Region:Middle East

Author(s):Dev

Product Code:KRAD1796

Pages:82

Published On:November 2025

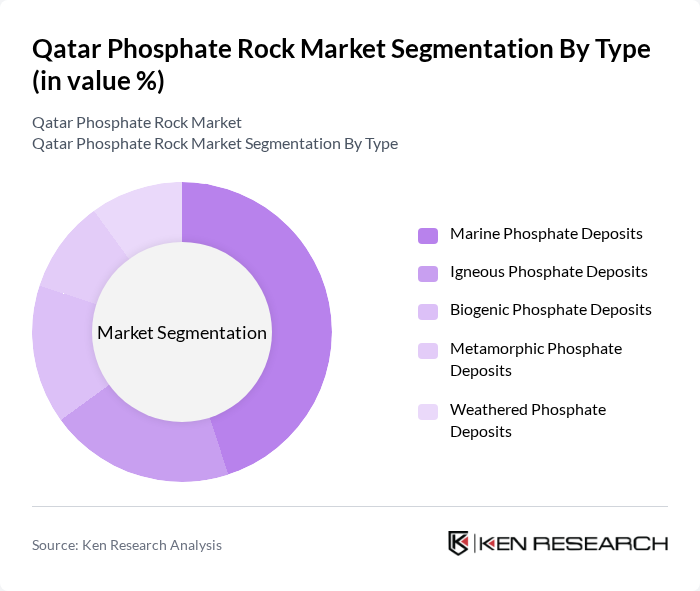

By Type:The phosphate rock market can be segmented into various types based on their geological formation. The primary types include Marine Phosphate Deposits, Igneous Phosphate Deposits, Biogenic Phosphate Deposits, Metamorphic Phosphate Deposits, and Weathered Phosphate Deposits. Among these, Marine Phosphate Deposits are currently leading the market due to their abundance and ease of extraction. The increasing demand for high-quality phosphate for fertilizer production further drives the preference for this type.

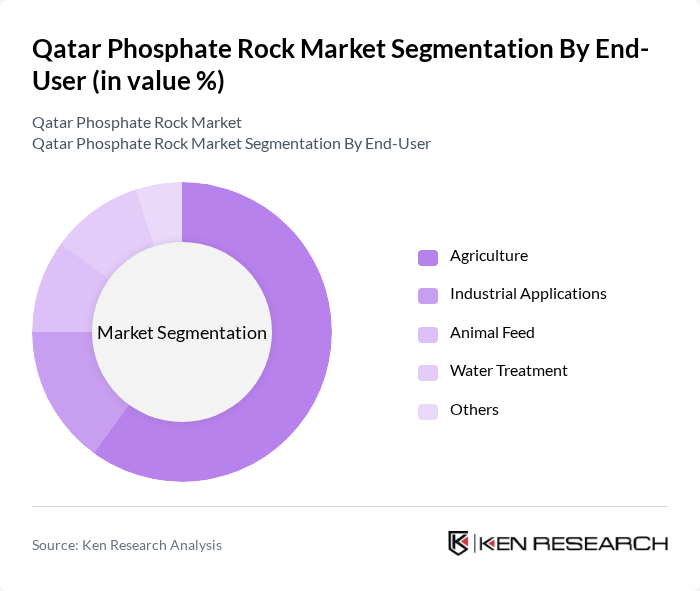

By End-User:The end-user segmentation of the phosphate rock market includes Agriculture, Industrial Applications, Animal Feed, Water Treatment, and Others. The Agriculture sector dominates the market, driven by the increasing need for fertilizers to enhance crop yields. The growing awareness of sustainable agricultural practices and the need for food security further bolster the demand for phosphate rock in this segment.

The Qatar Phosphate Rock Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Mining Company (QM), Industries Qatar Q.P.S.C., Ma'aden Phosphate Company, OCP Group, The Mosaic Company, Nutrien Ltd., Yara International ASA, PhosAgro PJSC, CF Industries Holdings, Inc., ICL Group Ltd., EuroChem Group AG, K+S Aktiengesellschaft (K+S AG), Vale Fertilizantes S.A., Sinochem International Corporation, Acron Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar phosphate rock market appears promising, driven by increasing agricultural demands and government support for sustainable practices. As the global focus shifts towards organic farming, the market is likely to adapt by developing eco-friendly phosphate products. Additionally, technological advancements in mining operations will enhance efficiency and reduce environmental impact, positioning Qatar as a competitive player in the global phosphate market while addressing food security challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Marine Phosphate Deposits Igneous Phosphate Deposits Biogenic Phosphate Deposits Metamorphic Phosphate Deposits Weathered Phosphate Deposits |

| By End-User | Agriculture Industrial Applications Animal Feed Water Treatment Others |

| By Application | Fertilizer Production Animal Feed Supplements Chemical Manufacturing Water Treatment Chemicals Food Processing Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | Domestic Market Export Markets Others |

| By Product Form | Granular Powdered Liquid Others |

| By Quality | High-Grade Phosphate Medium-Grade Phosphate Low-Grade Phosphate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Phosphate Rock Producers | 60 | Mining Executives, Operations Managers |

| Agricultural Fertilizer Manufacturers | 50 | Procurement Managers, Product Development Managers |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

| Research Institutions | 40 | Academic Researchers, Industry Analysts |

| Export and Trade Associations | 40 | Trade Representatives, Market Analysts |

The Qatar Phosphate Rock Market is valued at approximately USD 224 million, driven by increasing fertilizer demand in agriculture, a growing global population, and advancements in mining technologies.