Region:Middle East

Author(s):Dev

Product Code:KRAA9667

Pages:90

Published On:November 2025

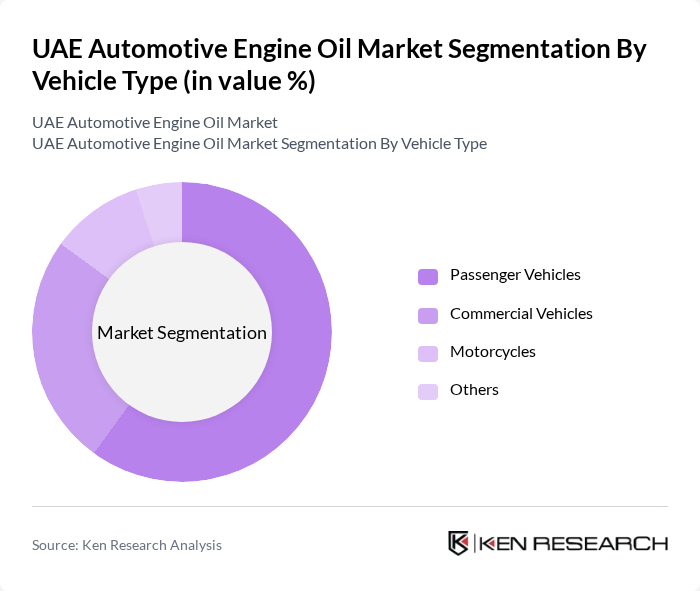

By Vehicle Type:The segmentation by vehicle type includes Passenger Vehicles, Commercial Vehicles, Motorcycles, and Others. The Passenger Vehicles segment dominates the market due to the high number of personal vehicles in the UAE, driven by a growing population and increasing disposable income. The demand for engine oil in this segment is further fueled by the need for regular maintenance, performance enhancement, and the preference for high-quality lubricants among private car owners .

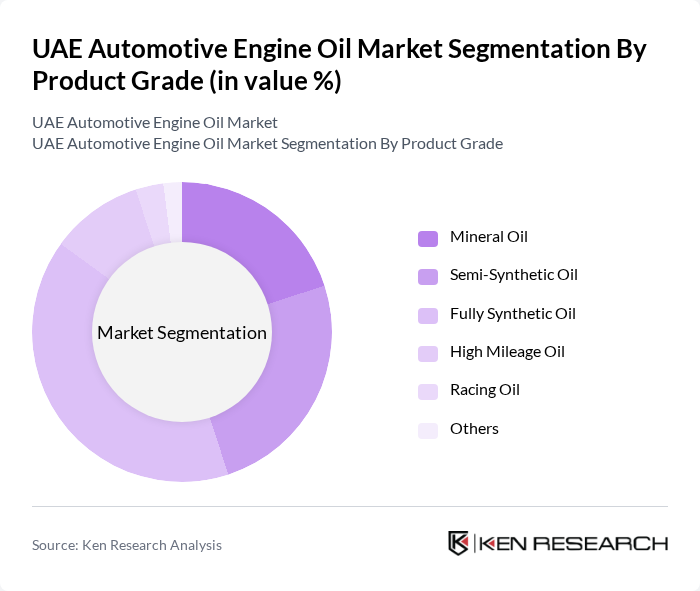

By Product Grade:The product grade segmentation includes Mineral Oil, Semi-Synthetic Oil, Fully Synthetic Oil, High Mileage Oil, Racing Oil, and Others. Fully Synthetic Oil is the leading sub-segment, driven by its superior performance, longevity, and ability to meet the requirements of modern engines and environmental standards. The increasing consumer preference for high-quality lubricants that enhance engine efficiency, reduce wear, and support sustainability is propelling the growth of this segment .

The UAE Automotive Engine Oil Market is characterized by a dynamic mix of regional and international players. Leading participants such as ADNOC Distribution, ENOC (Emirates National Oil Company), TotalEnergies Marketing Middle East, Shell Markets Middle East, ExxonMobil (Mobil 1), Castrol (BP), Gulf Oil Middle East, Fuchs Lubricants Middle East, Petronas Lubricants International, Valvoline Middle East, Liqui Moly Middle East, Amsoil, Chevron Middle East, Lukoil Lubricants Middle East, Repsol Middle East contribute to innovation, geographic expansion, and service delivery in this space.

The UAE automotive engine oil market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The shift towards eco-friendly products is expected to gain momentum, with a projected increase in demand for bio-based and synthetic oils. Additionally, the rise of electric vehicles will necessitate the development of specialized lubricants, creating new avenues for growth. As the market adapts to these trends, companies that invest in innovation and sustainability will likely lead the industry.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Passenger Vehicles Commercial Vehicles Motorcycles Others |

| By Product Grade | Mineral Oil Semi-Synthetic Oil Fully Synthetic Oil High Mileage Oil Racing Oil Others |

| By Engine Type | Gasoline Engines Diesel Engines Hybrid/Electric Vehicles Others |

| By Application | Engine Lubrication Fuel Economy Improvement Engine Cleaning Performance Enhancement Others |

| By Packaging Type | Bottles Drums Bulk Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Others |

| By Brand Type | Premium Brands Mid-Range Brands Budget Brands Others |

| By Region | Abu Dhabi Dubai Sharjah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Oil Retailers | 100 | Store Managers, Sales Representatives |

| Automotive Service Centers | 80 | Service Managers, Technicians |

| Oil Manufacturers | 60 | Product Managers, R&D Specialists |

| Fleet Operators | 50 | Fleet Managers, Maintenance Supervisors |

| Automotive Industry Experts | 40 | Consultants, Industry Analysts |

The UAE Automotive Engine Oil Market is valued at approximately USD 730 million, driven by factors such as increasing vehicle ownership, consumer awareness regarding maintenance, and the demand for high-performance lubricants.