Region:Europe

Author(s):Geetanshi

Product Code:KRAB4042

Pages:81

Published On:October 2025

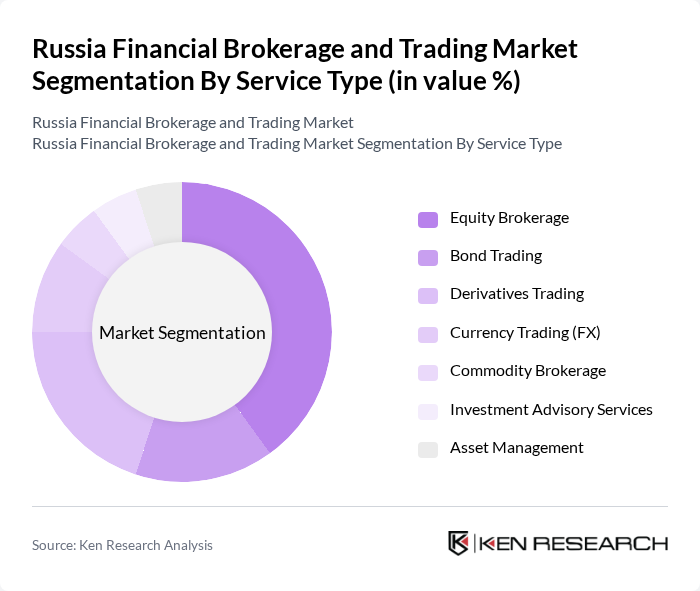

By Service Type:The service type segmentation includes various offerings such as equity brokerage, bond trading, derivatives trading, currency trading (FX), commodity brokerage, investment advisory services, and asset management. Among these, equity brokerage has emerged as the leading sub-segment, driven by the growing interest of retail investors in stock markets and the increasing availability of online trading platforms. The demand for equity trading services has surged, reflecting a shift in consumer behavior towards more active investment strategies. Notably, the structure of retail investments has evolved, with bonds increasing their share to 35% as investors anticipate rate cuts and seek to lock in high yields on long-term government bonds and corporate securities.

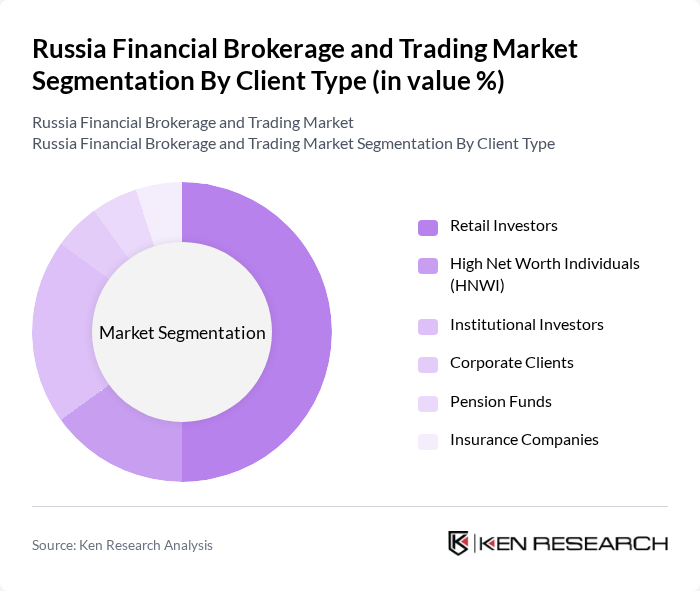

By Client Type:The client type segmentation encompasses retail investors, high net worth individuals (HNWI), institutional investors, corporate clients, pension funds, and insurance companies. Retail investors have become the dominant segment, largely due to the rise of online trading platforms that have made investing more accessible. This trend is further supported by educational initiatives aimed at increasing financial literacy among the general population, leading to a surge in retail participation in the financial markets. The number of retail clients with more than RUB 10,000 in their brokerage accounts has reached 5.1 million people, demonstrating the significant expansion of retail market participation.

The Russia Financial Brokerage and Trading Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sberbank CIB, VTB Capital, Tinkoff Investments, BCS Global Markets, Alfa Capital, Gazprombank Investment, Otkritie Broker, Renaissance Capital, Finam, ITI Capital, Freedom Finance, Aton, Kit Finance, Solid Management, PSB Brokerage contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Russian financial brokerage and trading market appears promising, driven by technological advancements and evolving investor preferences. As digital trading platforms continue to gain traction, the market is likely to see increased participation from younger investors. Additionally, the expansion of innovative financial products, including ESG and cryptocurrency offerings, will cater to diverse investment strategies. However, ongoing geopolitical tensions and regulatory challenges may pose risks that require careful navigation by market participants.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Equity Brokerage Bond Trading Derivatives Trading Currency Trading (FX) Commodity Brokerage Investment Advisory Services Asset Management |

| By Client Type | Retail Investors High Net Worth Individuals (HNWI) Institutional Investors Corporate Clients Pension Funds Insurance Companies |

| By Trading Platform | Online Trading Platforms Mobile Trading Applications Traditional Branch-Based Services Robo-Advisory Platforms |

| By Market Segment | Moscow Exchange (MOEX) Over-the-Counter (OTC) Markets International Markets Access Alternative Trading Systems |

| By Revenue Model | Commission-Based Fee-Based Advisory Spread-Based Trading Subscription-Based Services |

| By Geographic Region | Moscow Federal City St. Petersburg Central Federal District Siberian Federal District Ural Federal District Far Eastern Federal District |

| By Investment Product | Russian Equities Government Bonds (OFZ) Corporate Bonds Mutual Funds Exchange-Traded Funds (ETFs) Structured Products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Brokerage Services | 100 | Individual Investors, Financial Advisors |

| Institutional Trading Platforms | 80 | Portfolio Managers, Institutional Investors |

| Derivatives Trading | 60 | Traders, Risk Management Analysts |

| Forex Trading Services | 50 | Forex Traders, Financial Analysts |

| Investment Advisory Services | 40 | Investment Advisors, Wealth Managers |

The Russia Financial Brokerage and Trading Market is valued at approximately USD 1,150 million, reflecting significant growth driven by increased retail investor participation, technological advancements, and the expansion of online trading platforms.