Region:Europe

Author(s):Rebecca

Product Code:KRAB1783

Pages:83

Published On:October 2025

By Type:The e-learning market is segmented into various types, including Learning Management Systems (LMS), Content Creation Tools, Assessment and Testing Platforms, Virtual Classrooms, Mobile Learning Applications, Corporate Training Solutions, and Others. Among these, Learning Management Systems (LMS) dominate the market due to their ability to streamline the learning process, track progress, and provide a centralized platform for educational content. The increasing adoption of LMS by educational institutions and corporations for training and development purposes has significantly contributed to their market leadership.

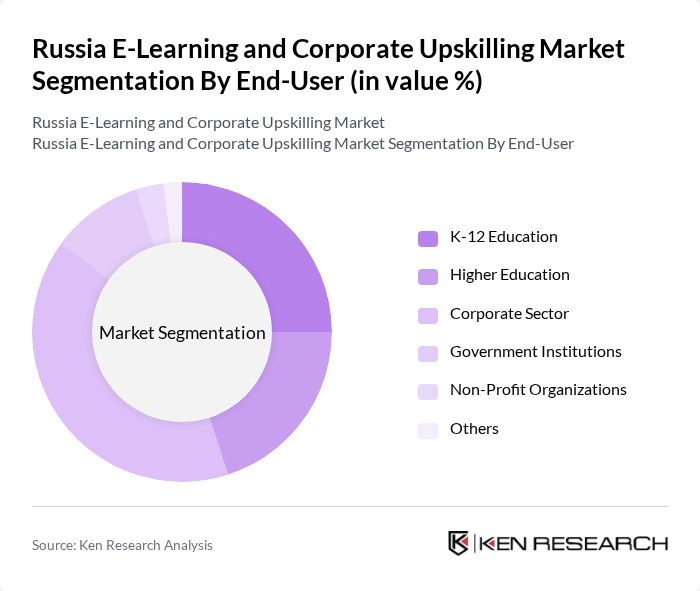

By End-User:The end-user segmentation includes K-12 Education, Higher Education, Corporate Sector, Government Institutions, Non-Profit Organizations, and Others. The Corporate Sector is the leading end-user of e-learning solutions, driven by the need for continuous employee training and upskilling in a rapidly changing job market. Companies are increasingly investing in e-learning platforms to enhance employee productivity and retention, making this segment a significant contributor to market growth.

The Russia E-Learning and Corporate Upskilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Skillbox, GeekBrains, Netology, Coursera, Udemy, Stepik, Eduson, Skyeng, LinguaTrip, Open Education (???????? ???????????), Yandex.Practicum, SkillFactory, Innotech, Lectorium, Uchi.ru, Znanium contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Russia e-learning and corporate upskilling market appears promising, driven by technological advancements and increasing acceptance of digital education. As more institutions and corporations embrace blended learning models, the demand for personalized and engaging content will rise. Additionally, the integration of artificial intelligence in learning platforms is expected to enhance user experiences, making education more accessible and tailored to individual needs. This evolution will likely attract further investments and innovations in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Learning Management Systems (LMS) Content Creation Tools Assessment and Testing Platforms Virtual Classrooms Mobile Learning Applications Corporate Training Solutions Others |

| By End-User | K-12 Education Higher Education Corporate Sector Government Institutions Non-Profit Organizations Others |

| By Industry | IT and Software Healthcare Manufacturing Retail Finance Others |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Blended Learning Self-Paced Learning Others |

| By Content Type | Video-Based Learning Text-Based Learning Interactive Learning Modules Simulation-Based Learning Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Model Licensing Fees Others |

| By Geographic Coverage | National Regional International Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate E-Learning Adoption | 120 | HR Managers, Learning and Development Specialists |

| Upskilling Program Effectiveness | 80 | Training Coordinators, Employee Development Managers |

| Industry-Specific Training Needs | 60 | Sector Experts, Corporate Trainers |

| Employee Engagement in E-Learning | 100 | Employees from Various Departments, Team Leaders |

| Technology Integration in Training | 50 | IT Managers, E-Learning Platform Administrators |

The Russia E-Learning and Corporate Upskilling Market is valued at approximately USD 1.65 billion, reflecting significant growth driven by the demand for digital learning solutions, particularly accelerated by the COVID-19 pandemic.