Region:Middle East

Author(s):Shubham

Product Code:KRAB3215

Pages:83

Published On:October 2025

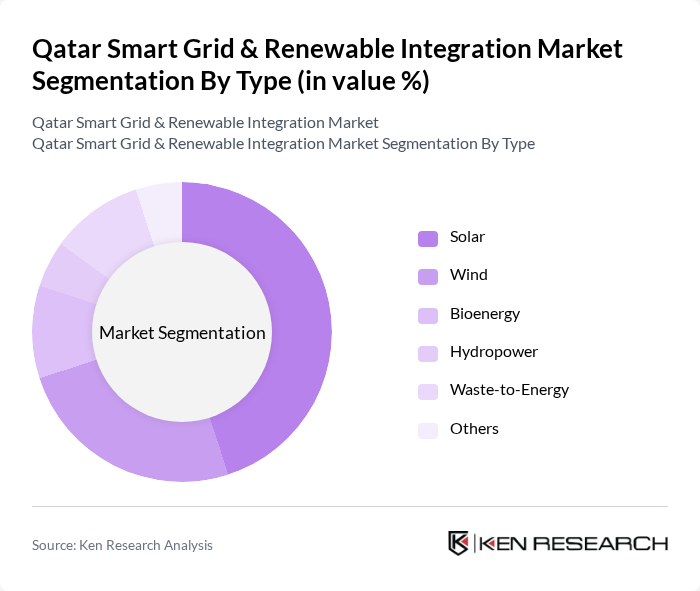

By Type:The market is segmented into various types, including Solar, Wind, Bioenergy, Hydropower, Waste-to-Energy, and Others. Among these, solar energy is the most dominant segment due to Qatar's abundant sunlight, making it a favorable option for renewable energy projects. The increasing adoption of solar technologies in residential and commercial sectors is driving this segment's growth. Wind energy is also gaining traction, particularly in coastal areas, while bioenergy and waste-to-energy solutions are being explored for their potential in waste management and energy generation.

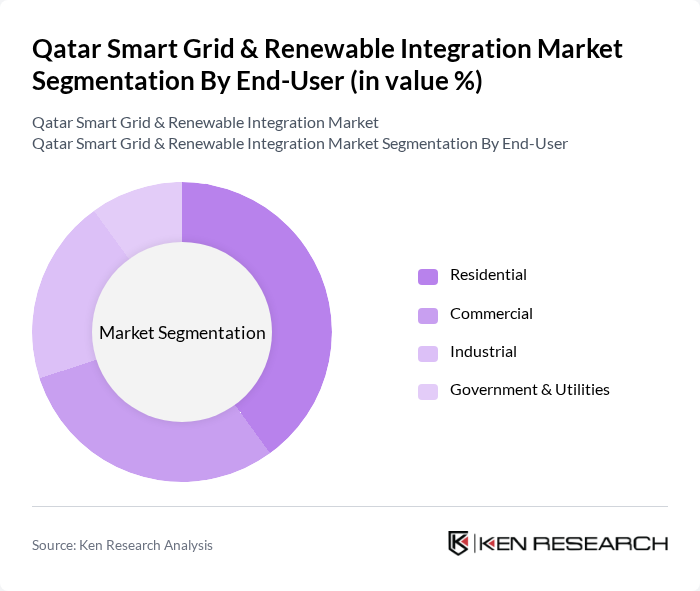

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The residential segment is currently leading the market, driven by increasing consumer awareness of renewable energy benefits and government incentives for solar installations. The commercial sector is also expanding as businesses seek to reduce energy costs and enhance sustainability. Industrial applications are growing, particularly in energy-intensive sectors, while government and utilities are investing in smart grid technologies to improve energy distribution and management.

The Qatar Smart Grid & Renewable Integration Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Electricity and Water Company, Siemens AG, Schneider Electric, ABB Ltd., General Electric, Honeywell International Inc., Mitsubishi Electric Corporation, Enel Green Power, First Solar, Inc., Canadian Solar Inc., Trina Solar Limited, JinkoSolar Holding Co., Ltd., Vestas Wind Systems A/S, NextEra Energy, Inc., TotalEnergies SE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar Smart Grid and Renewable Integration Market appears promising, driven by increasing investments in technology and infrastructure. As the government continues to prioritize renewable energy, the integration of smart grid solutions will become essential for managing energy distribution efficiently. The anticipated growth in electric vehicle infrastructure and energy storage technologies will further enhance the market landscape, fostering innovation and collaboration among stakeholders to meet the evolving energy demands of the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Solar Wind Bioenergy Hydropower Waste-to-Energy Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects |

| By Investment Source | Domestic FDI PPP Government Schemes |

| By Policy Support | Subsidies Tax Exemptions RECs |

| By Distribution Mode | Direct Sales Online Sales Distributors |

| By Component | Smart Meters Control Systems Communication Networks Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Grid Technology Adoption | 100 | Utility Managers, IT Directors |

| Renewable Energy Project Development | 80 | Project Managers, Renewable Energy Analysts |

| Energy Policy and Regulation | 60 | Government Officials, Regulatory Affairs Specialists |

| Consumer Engagement in Energy Efficiency | 75 | Marketing Managers, Customer Experience Leaders |

| Investment in Renewable Technologies | 90 | Investment Analysts, Financial Advisors |

The Qatar Smart Grid & Renewable Integration Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the demand for energy efficiency, government initiatives, and advancements in smart grid technologies.