Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3939

Pages:88

Published On:November 2025

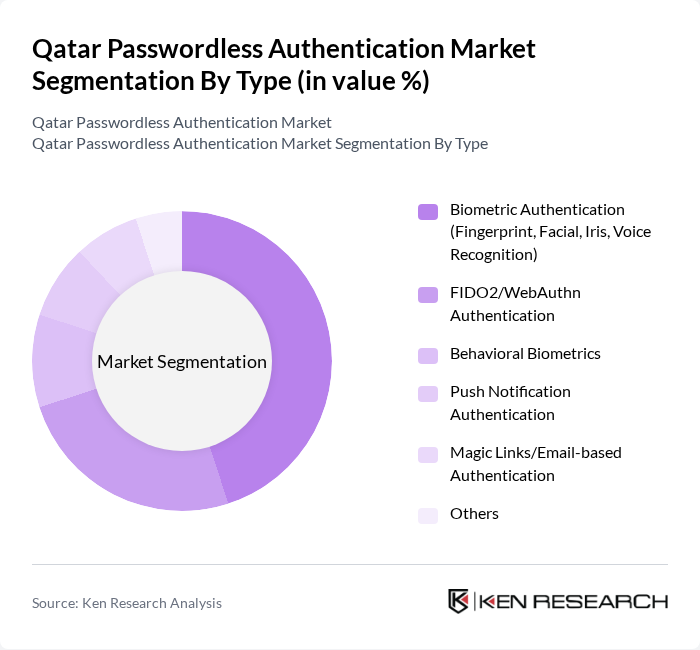

By Type:The market is segmented into various types of passwordless authentication methods, including Biometric Authentication, FIDO2/WebAuthn Authentication, Behavioral Biometrics, Push Notification Authentication, Magic Links/Email-based Authentication, and Others. Among these, Biometric Authentication leads the market due to its high security and user convenience, driven by the increasing adoption of smartphones, biometric-enabled devices, and regulatory requirements for secure access in financial and government sectors.

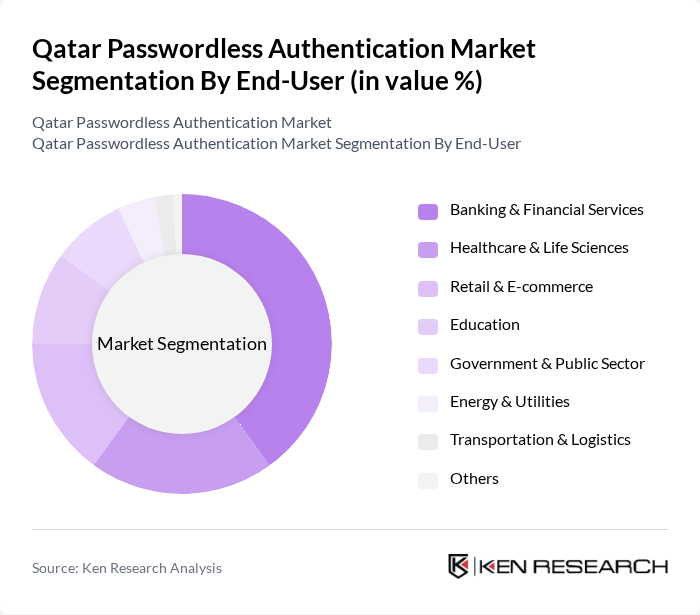

By End-User:The end-user segmentation includes Banking & Financial Services, Healthcare & Life Sciences, Retail & E-commerce, Education, Government & Public Sector, Energy & Utilities, Transportation & Logistics, and Others. The Banking & Financial Services sector is the largest end-user, driven by the need for secure transactions, compliance with regulatory requirements, and the adoption of biometric and multi-factor authentication standards to combat financial fraud and identity theft.

The Qatar Passwordless Authentication Market is characterized by a dynamic mix of regional and international players. Leading participants such as Okta, Inc., Microsoft Corporation, Auth0 (a product unit of Okta, Inc.), Ping Identity Holding Corp., Duo Security (a Cisco company), RSA Security LLC, ForgeRock, Inc., OneLogin, Inc. (now part of One Identity), Yubico AB, LastPass US LP, CyberArk Software Ltd., Thales Group, IBM Security (International Business Machines Corporation), Google Cloud Identity (Google LLC), SecureAuth Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the passwordless authentication market in Qatar appears promising, driven by technological advancements and increasing awareness of cybersecurity. As organizations continue to prioritize user experience and security, the adoption of biometric and multi-factor authentication solutions is expected to rise. Additionally, the integration of artificial intelligence in authentication processes will enhance security measures, making them more efficient. Overall, the market is poised for significant growth as businesses adapt to evolving digital landscapes and consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Biometric Authentication (Fingerprint, Facial, Iris, Voice Recognition) FIDO2/WebAuthn Authentication Behavioral Biometrics Push Notification Authentication Magic Links/Email-based Authentication Others |

| By End-User | Banking & Financial Services Healthcare & Life Sciences Retail & E-commerce Education Government & Public Sector Energy & Utilities Transportation & Logistics Others |

| By Industry Vertical | Banking and Financial Services Telecommunications Transportation and Logistics Energy and Utilities Government Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Managed Services Others |

| By Authentication Method | Multi-Factor Authentication (MFA) Single Sign-On (SSO) Passwordless Solutions (Biometric, Token-based, Magic Link, etc.) Risk-Based Authentication Others |

| By Region | Doha Al Rayyan Umm Salal Al Wakrah Al Khor Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support National Cybersecurity Initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Authentication | 45 | IT Security Managers, Compliance Officers |

| Healthcare Sector Security | 38 | Healthcare IT Directors, Data Protection Officers |

| Government Digital Services | 32 | Government IT Administrators, Cybersecurity Analysts |

| Retail Industry Authentication | 28 | eCommerce Managers, IT Support Leads |

| Telecommunications Security | 42 | Network Security Engineers, Risk Management Specialists |

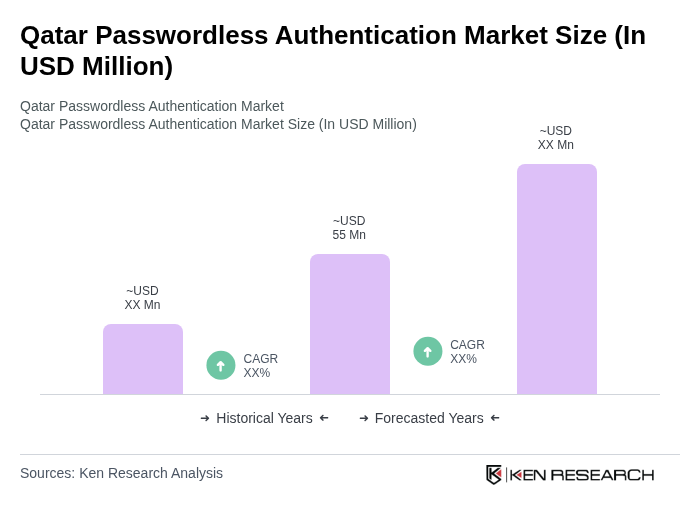

The Qatar Passwordless Authentication Market is valued at approximately USD 55 million, reflecting a significant growth driven by the increasing demand for enhanced security measures and the rise in cyber threats across various sectors.