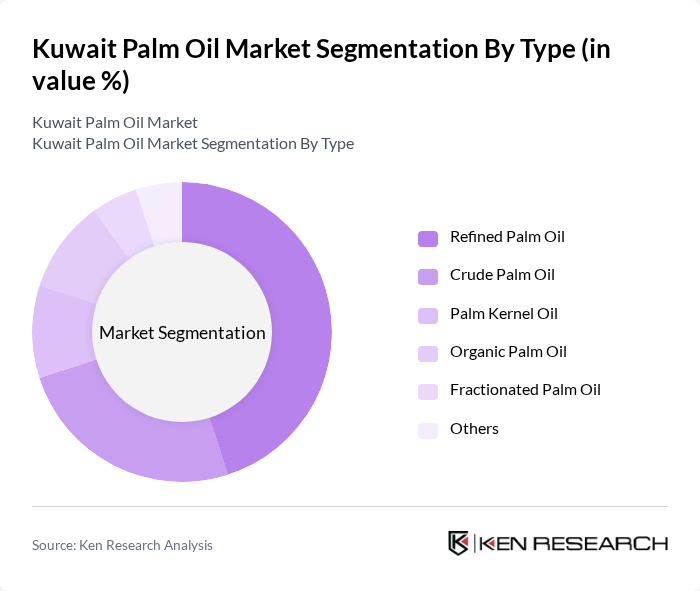

By Type:The market is segmented into various types of palm oil, including refined palm oil, crude palm oil, palm kernel oil, organic palm oil, fractionated palm oil, and others. Among these, refined palm oil is the most widely used due to its versatility in cooking and food processing. The demand for organic palm oil is also on the rise as consumers become more health-conscious and prefer sustainably sourced products .

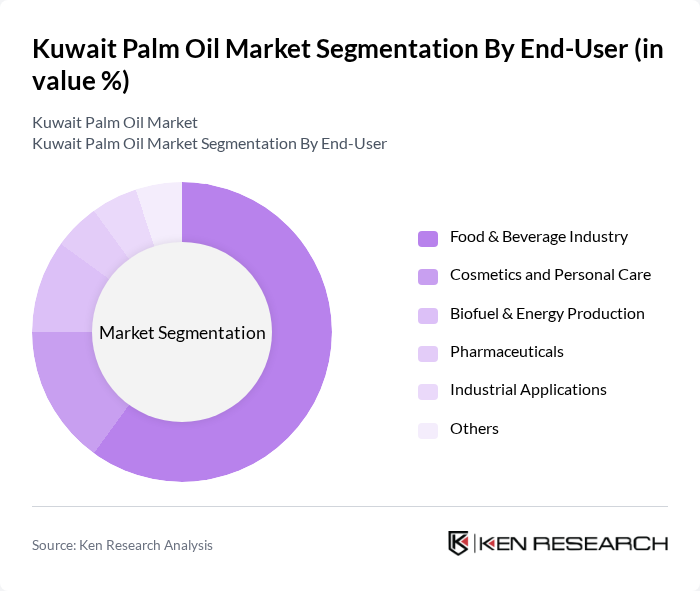

By End-User:The end-user segmentation includes the food and beverage industry, cosmetics and personal care, biofuel and energy production, pharmaceuticals, industrial applications, and others. The food and beverage industry is the largest consumer of palm oil, driven by its extensive use in cooking oils, margarine, and processed foods. The cosmetics sector is also growing, as palm oil is favored for its moisturizing properties .

The Kuwait Palm Oil Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Flour Mills & Bakeries Company (KFMB), Mezzan Holding Co., Alghanim Industries, Americana Group, Almarai Company, United Food Industries Corporation Ltd., Savola Group, Cargill Inc., Wilmar International Ltd., IOI Corporation Berhad, Kuala Lumpur Kepong Berhad (KLK), Golden Agri-Resources Ltd., Sime Darby Plantation Berhad, ADM (Archer Daniels Midland Company), Godrej Agrovet Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait palm oil market appears promising, driven by increasing health consciousness and the expansion of the food processing industry. As consumers continue to prioritize health and wellness, the demand for organic and sustainably sourced palm oil is expected to rise. Additionally, technological advancements in oil extraction and processing will likely enhance efficiency and product quality, positioning palm oil favorably in a competitive market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Refined Palm Oil Crude Palm Oil Palm Kernel Oil Organic Palm Oil Fractionated Palm Oil Others |

| By End-User | Food & Beverage Industry Cosmetics and Personal Care Biofuel & Energy Production Pharmaceuticals Industrial Applications Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Wholesale Distributors Food Service Providers Others |

| By Packaging Type | Bottles Tetra Packs Bulk Packaging Sachets Others |

| By Price Range | Economy Mid-Range Premium |

| By Application | Cooking Baking Frying Processed Foods Industrial Use Others |

| By Quality Certification | Halal Certified RSPO Certified (Sustainable Palm Oil) Organic Certified Non-GMO Certified Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Manufacturing Sector | 100 | Production Managers, Quality Assurance Officers |

| Retail Grocery Chains | 80 | Category Managers, Purchasing Agents |

| Cosmetics and Personal Care Products | 50 | Product Development Managers, Brand Managers |

| Food Service Industry | 70 | Restaurant Owners, Executive Chefs |

| Import/Export Trade Companies | 40 | Logistics Coordinators, Trade Compliance Officers |

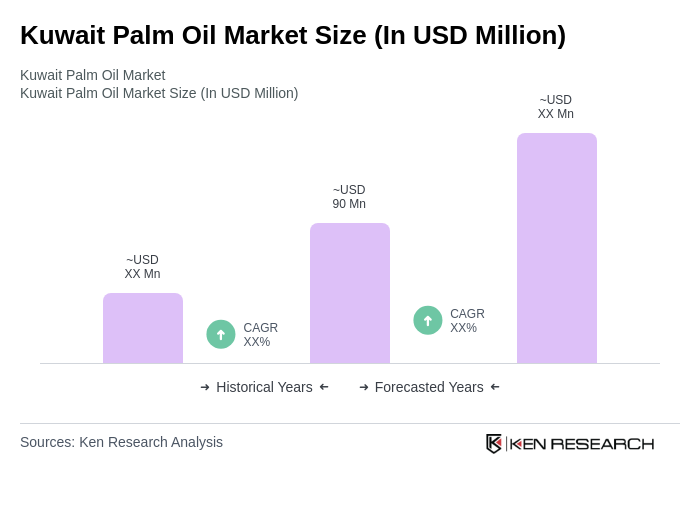

The Kuwait Palm Oil Market is valued at approximately USD 90 million, reflecting a steady growth driven by increasing consumer demand for palm oil in various sectors, including food products, cosmetics, and biofuels.