Region:Middle East

Author(s):Dev

Product Code:KRAB7244

Pages:89

Published On:October 2025

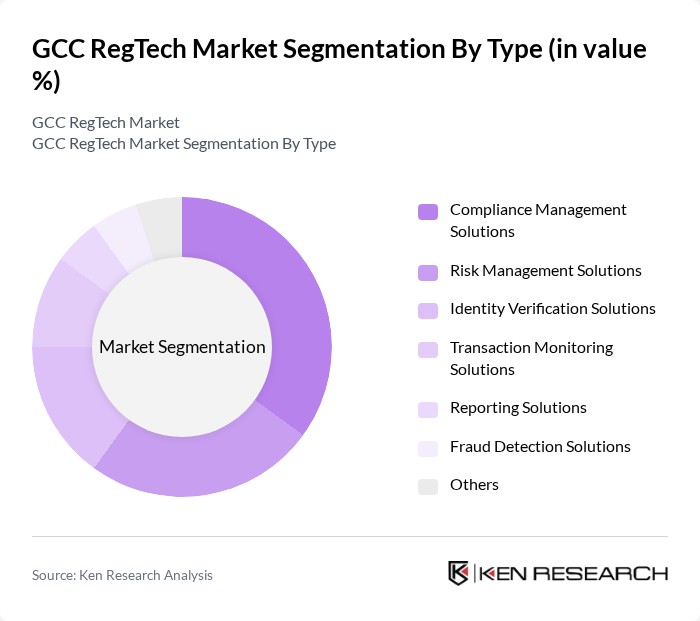

By Type:The market is segmented into various types, including Compliance Management Solutions, Risk Management Solutions, Identity Verification Solutions, Transaction Monitoring Solutions, Reporting Solutions, Fraud Detection Solutions, and Others. Among these, Compliance Management Solutions are currently leading the market due to the increasing regulatory pressures on financial institutions to ensure adherence to laws and regulations. The demand for these solutions is driven by the need for efficient compliance processes and the ability to manage complex regulatory requirements effectively.

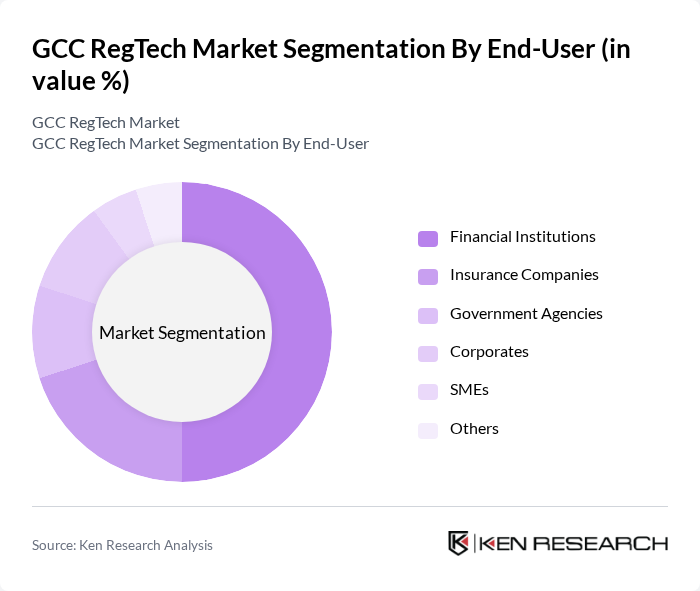

By End-User:The end-user segmentation includes Financial Institutions, Insurance Companies, Government Agencies, Corporates, SMEs, and Others. Financial Institutions dominate this segment as they are the primary users of RegTech solutions to comply with stringent regulations and manage risks effectively. The increasing complexity of financial regulations and the need for real-time compliance monitoring are driving the adoption of RegTech solutions among banks and other financial entities.

The GCC RegTech Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fenergo, ComplyAdvantage, RiskScreen, NICE Actimize, Amlify, SAS Institute, Oracle Financial Services, Refinitiv, LexisNexis Risk Solutions, Actico, Verafin, InfrasoftTech, ComplyAdvantage, Quantexa, Templafy contribute to innovation, geographic expansion, and service delivery in this space.

The GCC RegTech market is poised for significant evolution, driven by ongoing technological advancements and regulatory changes. As financial institutions increasingly adopt cloud-based solutions, the demand for scalable and flexible compliance tools will rise. Additionally, the integration of AI and machine learning technologies is expected to enhance predictive analytics capabilities, allowing firms to proactively manage compliance risks. The establishment of regulatory sandboxes will further encourage innovation, enabling startups to develop tailored solutions that address specific regional challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Compliance Management Solutions Risk Management Solutions Identity Verification Solutions Transaction Monitoring Solutions Reporting Solutions Fraud Detection Solutions Others |

| By End-User | Financial Institutions Insurance Companies Government Agencies Corporates SMEs Others |

| By Application | Anti-Money Laundering Fraud Prevention Regulatory Reporting Risk Assessment Compliance Monitoring Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Region | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Compliance Solutions | 100 | Compliance Officers, Risk Managers |

| Insurance Industry RegTech Applications | 80 | Underwriting Managers, Compliance Analysts |

| Investment Firms' Risk Management Tools | 70 | Portfolio Managers, Compliance Directors |

| FinTech Startups and Regulatory Challenges | 60 | Founders, CTOs, Regulatory Affairs Managers |

| Government Regulatory Bodies' Perspectives | 50 | Regulatory Officials, Policy Advisors |

The GCC RegTech Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by increasing regulatory requirements and the demand for enhanced compliance solutions among businesses in the region.