Region:Global

Author(s):Shubham

Product Code:KRAA3135

Pages:83

Published On:August 2025

By Type:The market is segmented into various types of managed services, including Managed Network Services, Managed Security Services, Managed Cloud Services, Managed Data Center Services, Managed Unified Communications, Managed Mobility Services, Managed IT Infrastructure Services, and Others. Each of these segments caters to specific needs within the telecom industry, with varying levels of demand based on technological advancements and customer requirements. Managed Network Services hold the largest share due to the critical need for secure and reliable connectivity, while Managed Security Services are rapidly growing as enterprises prioritize advanced threat detection and response. Cloud-based managed services are also gaining traction, driven by the shift to scalable, cost-effective solutions and the adoption of 5G and IoT technologies .

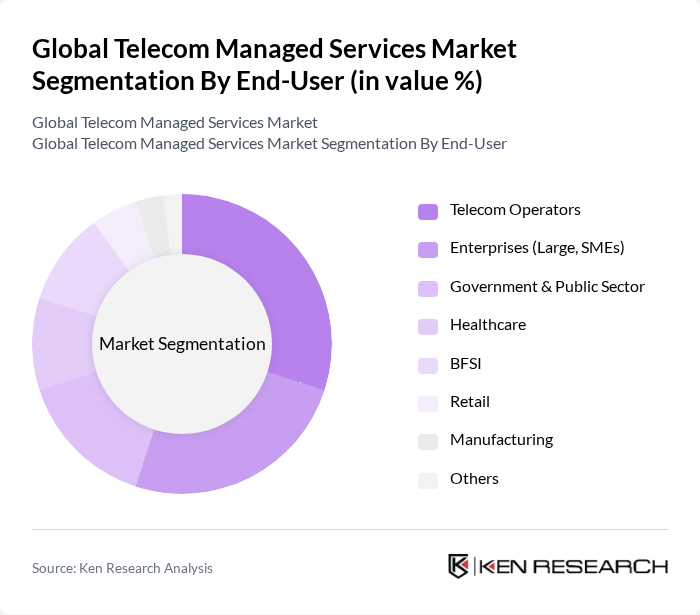

By End-User:The end-user segmentation includes Telecom Operators, Enterprises (Large, SMEs), Government & Public Sector, Healthcare, BFSI, Retail, Manufacturing, and Others. Each segment has unique requirements and challenges, influencing the demand for managed services tailored to their specific operational needs. Telecom Operators and Enterprises remain the largest consumers, leveraging managed services for network optimization, security, and digital transformation, while sectors such as Healthcare and BFSI are increasingly adopting managed services to address regulatory compliance and data security needs .

The Global Telecom Managed Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as AT&T Inc., Verizon Communications Inc., IBM Corporation, Cisco Systems, Inc., Accenture plc, Ericsson AB, Nokia Corporation, Huawei Technologies Co., Ltd., Fujitsu Limited, T-Systems International GmbH, Dimension Data Holdings plc (NTT Ltd.), NTT DATA Corporation, Orange Business Services, BT Group plc, Tata Consultancy Services Limited, Wipro Limited, Tech Mahindra Limited, HCL Technologies Limited, Telefonica S.A., Telstra Corporation Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the telecom managed services market appears promising, driven by the increasing integration of advanced technologies such as AI and machine learning. As businesses prioritize digital transformation, the demand for tailored managed services will rise, particularly in sectors like healthcare and finance. Additionally, the shift towards hybrid cloud solutions will create new avenues for service providers, enabling them to offer more flexible and scalable options that meet diverse client needs while enhancing operational efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Managed Network Services Managed Security Services Managed Cloud Services Managed Data Center Services Managed Unified Communications Managed Mobility Services Managed IT Infrastructure Services Others |

| By End-User | Telecom Operators Enterprises (Large, SMEs) Government & Public Sector Healthcare BFSI Retail Manufacturing Others |

| By Service Model | On-Premises Cloud-Based Hybrid Others |

| By Deployment Type | Public Cloud Private Cloud Hybrid Cloud Others |

| By Industry Vertical | Banking, Financial Services, and Insurance (BFSI) Retail Manufacturing Energy and Utilities Transportation and Logistics Healthcare IT & Telecom Government Others |

| By Geographic Presence | North America (U.S., Canada) Europe (U.K., Germany, France, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Rest of APAC) Latin America (Brazil, Mexico, Rest of Latin America) Middle East and Africa (GCC, South Africa, Rest of MEA) Others |

| By Pricing Model | Subscription-Based Pay-As-You-Go Tiered Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Network Management Services | 100 | Network Operations Managers, IT Directors |

| Cloud Services Adoption | 60 | Cloud Solutions Architects, IT Managers |

| Security Services in Telecom | 50 | Cybersecurity Analysts, Risk Management Officers |

| Customer Experience Management | 40 | Customer Service Managers, Experience Officers |

| Telecom Infrastructure Outsourcing | 45 | Procurement Managers, Operations Executives |

The Global Telecom Managed Services Market is valued at approximately USD 32 billion, reflecting a significant growth trend driven by the increasing demand for efficient network management, cloud computing, and enhanced security solutions.