Region:Asia

Author(s):Geetanshi

Product Code:KRAB4574

Pages:88

Published On:October 2025

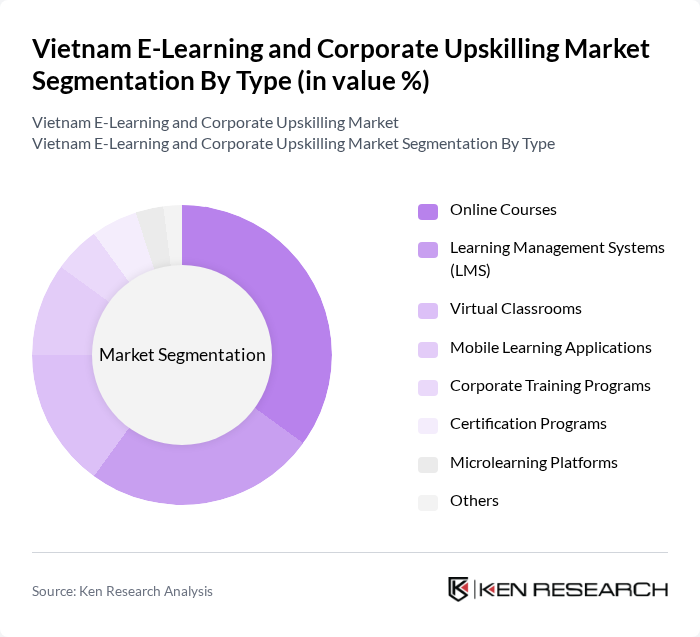

By Type:The market is segmented into various types, including Online Courses, Learning Management Systems (LMS), Virtual Classrooms, Mobile Learning Applications, Corporate Training Programs, Certification Programs, Microlearning Platforms, and Others. Among these, Online Courses have gained significant traction due to their accessibility and flexibility, allowing learners to engage with content at their own pace. Learning Management Systems (LMS) are also crucial as they provide a structured environment for both educators and learners, facilitating the management of educational content and tracking of learner progress. Virtual Classrooms and Mobile Learning Applications are increasingly adopted, driven by the proliferation of smartphones and remote work trends. Microlearning platforms and certification programs are gaining popularity for targeted skill development and professional accreditation .

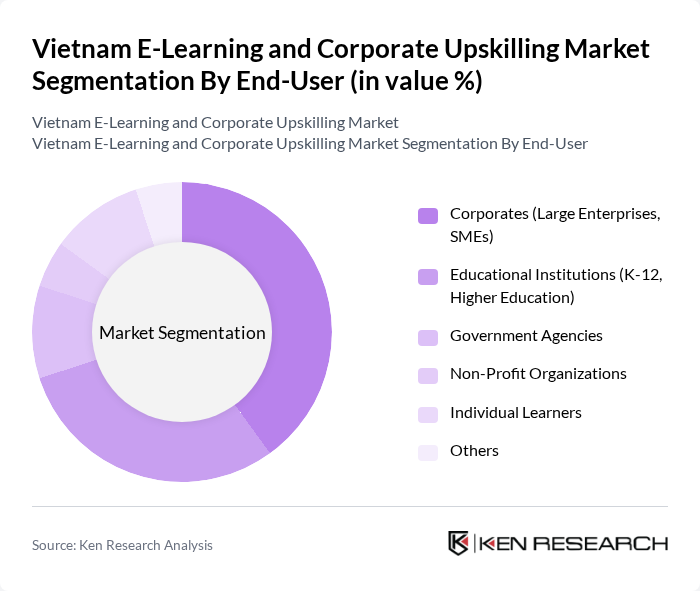

By End-User:The end-user segmentation includes Corporates (Large Enterprises, SMEs), Educational Institutions (K-12, Higher Education), Government Agencies, Non-Profit Organizations, Individual Learners, and Others. Corporates, particularly large enterprises, are the leading end-users as they increasingly invest in upskilling their workforce to remain competitive. Educational institutions also play a significant role, leveraging e-learning solutions to enhance their curriculum and provide students with modern learning experiences. Government agencies and non-profit organizations utilize e-learning for capacity building and outreach, while individual learners drive demand for flexible, self-paced education .

The Vietnam E-Learning and Corporate Upskilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Topica Edtech Group, Kyna.vn, Edumall, Hocmai.vn, VnEdu (VNPT Group), Unica, MindX, FPT Education (FPT University, FPT Polytechnic), Viettel Group (Viettel Solutions, Viettel Learning Platform), CMC Corporation (CMC Institute of Science and Technology), VNG Corporation (VNG Campus, E-learning Solutions), TMA Solutions (TMA Innovation, TMA E-Learning), FUNiX (FPT Corporation), OES - Online Education System, 123Doc Education contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam e-learning and corporate upskilling market is poised for significant transformation as technological advancements and changing workforce dynamics reshape educational paradigms. By future, the integration of artificial intelligence and personalized learning experiences will enhance engagement and effectiveness. Additionally, the increasing emphasis on soft skills development will drive demand for innovative training solutions. As the government continues to support digital education initiatives, the market is expected to evolve, creating new opportunities for both providers and learners in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses Learning Management Systems (LMS) Virtual Classrooms Mobile Learning Applications Corporate Training Programs Certification Programs Microlearning Platforms Others |

| By End-User | Corporates (Large Enterprises, SMEs) Educational Institutions (K-12, Higher Education) Government Agencies Non-Profit Organizations Individual Learners Others |

| By Content Type | Technical Skills Soft Skills Compliance & Regulatory Training Language Learning Leadership & Management Development Digital Literacy & IT Skills Others |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Blended Learning Self-Paced Learning Instructor-Led Online Training Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Model Corporate Licensing Volume-Based Pricing Others |

| By Geographic Reach | National Regional (North, Central, South Vietnam) International Others |

| By User Demographics | Age Group Professional Background Educational Background Urban vs Rural Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs | 100 | HR Managers, Training Coordinators |

| E-Learning Platform Users | 80 | Employees, Course Participants |

| Industry-Specific Upskilling Initiatives | 60 | Department Heads, Project Managers |

| Government Education Initiatives | 50 | Policy Makers, Educational Administrators |

| Technology Adoption in Training | 40 | IT Managers, Learning & Development Specialists |

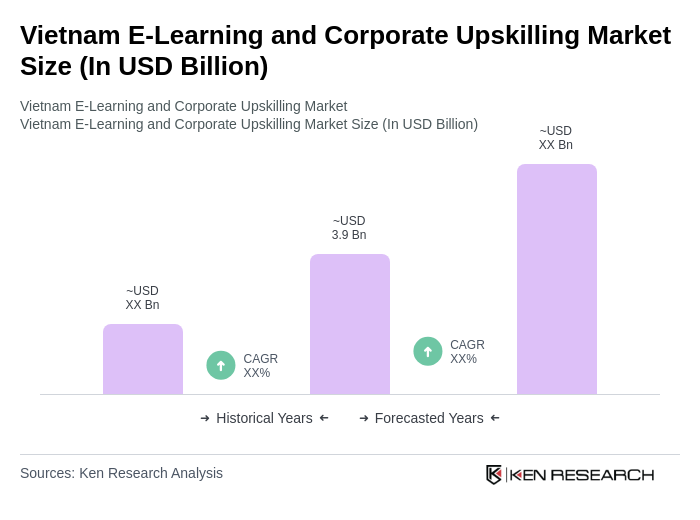

The Vietnam E-Learning and Corporate Upskilling Market is valued at approximately USD 3.9 billion, driven by the demand for flexible learning solutions, digitalization, and the need for continuous skill development in a rapidly changing job market.