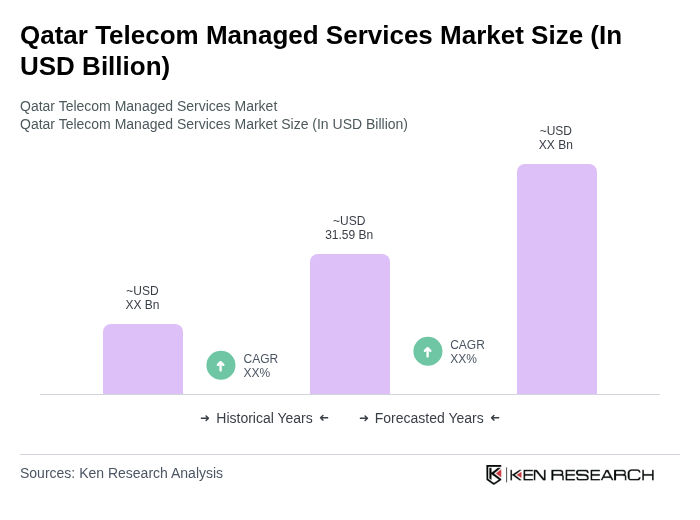

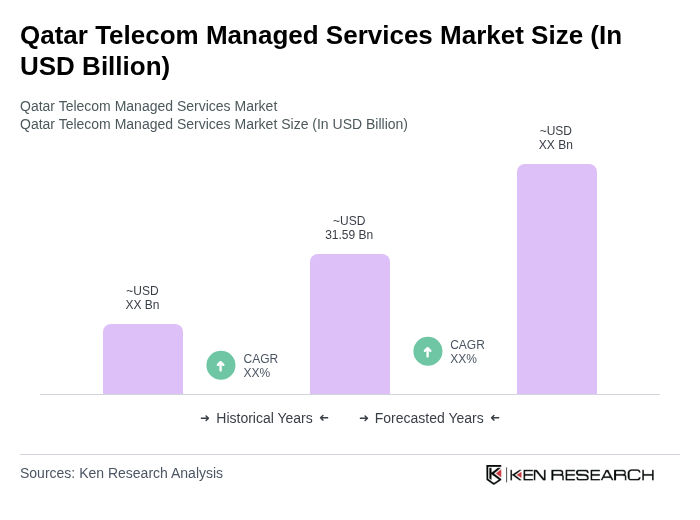

Qatar Telecom Managed Services Market Overview

- The Qatar Telecom Managed Services Market is valued at USD 31.59 billion, based on current market analysis. This growth is primarily driven by the increasing demand for efficient network management, cloud computing solutions, and enhanced cybersecurity measures. The rise in digital transformation initiatives across various sectors has further propelled the need for managed services, enabling organizations to focus on their core competencies while outsourcing IT functions. Security services dominate the market, contributing 28.21% of market share, with managed security spending gaining momentum from the USD 1.64 billion National Cybersecurity Strategy that directs funds toward 24×7 monitoring and incident-response platforms.

- Key players in this market include Doha, Al Rayyan, and Lusail, which dominate due to their advanced telecommunications infrastructure and high population density. The concentration of businesses and government institutions in these cities fosters a competitive environment, encouraging innovation and investment in managed services. Doha is expected to dominate the Qatar Managed Services Market, with 92% of registered firms headquartered there and over 850 enterprises in the financial district alone demanding solid IT infrastructure and management services. Lusail is the fastest-growing region, with its Smart City plan representing one of Qatar's most ambitious digital transformation projects, featuring more than USD 45 billion committed to smart infrastructure development and over 400,000 IoT sensors and connected devices.

- The Qatari government has implemented comprehensive cybersecurity regulations requiring all telecom service providers to adhere to stringent cybersecurity standards. These regulatory frameworks aim to protect consumer data and enhance the overall security of telecommunications networks. Providers are required to invest in advanced security technologies and undergo regular audits to ensure compliance, thereby fostering a safer digital environment for users. The National Cybersecurity Strategy allocates significant resources toward threat intelligence, endpoint detection, and compliance services, with enforcement mechanisms in place across the financial and energy sectors.

Qatar Telecom Managed Services Market Segmentation

By Type:The market is segmented into various types of managed services, including Network Management Services, Cloud Services, Security Services, Data Center Services, Managed IT Services, Unified Communications, and Others. Each of these segments plays a crucial role in addressing specific customer needs and preferences, with a notable trend towards integrated solutions that combine multiple services for enhanced efficiency. Security services currently dominate, driven by enterprises prioritizing threat intelligence and compliance, while cloud services accelerate adoption across banking, finance, and healthcare sectors.

By End-User:The end-user segmentation includes Banking, Financial Services and Insurance (BFSI), IT & Telecom, Healthcare, Government, Real Estate and Construction, Transportation, Retail, Manufacturing, and Education. Each sector has unique requirements for managed services, with BFSI and healthcare being the largest consumers due to their critical need for reliable and secure communication infrastructures. BFSI retained a 22.56% share of the market in 2024 as banks modernized mobile channels and payment rails, while healthcare grows the fastest at 13.21% CAGR, propelled by 300 digital-health projects within the National Health Strategy 2024-2030.

Qatar Telecom Managed Services Market Competitive Landscape

The Qatar Telecom Managed Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ooredoo, Vodafone Qatar, Qtel (Ooredoo Group), Gulf Bridge International, Qatar National Broadband Network (Qnbn), MEEZA, Qatari Businessmen Association (QBA), Qatari IT Services (QITCOM), Qatari Cloud Services (QCS), Qatari Cybersecurity Solutions (QCSec), Qatar Digital Services (QDS), Qatar Smart Solutions (QSS), Qatar Telecom Solutions (QTS), Qatar Managed Services (QMS), Techno Q contribute to innovation, geographic expansion, and service delivery in this space.

Qatar Telecom Managed Services Market Industry Analysis

Growth Drivers

- Increasing Demand for Digital Transformation:The digital transformation in Qatar is projected to reach $1.5 billion in future, driven by businesses seeking to enhance operational efficiency. The Qatar National Vision 2030 emphasizes technology adoption, with 70% of organizations planning to invest in digital solutions. This shift is supported by a 15% annual increase in IT spending, indicating a robust demand for managed services that facilitate this transformation.

- Rise in Cloud-Based Services Adoption:The cloud services market in Qatar is expected to grow to $500 million in future, reflecting a 20% increase from the previous year. This growth is fueled by enterprises migrating to cloud platforms for scalability and cost efficiency. With 60% of businesses already utilizing cloud solutions, the demand for managed services that support cloud infrastructure is surging, creating significant opportunities for service providers.

- Enhanced Focus on Cybersecurity Solutions:Cybersecurity spending in Qatar is projected to reach $300 million in future, driven by increasing cyber threats and regulatory requirements. The government has mandated compliance with international cybersecurity standards, leading to a 25% rise in demand for managed security services. This focus on cybersecurity is crucial for businesses, creating a strong market for telecom managed services that offer comprehensive security solutions.

Market Challenges

- High Competition Among Service Providers:The Qatar telecom managed services market is characterized by intense competition, with over 15 major players vying for market share. This saturation leads to price wars, reducing profit margins. In the previous year, the average revenue per user (ARPU) declined by 10%, pressuring providers to innovate and differentiate their offerings to maintain profitability in a crowded market.

- Regulatory Compliance Complexities:Navigating the regulatory landscape in Qatar poses significant challenges for telecom service providers. Compliance with data protection laws and licensing requirements can incur costs exceeding $1 million annually for larger firms. The complexity of these regulations often leads to delays in service deployment, hindering market growth and increasing operational risks for providers attempting to meet compliance standards.

Qatar Telecom Managed Services Market Future Outlook

The future of the Qatar telecom managed services market appears promising, driven by technological advancements and increasing digitalization across sectors. As organizations prioritize cybersecurity and cloud solutions, the demand for managed services is expected to rise significantly. Additionally, the expansion of 5G networks will facilitate new service offerings, enhancing connectivity and enabling innovative applications. Strategic partnerships with technology firms will further bolster service capabilities, positioning providers to capitalize on emerging trends and customer needs.

Market Opportunities

- Expansion of 5G Networks:The rollout of 5G technology in Qatar is anticipated to create a market opportunity worth $200 million in future. This expansion will enable telecom providers to offer enhanced managed services, including IoT solutions, which are expected to grow by 30% as businesses seek to leverage real-time data for operational efficiency.

- Growth in IoT Applications:The IoT market in Qatar is projected to reach $150 million in future, driven by increased adoption across various sectors. This growth presents a significant opportunity for managed service providers to develop tailored IoT solutions, enhancing service delivery and customer engagement while addressing the rising demand for connected devices and smart solutions.