Region:Middle East

Author(s):Geetanshi

Product Code:KRAD1136

Pages:95

Published On:November 2025

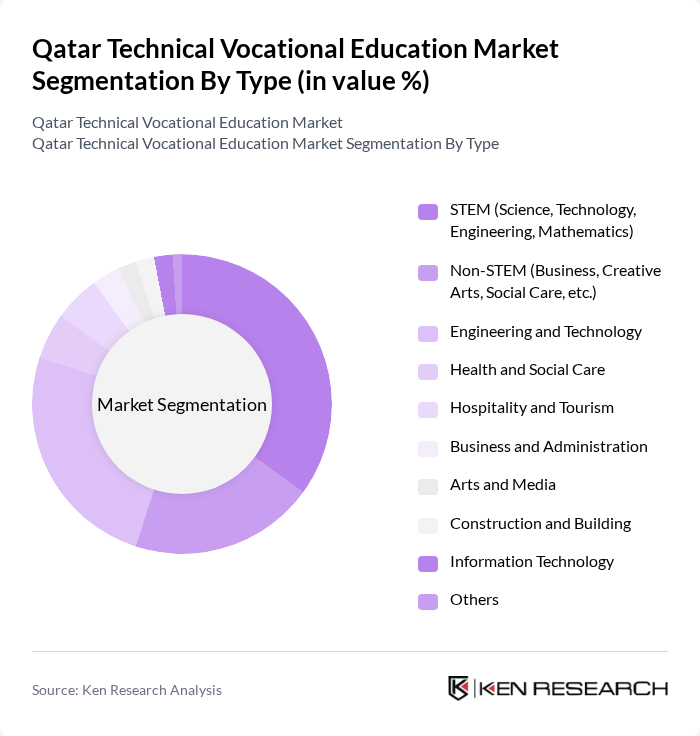

By Type:The market is segmented into STEM (Science, Technology, Engineering, Mathematics), Non-STEM (Business, Creative Arts, Social Care, etc.), Engineering and Technology, Health and Social Care, Hospitality and Tourism, Business and Administration, Arts and Media, Construction and Building, Information Technology, and Others.STEMandEngineering and Technologyare the leading segments, reflecting high demand for technical and digital skills in Qatar’s evolving job market. Specialized programs in ICT, engineering, and applied sciences are expanding rapidly to meet sectoral workforce needs, while Non-STEM fields such as business and creative arts are also growing due to diversification of the economy .

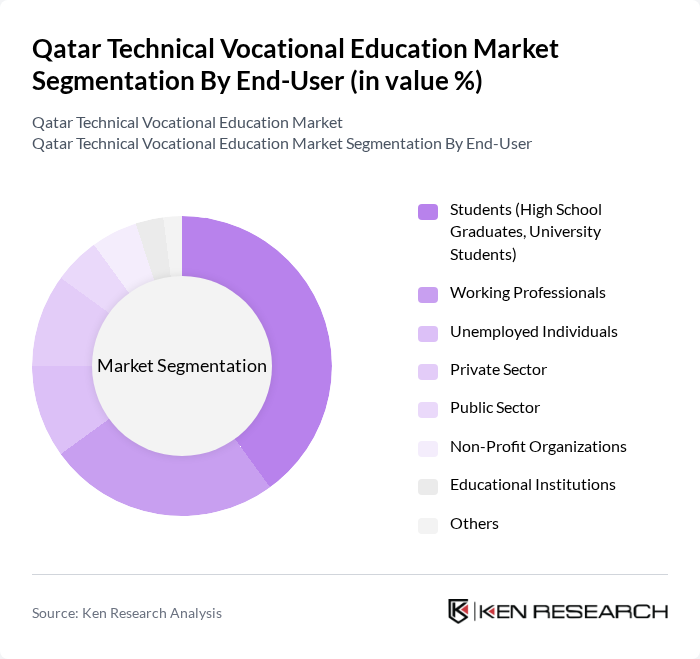

By End-User:The end-user segmentation includes Students (High School Graduates, University Students), Working Professionals, Unemployed Individuals, Private Sector, Public Sector, Non-Profit Organizations, Educational Institutions, and Others.Studentsrepresent the largest segment, driven by a growing number of high school graduates and university students seeking vocational training to enhance employability. Working professionals and private sector employees are increasingly enrolling in upskilling and reskilling programs as part of workforce development and industry transformation initiatives .

The Qatar Technical Vocational Education Market is characterized by a dynamic mix of regional and international players. Leading participants such as College of the North Atlantic – Qatar (CNA-Q), Qatar Skills Academy, Qatar Technical Secondary School for Boys, Qatar Petroleum Training Center (QPTC), Aspire Academy, Qatar Aeronautical Academy, Qatar Finance and Business Academy (QFBA), Qatar University – Continuing Education Office, Qatar Foundation – Education City (inc. HBKU, TAMUQ, WCM-Q, etc.), Doha Institute for Graduate Studies, Qatar Chamber of Commerce and Industry, Qatar International Safety Centre (QISC), Qatar National Tourism Council – Training Initiatives, Qatar University of Science and Technology, Qatar International School of Choueifat – Doha contribute to innovation, geographic expansion, and service delivery in this space.

The future of Qatar's technical vocational education market appears promising, driven by increasing government support and a growing recognition of the importance of skilled labor. As industries evolve, the demand for specialized training will likely rise, prompting educational institutions to innovate their curricula. Additionally, the integration of technology in training programs will enhance learning experiences, making vocational education more appealing. Overall, the sector is poised for growth, with a focus on aligning educational outcomes with labor market needs.

| Segment | Sub-Segments |

|---|---|

| By Type | STEM (Science, Technology, Engineering, Mathematics) Non-STEM (Business, Creative Arts, Social Care, etc.) Engineering and Technology Health and Social Care Hospitality and Tourism Business and Administration Arts and Media Construction and Building Information Technology Others |

| By End-User | Students (High School Graduates, University Students) Working Professionals Unemployed Individuals Private Sector Public Sector Non-Profit Organizations Educational Institutions Others |

| By Program Duration | Short-term Programs Long-term Programs Certification Courses Diploma Programs Apprenticeship Programs Others |

| By Delivery Mode | In-person Training Online Training Hybrid Training Corporate Training Others |

| By Funding Source | Government Funding Private Investment International Aid Tuition Fees Others |

| By Certification Type | National Certifications International Certifications Industry-recognized Certifications Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Institutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Technical Colleges and Institutes | 45 | Deans, Program Coordinators |

| Industry Employers | 52 | HR Managers, Training Coordinators |

| Current Students in Vocational Programs | 75 | Students, Recent Graduates |

| Government Education Officials | 38 | Policy Makers, Education Inspectors |

| Vocational Training Providers | 42 | Directors, Instructors |

The Qatar Technical Vocational Education Market is valued at approximately USD 790 million, reflecting its significant role in the Middle East's vocational training sector and Qatar's commitment to developing skilled labor in various industries.