Region:Middle East

Author(s):Dev

Product Code:KRAD6393

Pages:84

Published On:December 2025

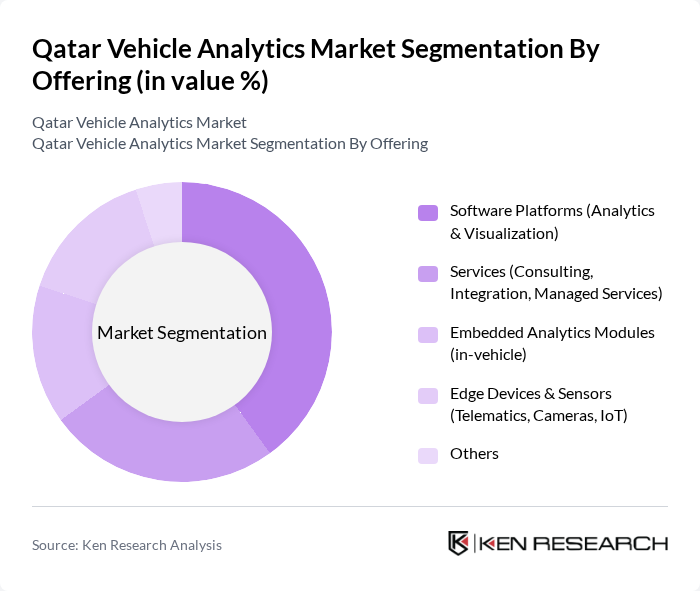

By Offering:The market is segmented into various offerings that cater to different needs within the vehicle analytics landscape. The key subsegments include Software Platforms (Analytics & Visualization), Services (Consulting, Integration, Managed Services), Embedded Analytics Modules (in-vehicle), Edge Devices & Sensors (Telematics, Cameras, IoT), and Others. Among these, Software Platforms are leading due to the increasing demand for data visualization and analytics capabilities.

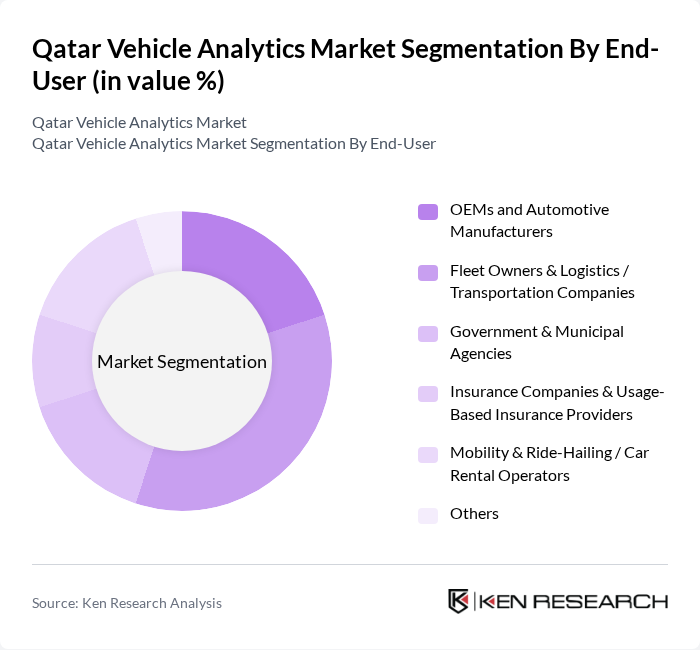

By End-User:The end-user segmentation includes OEMs and Automotive Manufacturers, Fleet Owners & Logistics / Transportation Companies, Government & Municipal Agencies, Insurance Companies & Usage-Based Insurance Providers, Mobility & Ride-Hailing / Car Rental Operators, and Others. Fleet Owners are currently the dominant end-user segment, driven by the need for efficient fleet management and cost reduction through analytics.

The Qatar Vehicle Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Mobility Innovations Center (QMIC), Ooredoo Qatar Q.P.S.C., Vodafone Qatar P.Q.S.C., Woqod Vehicles Inspection (Fahes), Mowasalat (Karwa), Qatar Railways Company (Qatar Rail), Gulf Warehousing Company Q.P.S.C. (GWC), Qatar Electronic Systems Company (QES), Qatar Science and Technology Park (QSTP), Karhoo Qatar / Leading Ride-Hailing & Mobility Platforms (e.g. Uber, Careem, Karwa Taxi), International Vehicle Analytics & Telematics Vendors Active in Qatar (e.g. Geotab Inc.), Global Automotive OEMs with Connected Services in Qatar (e.g. Toyota Connected, BMW ConnectedDrive), Trimble Inc., TomTom N.V., Continental AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar vehicle analytics market appears promising, driven by technological advancements and increasing government support for smart transportation initiatives. As the adoption of electric and autonomous vehicles rises, analytics solutions will play a crucial role in optimizing performance and enhancing user experience. Furthermore, the integration of AI and machine learning technologies is expected to revolutionize data processing, leading to more accurate insights and predictive capabilities, thereby fostering market growth.

| Segment | Sub-Segments |

|---|---|

| By Offering | Software Platforms (Analytics & Visualization) Services (Consulting, Integration, Managed Services) Embedded Analytics Modules (in-vehicle) Edge Devices & Sensors (Telematics, Cameras, IoT) Others |

| By End-User | OEMs and Automotive Manufacturers Fleet Owners & Logistics / Transportation Companies Government & Municipal Agencies Insurance Companies & Usage-Based Insurance Providers Mobility & Ride-Hailing / Car Rental Operators Others |

| By Vehicle Type | Passenger Vehicles Light Commercial Vehicles Heavy Commercial Vehicles & Buses Specialty & Public Service Vehicles Others |

| By Application | Traffic & Mobility Management Fleet Management & Route Optimization Safety, Security & Driver Behaviour Analytics Predictive Maintenance & Vehicle Health Monitoring Usage-Based Insurance & Risk Scoring Revenue & Asset Utilization Analytics Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Edge / On-Device |

| By Region | Doha Al Rayyan Al Wakrah Others |

| By Policy Support & Project Type | Smart City & National Vision 2030 Programs Public Transport & Metro / Rail Projects Road Safety & Enforcement Initiatives Sustainability & Emissions Reduction Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fleet Management Solutions | 100 | Fleet Managers, Operations Directors |

| Insurance Telematics | 80 | Insurance Underwriters, Risk Assessment Analysts |

| Consumer Vehicle Analytics | 120 | Car Owners, Technology Enthusiasts |

| Telematics Service Providers | 90 | Product Managers, Business Development Executives |

| Government Transportation Agencies | 70 | Policy Makers, Transportation Planners |

The Qatar Vehicle Analytics Market is valued at approximately USD 15 million, driven by the increasing adoption of connected vehicles, advancements in telematics, and the demand for data-driven insights in fleet management and traffic optimization.