Region:Middle East

Author(s):Geetanshi

Product Code:KRAD8263

Pages:92

Published On:December 2025

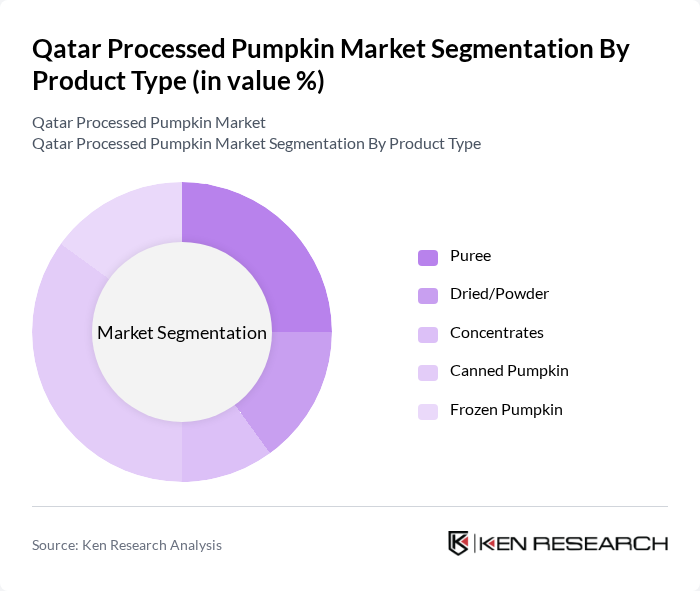

By Product Type:The product type segmentation includes various forms of processed pumpkin, such as puree, dried/powder, concentrates, canned pumpkin, and frozen pumpkin. Among these, canned pumpkin is currently the leading subsegment due to its convenience and long shelf life, making it a popular choice for both households and food service providers. The demand for pumpkin puree is also significant, driven by its use in baking and cooking, particularly in seasonal recipes.

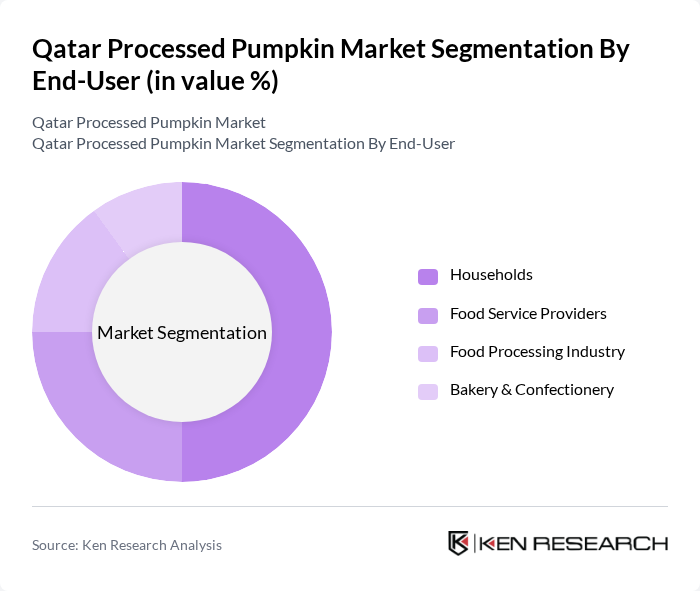

By End-User:The end-user segmentation encompasses households, food service providers, the food processing industry, and bakery & confectionery. Households represent the largest segment, driven by the increasing trend of home cooking and the popularity of healthy eating. Food service providers are also significant consumers, utilizing processed pumpkin in various dishes, particularly during the fall season when pumpkin-flavored items are in high demand.

The Qatar Processed Pumpkin Market is characterized by a dynamic mix of regional and international players. Leading participants such as Libby's (Nestlé subsidiary), Nestlé SA, PepsiCo Inc., McCormick & Co. Inc., Farmer's Market Foods, Nature's Way, Organic Foods Company, Al Watania Agriculture, Qatar National Food Company, Al Meera Consumer Goods Company, Al Jazeera Foods, Gulf Food Industries contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar processed pumpkin market appears promising, driven by increasing health awareness and a shift towards organic products. As the food processing industry continues to expand, innovations in production technology will likely enhance product quality and availability. Additionally, government initiatives aimed at boosting local agriculture may reduce import dependency. These factors combined suggest a favorable environment for growth, with potential for new product development and market diversification in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Puree Dried/Powder Concentrates Canned Pumpkin Frozen Pumpkin |

| By End-User | Households Food Service Providers Food Processing Industry Bakery & Confectionery |

| By Application | Beverages Bakery Products Snacks Baby Food Pet Food |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Specialty Stores Food Service Channels |

| By Region | Doha Al Rayyan Al Wakrah Other Municipalities |

| By Packaging Format | Canned Aseptic/Retort Pouches Bulk/Drum Flexible Packs |

| By Product Attributes | Organic High Fiber Low Calorie Clean Label |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 100 | Store Managers, Category Buyers |

| Consumer Preferences | 120 | Health-conscious Consumers, Families |

| Supply Chain Dynamics | 80 | Logistics Coordinators, Distribution Managers |

| Food Service Sector | 70 | Chefs, Restaurant Owners |

| Export Opportunities | 60 | Export Managers, Trade Analysts |

The Qatar processed pumpkin market is valued at approximately USD 25 million, reflecting a steady growth driven by increasing consumer demand for healthy food options and convenient processed formats like purées and powders.