Region:Europe

Author(s):Rebecca

Product Code:KRAB4082

Pages:82

Published On:October 2025

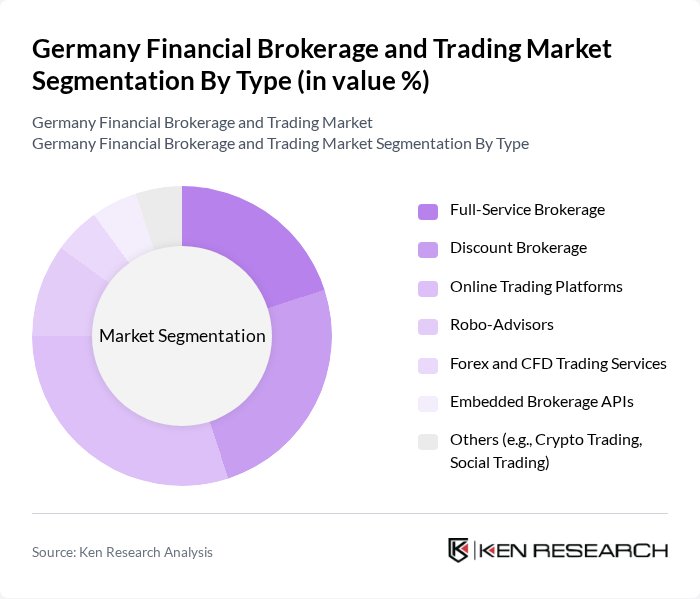

By Type:The market can be segmented into various types of brokerage services, including Full-Service Brokerage, Discount Brokerage, Online Trading Platforms, Robo-Advisors, Forex and CFD Trading Services, Embedded Brokerage APIs, and Others (e.g., Crypto Trading, Social Trading). Each of these segments caters to different investor needs and preferences, with online trading platforms and discount brokerages gaining significant traction due to their cost-effectiveness, mobile-first features, and accessibility for younger and first-time investors .

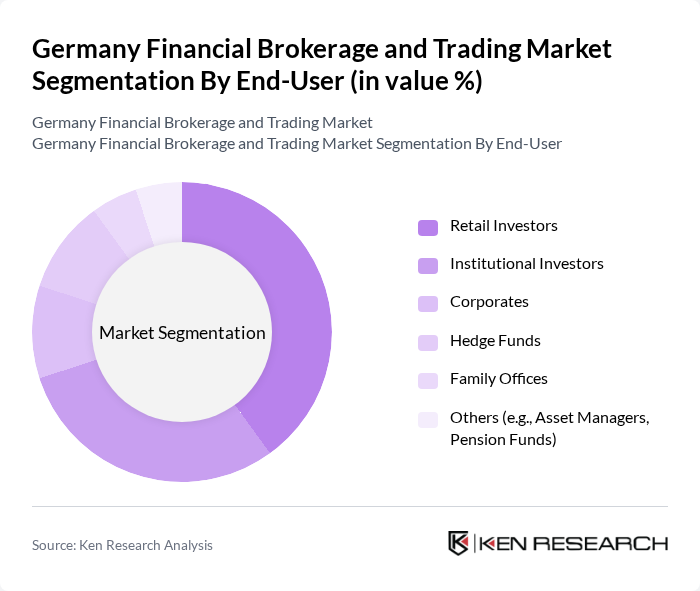

By End-User:The end-user segmentation includes Retail Investors, Institutional Investors, Corporates, Hedge Funds, Family Offices, and Others (e.g., Asset Managers, Pension Funds). Retail investors have increasingly participated in the market, driven by the accessibility of online trading platforms, the proliferation of investment apps, and the availability of fractional share trading and educational resources. Institutional investors continue to play a significant role, leveraging advanced trading strategies and technologies .

The Germany Financial Brokerage and Trading Market is characterized by a dynamic mix of regional and international players. Leading participants such as Deutsche Bank AG, Commerzbank AG, DWS Group GmbH & Co. KGaA, Baader Bank AG, flatexDEGIRO AG, Trade Republic Bank GmbH, Consorsbank (BNP Paribas S.A. Niederlassung Deutschland), ING-DiBa AG, Scalable Capital GmbH, HSBC Trinkaus & Burkhardt AG, LBBW (Landesbank Baden-Württemberg), Aareal Bank AG, Targobank AG, ODDO BHF AG, S Broker AG & Co. KG, Lemon.markets GmbH, Comdirect Bank AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the German financial brokerage and trading market appears promising, driven by technological advancements and evolving investor preferences. The integration of artificial intelligence and machine learning is expected to enhance trading strategies and risk management. Additionally, the growing emphasis on sustainable investing will likely lead to the development of innovative financial products. As the market adapts to these trends, firms that prioritize digital transformation and customer-centric services will be well-positioned to thrive in this dynamic environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Brokerage Discount Brokerage Online Trading Platforms Robo-Advisors Forex and CFD Trading Services Embedded Brokerage APIs Others (e.g., Crypto Trading, Social Trading) |

| By End-User | Retail Investors Institutional Investors Corporates Hedge Funds Family Offices Others (e.g., Asset Managers, Pension Funds) |

| By Investment Type | Equities Bonds Commodities Mutual Funds ETFs Derivatives (Options, Futures, CFDs) Cryptocurrencies Others |

| By Service Model | Managed Services Self-Directed Services Hybrid Services |

| By Distribution Channel | Direct Sales Online Platforms & Mobile Apps Financial Advisors Embedded Finance/Brokerage APIs Brokers |

| By Customer Segment | Retail Customers High Net-Worth Individuals Small and Medium Enterprises Large Corporates |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Brokerage Services | 100 | Individual Investors, Financial Advisors |

| Institutional Trading Platforms | 60 | Portfolio Managers, Institutional Traders |

| Fintech Innovations in Trading | 50 | Tech Developers, Product Managers |

| Regulatory Impact on Brokerage Operations | 40 | Compliance Officers, Legal Advisors |

| Market Sentiment Analysis | 50 | Market Analysts, Economic Researchers |

The Germany Financial Brokerage and Trading Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased digitization of financial services and rising retail trading participation.