Region:Middle East

Author(s):Geetanshi

Product Code:KRAB1557

Pages:88

Published On:October 2025

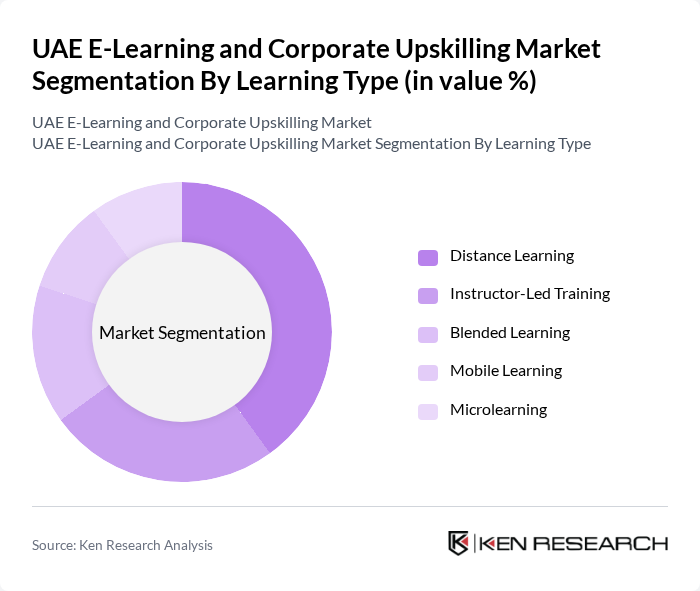

By Learning Type:The learning type segmentation includes various methods through which education and training are delivered. The subsegments include Distance Learning, Instructor-Led Training, Blended Learning, Mobile Learning, and Microlearning. Each of these methods caters to different learning preferences and environments, with Distance Learning being particularly popular due to its flexibility and accessibility. Distance Learning is favored for its ability to reach a broad audience, while Instructor-Led Training remains essential for interactive and personalized instruction. Blended Learning combines the benefits of online and face-to-face methods, Mobile Learning leverages smartphones for on-the-go education, and Microlearning delivers content in short, focused bursts for rapid skill acquisition .

The Distance Learning subsegment is currently dominating the market due to its ability to provide flexible and accessible education solutions to a diverse audience. The rise of online platforms and the increasing acceptance of remote learning have made it a preferred choice for both individuals and organizations. This method allows learners to access courses from anywhere, making it particularly appealing in a fast-paced, technology-driven environment. The convenience and adaptability of Distance Learning have led to its significant market share, as it meets the needs of a growing population seeking continuous education and skill enhancement .

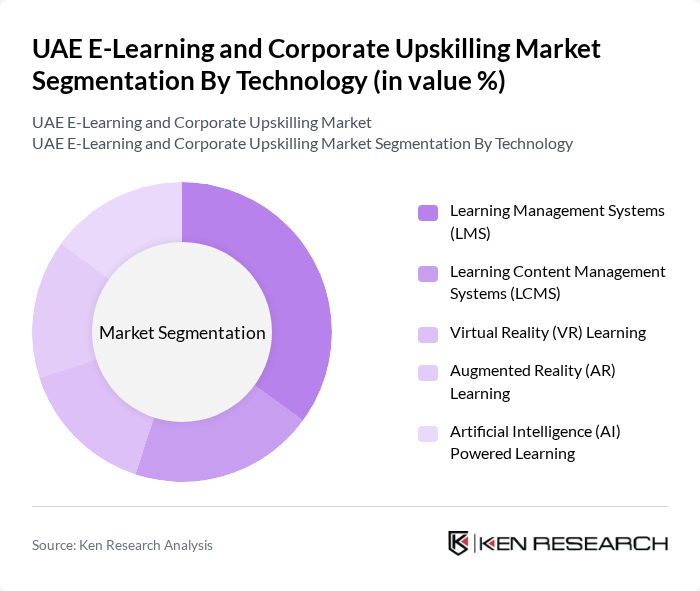

By Technology:The technology segmentation encompasses the various tools and platforms used to deliver e-learning and corporate upskilling. This includes Learning Management Systems (LMS), Learning Content Management Systems (LCMS), Virtual Reality (VR) Learning, Augmented Reality (AR) Learning, and Artificial Intelligence (AI) Powered Learning. Each technology offers unique features that enhance the learning experience and cater to different educational needs. LMS platforms are widely adopted for their ability to manage, deliver, and track educational content, while LCMS supports content creation and management. VR and AR technologies provide immersive learning experiences, and AI-powered solutions enable personalized learning pathways and data-driven insights .

Learning Management Systems (LMS) are leading the technology segment due to their comprehensive capabilities in managing, delivering, and tracking educational content. Organizations favor LMS for their ability to streamline training processes, monitor learner progress, and provide a centralized platform for various learning resources. The increasing demand for efficient training solutions and the need for data-driven insights into learner performance have solidified LMS as the dominant technology in the market .

The UAE E-Learning and Corporate Upskilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi School of Government (ADSG), Dubai Future Foundation, Emirates Institute for Banking and Financial Studies (EIBFS), Almentor, Knowledge Hub, Alef Education, Pearson Middle East, Coursera, Udemy, LinkedIn Learning, Blackboard, Moodle, Docebo, SAP Litmos, Cornerstone OnDemand contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE e-learning and corporate upskilling market appears promising, driven by technological advancements and a growing acceptance of digital learning. As organizations increasingly recognize the value of continuous education, the integration of AI and personalized learning experiences will likely enhance engagement and effectiveness. Furthermore, the government's ongoing support for digital initiatives will create a conducive environment for innovation, ensuring that the market remains dynamic and responsive to evolving educational needs.

| Segment | Sub-Segments |

|---|---|

| By Learning Type | Distance Learning Instructor-Led Training Blended Learning Mobile Learning Microlearning |

| By Technology | Learning Management Systems (LMS) Learning Content Management Systems (LCMS) Virtual Reality (VR) Learning Augmented Reality (AR) Learning Artificial Intelligence (AI) Powered Learning |

| By End-User | K-12 Education Higher Education Corporate Training Government Sector Healthcare Training |

| By Content Type | Soft Skills Training Technical Skills Training Compliance Training Leadership Development Language Learning Others |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Blended Learning Self-Paced Learning Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Model Corporate Licensing Others |

| By Geographic Reach | Local Regional International Others |

| By Certification Type | Accredited Certifications Non-Accredited Certifications Micro-Credentials Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs | 100 | HR Managers, Learning and Development Specialists |

| E-Learning Platform Users | 80 | Employees, Training Coordinators |

| Educational Institutions | 60 | University Administrators, Faculty Members |

| Industry-Specific Upskilling | 50 | Industry Experts, Corporate Trainers |

| Government Initiatives in E-Learning | 40 | Policy Makers, Educational Consultants |

The UAE E-Learning and Corporate Upskilling Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the demand for flexible learning solutions and digital transformation in businesses.