Region:Middle East

Author(s):Dev

Product Code:KRAD5124

Pages:83

Published On:December 2025

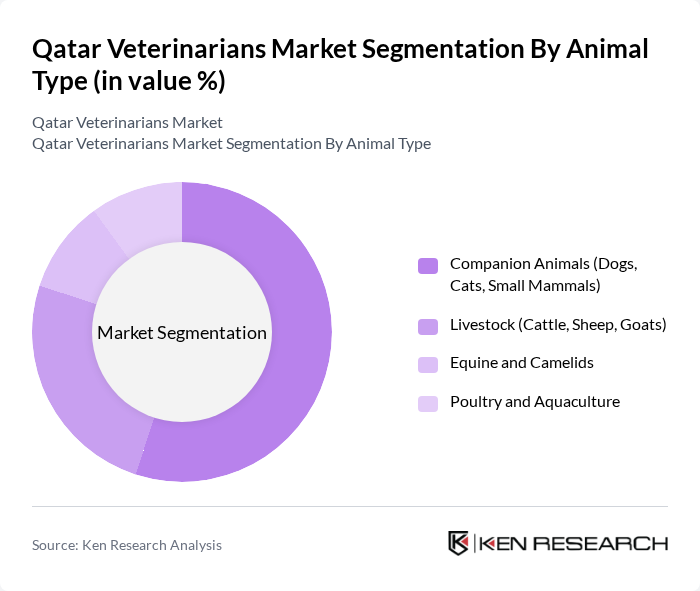

By Animal Type:The animal type segmentation includes various subsegments such as Companion Animals (Dogs, Cats, Small Mammals), Livestock (Cattle, Sheep, Goats), Equine and Camelids, and Poultry and Aquaculture. Among these, Companion Animals dominate the market due to the increasing trend of pet ownership and the growing willingness of pet owners to spend on healthcare services. The rising disposable income and changing lifestyles have led to a surge in demand for veterinary services for pets, making this subsegment the leading category.

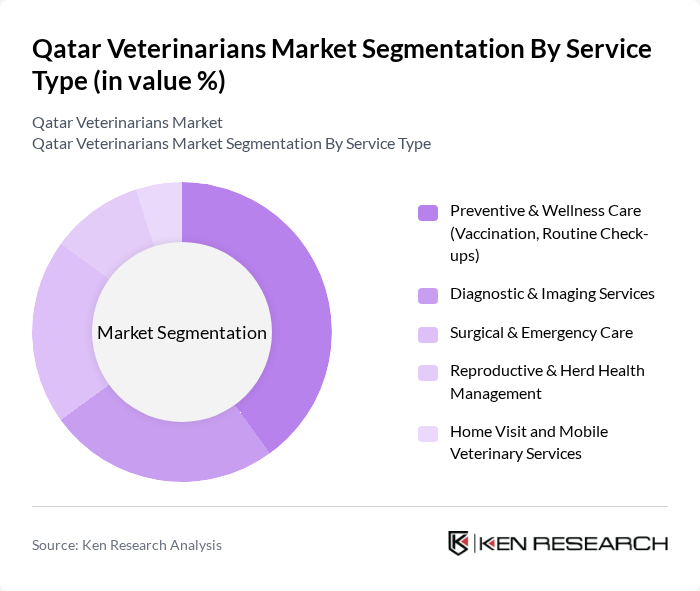

By Service Type:The service type segmentation encompasses Preventive & Wellness Care (Vaccination, Routine Check-ups), Diagnostic & Imaging Services, Surgical & Emergency Care, Reproductive & Herd Health Management, and Home Visit and Mobile Veterinary Services. Preventive & Wellness Care is the leading subsegment, driven by the increasing awareness among pet owners regarding the importance of regular health check-ups and vaccinations. This trend is further supported by the growing emphasis on preventive healthcare in veterinary practices.

The Qatar Veterinarians Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Veterinary Center (QVC), Doha Veterinary Services, Canadian Veterinary Hospital – Doha, Parkview Pet Center, Qatar Animal Welfare Society (QAWS), Pet Vet Veterinary Clinic, Al Wabra Veterinary Center, German Veterinary Clinic Doha, Royal Veterinary Center, Al Wakra Veterinary Clinic, Al Khor Veterinary Clinic, Al Shamal Veterinary Clinic, Ministry of Municipality – Government Veterinary Clinics, Equine Veterinary Medical Center (EVMC), Al Shaqab, Baladna Veterinary & Farm Health Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar veterinarians market appears promising, driven by increasing pet ownership and a growing emphasis on animal health. As the pet population continues to rise, the demand for veterinary services is expected to expand. Additionally, advancements in technology, such as telemedicine and digital health records, will likely enhance service delivery. The integration of these innovations will improve accessibility and efficiency, positioning the market for sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Animal Type | Companion Animals (Dogs, Cats, Small Mammals) Livestock (Cattle, Sheep, Goats) Equine and Camelids Poultry and Aquaculture |

| By Service Type | Preventive & Wellness Care (Vaccination, Routine Check-ups) Diagnostic & Imaging Services Surgical & Emergency Care Reproductive & Herd Health Management Home Visit and Mobile Veterinary Services |

| By Practice Ownership | Independent Private Clinics Corporate / Chain Veterinary Providers Government Veterinary Facilities NGO & Charity-Run Facilities |

| By End User | Individual Pet Owners Commercial Farms & Livestock Producers Equine & Camel Owners / Racing Stables Animal Shelters & Welfare Organizations Research & Academic Institutions |

| By Service Delivery Channel | In-Clinic / Hospital-Based Services Mobile & On-Farm Services Tele-veterinary / Online Consultation Referral & Specialty Centers |

| By Geographic Area | Doha & Al Wakrah Al Rayyan Al Khor & Al Shamal Umm Salal & Al Daayen Other Municipalities |

| By Species Focus of Practice | Small Animal–Only Practices Mixed Animal Practices Large Animal & Livestock–Focused Practices Equine & Camel–Focused Practices |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 90 | Veterinarians, Clinic Managers |

| Pet Owners | 120 | Dog and Cat Owners, Pet Care Enthusiasts |

| Animal Welfare Organizations | 40 | Directors, Program Coordinators |

| Veterinary Pharmaceutical Suppliers | 80 | Sales Representatives, Product Managers |

| Pet Service Providers | 70 | Groomers, Trainers, Boarding Facility Owners |

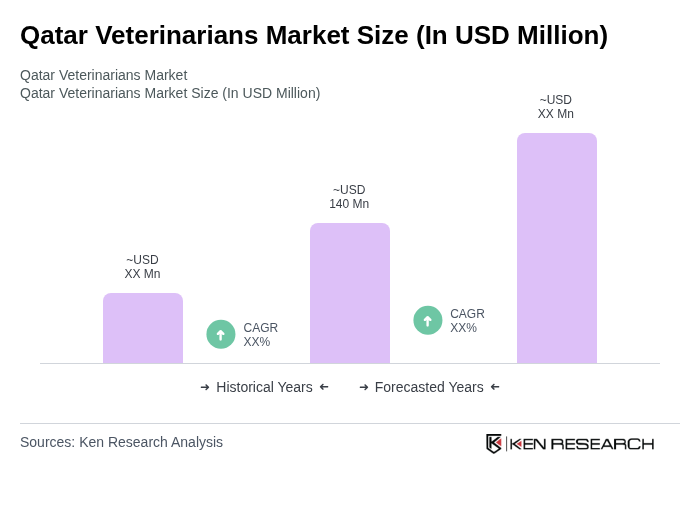

The Qatar Veterinarians Market is valued at approximately USD 140 million, reflecting significant growth driven by increasing pet ownership, heightened awareness of animal health, and advancements in veterinary services across the country.