Region:Middle East

Author(s):Rebecca

Product Code:KRAA4573

Pages:87

Published On:September 2025

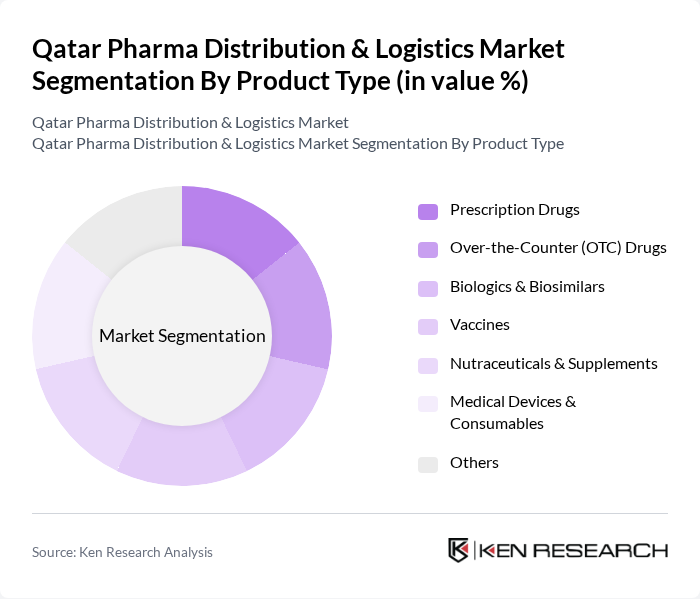

By Product Type:The product type segmentation includes various categories such as Prescription Drugs, Over-the-Counter (OTC) Drugs, Biologics & Biosimilars, Vaccines, Nutraceuticals & Supplements, Medical Devices & Consumables, and Others. Among these,Prescription Drugsdominate the market, driven by the high prevalence of chronic diseases, affordability, and widespread physician recommendations. The demand for OTC drugs is also significant, supported by growing consumer awareness, self-medication trends, and increased accessibility through retail and online channels. Biologics & Biosimilars are gaining traction due to rising demand for advanced therapies, especially in oncology and chronic disease management. Vaccines, nutraceuticals, and medical devices are supported by ongoing public health initiatives and preventive healthcare trends .

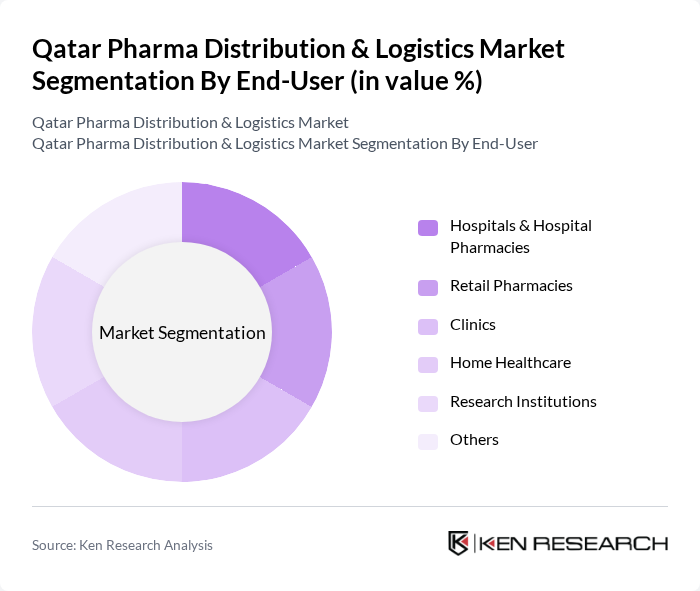

By End-User:The end-user segmentation encompasses Hospitals, Hospital Pharmacies, Retail Pharmacies, Clinics, Home Healthcare, Research Institutions, and Others.Hospitals and hospital pharmaciesare the leading end-users, driven by the increasing number of healthcare facilities, integration with patient care, and the rising patient population requiring medical attention. Hospital pharmacies hold the largest share due to their accessibility and integration with healthcare services, ensuring timely access to medications. Retail pharmacies and clinics also contribute significantly, supported by consumer convenience and the expansion of outpatient services. Home healthcare and research institutions represent emerging segments as personalized medicine and clinical research activities grow .

The Qatar Pharma Distribution & Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Pharma, QLife Pharma, Pharmakeia, Doha Drug Store, Qatar Pharmaceutical Industries (QPI), Philex Pharmaceuticals, DOHAPHARMA Co., Ltd., International Medical Company (Kulud Pharmacy), Mannai Medical & Scientific, MBM Medicines Trading, Ultra Pharma Trading, MIG Qatar Medical Group, ICON Pharma Trading, Aster DM Healthcare, Novartis Qatar, Pfizer Qatar, Roche Qatar, Sanofi Qatar contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Qatar pharma distribution and logistics market appears promising, driven by ongoing investments in healthcare infrastructure and technological advancements. As the government continues to prioritize healthcare improvements, the logistics sector will likely adapt to meet evolving demands. Additionally, the integration of digital solutions and automation in logistics processes is expected to enhance efficiency, reduce costs, and improve service delivery, positioning the market for sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Prescription Drugs Over-the-Counter (OTC) Drugs Biologics & Biosimilars Vaccines Nutraceuticals & Supplements Medical Devices & Consumables Others |

| By End-User | Hospitals Hospital Pharmacies Retail Pharmacies Clinics Home Healthcare Research Institutions Others |

| By Distribution Channel | Direct Distribution Wholesalers/Distributors Retail Pharmacies Online/E-Pharmacies Hospital Pharmacies Others |

| By Logistics Mode | Road Transport Air Freight Sea Freight Others |

| By Temperature Control | Ambient Cold Chain (Refrigerated & Frozen) Others |

| By Packaging Type | Primary Packaging Secondary Packaging Tertiary Packaging Others |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Distribution Channels | 100 | Logistics Managers, Distribution Coordinators |

| Healthcare Provider Logistics | 90 | Pharmacy Managers, Hospital Supply Chain Directors |

| Regulatory Compliance in Pharma Logistics | 60 | Compliance Officers, Quality Assurance Managers |

| Cold Chain Logistics for Pharmaceuticals | 70 | Operations Managers, Cold Chain Specialists |

| Market Entry Strategies for New Pharma Distributors | 40 | Business Development Managers, Market Analysts |

The Qatar Pharma Distribution & Logistics Market is valued at approximately USD 530 million, driven by increasing pharmaceutical demand, advancements in healthcare infrastructure, and a growing population requiring efficient distribution solutions.