Region:Middle East

Author(s):Shubham

Product Code:KRAB7265

Pages:87

Published On:October 2025

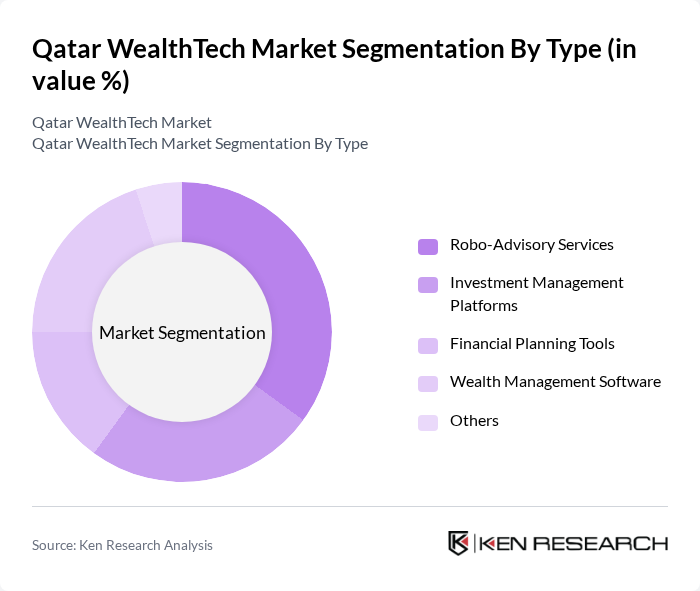

By Type:The WealthTech market is segmented into various types, including Robo-Advisory Services, Investment Management Platforms, Financial Planning Tools, Wealth Management Software, and Others. Among these, Robo-Advisory Services are gaining significant traction due to their cost-effectiveness and accessibility for individual investors. The increasing preference for automated investment solutions is driving the growth of this sub-segment, as it allows users to manage their portfolios with minimal human intervention.

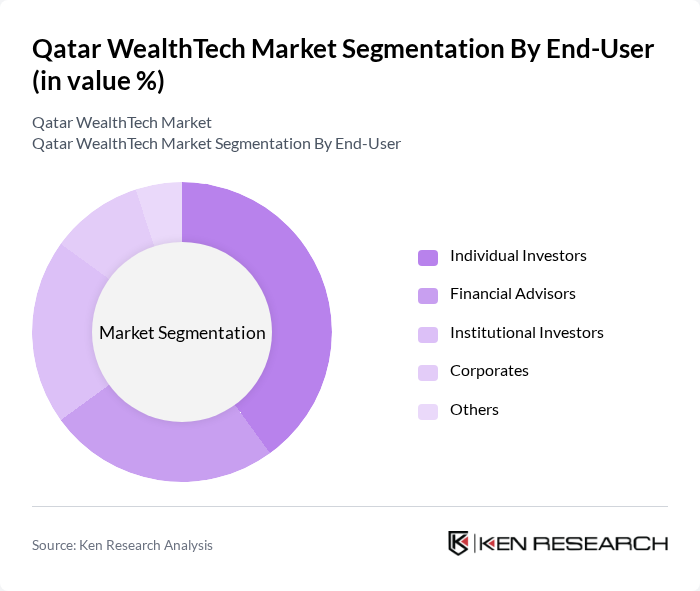

By End-User:The end-user segmentation includes Individual Investors, Financial Advisors, Institutional Investors, Corporates, and Others. Individual Investors are the leading segment, driven by the increasing number of retail investors entering the market. The rise of mobile investment applications and online trading platforms has made it easier for individuals to access wealth management services, thus propelling this segment's growth.

The Qatar WealthTech Market is characterized by a dynamic mix of regional and international players. Leading participants such as QInvest, Qatar National Bank (QNB), Doha Bank, Qatar Islamic Bank (QIB), Al Rayan Investment, Dlala Brokerage, QNB Financial Services, Amwal, Qatar Financial Centre (QFC), Investment House, Qatar Development Bank, Barwa Bank, Qatar Insurance Company, Al Khaliji Commercial Bank, Qatar Stock Exchange contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar WealthTech market is poised for significant growth, driven by increasing digital adoption and a rising affluent population. As consumers demand more personalized financial solutions, WealthTech firms will likely enhance their offerings through advanced technologies like AI and machine learning. Additionally, regulatory support for fintech innovations will create a conducive environment for startups, fostering collaboration and investment in the sector. This dynamic landscape suggests a promising future for WealthTech in Qatar, with opportunities for both established players and new entrants.

| Segment | Sub-Segments |

|---|---|

| By Type | Robo-Advisory Services Investment Management Platforms Financial Planning Tools Wealth Management Software Others |

| By End-User | Individual Investors Financial Advisors Institutional Investors Corporates Others |

| By Investment Type | Equities Fixed Income Real Estate Commodities Others |

| By Distribution Channel | Direct Sales Online Platforms Financial Intermediaries Others |

| By Customer Segment | High Net-Worth Individuals (HNWIs) Mass Affluent Retail Investors Others |

| By Service Model | Subscription-Based Commission-Based Fee-Only Others |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Robo-Advisory Services | 100 | Wealth Managers, Financial Advisors |

| Investment Platforms | 80 | Fintech Entrepreneurs, Product Managers |

| Financial Planning Tools | 70 | Financial Analysts, Compliance Officers |

| Blockchain in Wealth Management | 60 | Technology Officers, Blockchain Developers |

| Regulatory Impact on WealthTech | 50 | Regulatory Affairs Specialists, Legal Advisors |

The Qatar WealthTech market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of digital financial services and a rise in high-net-worth individuals seeking personalized investment solutions.