Region:Middle East

Author(s):Geetanshi

Product Code:KRAD1281

Pages:81

Published On:November 2025

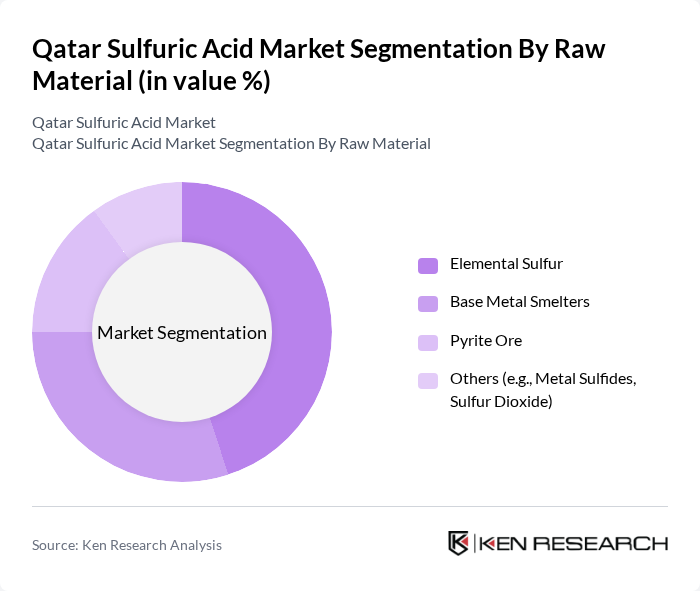

By Raw Material:The market is segmented based on the raw materials used in the production of sulfuric acid. The primary raw materials include Elemental Sulfur, Base Metal Smelters, Pyrite Ore, and Others (e.g., Metal Sulfides, Sulfur Dioxide). Elemental Sulfur is the most widely used due to its abundant availability as a by-product from oil and gas processing in Qatar and its cost-effectiveness. Base Metal Smelters also contribute significantly, as they produce sulfuric acid as a by-product during metal extraction processes .

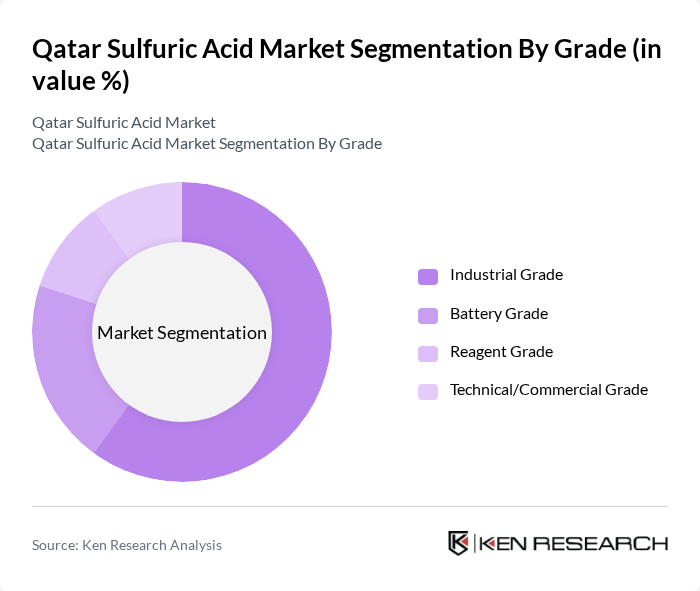

By Grade:The sulfuric acid market is also segmented by grade, which includes Industrial Grade, Battery Grade, Reagent Grade, and Technical/Commercial Grade. Industrial Grade sulfuric acid is the most commonly produced and consumed type, primarily used in fertilizers and chemical manufacturing. Battery Grade sulfuric acid is gaining traction due to the increasing demand for lead-acid batteries, while Reagent Grade is utilized in laboratories and research applications .

The Qatar Sulfuric Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Petrochemical Company (QAPCO), Qatar Chemical Company (Q-Chem), Industries Qatar (IQ), Gulf Chemicals and Industrial Oils Company (Gulfco), Qatar Fertiliser Company (QAFCO), Qatar National Chemical Company (QNCC), Qatar Industrial Manufacturing Company (QIMC), Qatar Steel Company (Qatar Steel), Qatar Aluminium Manufacturing Company (QAMCO), Qatar National Cement Company (QNCC), Qatar Gas Transport Company (Nakilat), QatarEnergy, Qatar Mining Company (QMC), Qatar Chemical Industries Company (QCIC), and Qatar General Electricity and Water Corporation (Kahramaa) contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar sulfuric acid market is poised for significant developments driven by increasing industrialization and a focus on sustainable practices. The anticipated growth in the mining sector, particularly in phosphate mining, will further boost demand for sulfuric acid. Additionally, technological advancements in production processes are expected to enhance efficiency and reduce environmental impact, aligning with global trends towards greener chemical manufacturing. These factors will shape the market landscape, fostering innovation and competitiveness in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Raw Material | Elemental Sulfur Base Metal Smelters Pyrite Ore Others (e.g., Metal Sulfides, Sulfur Dioxide) |

| By Grade | Industrial Grade Battery Grade Reagent Grade Technical/Commercial Grade |

| By Application | Fertilizers Chemical Manufacturing Metal Processing Petroleum Refining Mining Pharmaceuticals Others (e.g., Battery Manufacturing, Textile, Automotive) |

| By End-User Industry | Agriculture Chemical Industry Metals and Mining Refining Automotive Others (e.g., Textile, Pharmaceuticals) |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Packaging Type | Bulk Packaging Drums IBC Totes Others |

| By Region | Doha Al Rayyan Umm Salal Others |

| By Policy Support | Subsidies for Production Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fertilizer Production Sector | 100 | Production Managers, Supply Chain Coordinators |

| Petrochemical Industry | 80 | Operations Directors, Chemical Engineers |

| Metal Processing Companies | 70 | Procurement Managers, Quality Control Supervisors |

| Environmental Compliance Sector | 60 | Regulatory Affairs Managers, Environmental Engineers |

| Research and Development in Chemicals | 40 | R&D Managers, Product Development Specialists |

The Qatar Sulfuric Acid Market is valued at approximately USD 95 million, driven by increasing demand from the fertilizer and chemical manufacturing sectors, as well as growth in battery manufacturing and industrial activities.