Russia Transportation Outsourcing Market Overview

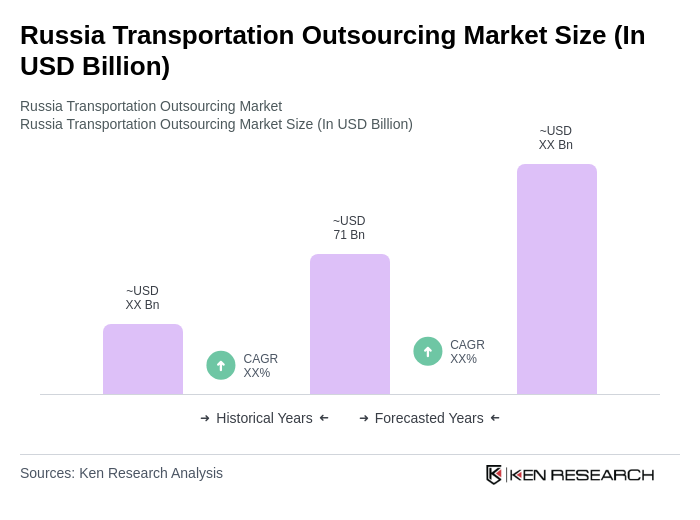

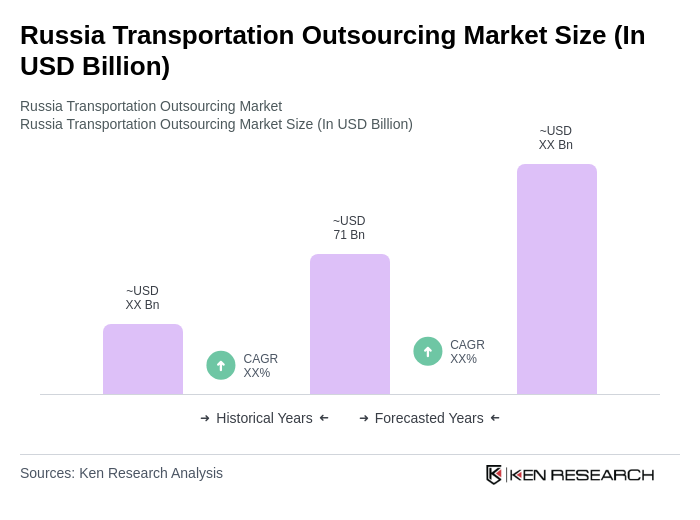

- The Russia Transportation Outsourcing Market is valued at approximately USD 71 billion, based on a five-year historical analysis of the broader freight and logistics sector. This growth is primarily driven by the increasing demand for efficient logistics solutions, the expansion of e-commerce, and the need for cost-effective transportation services. The market has seen a significant rise in outsourcing as companies seek to focus on core competencies while leveraging third-party logistics providers for transportation needs. E-commerce expansion, infrastructure modernization, and cross-border trade with China and Central Asia are key market drivers .

- Moscow, St. Petersburg, and Kazan are the dominant cities in the Russia Transportation Outsourcing Market. Moscow, as the capital, serves as a major economic and logistical hub, facilitating trade and transportation across the country. St. Petersburg, with its strategic port, plays a crucial role in maritime logistics, while Kazan benefits from its central location, enhancing connectivity between various regions .

- In 2023, the Russian government implemented the "Transport Strategy of the Russian Federation for the Period up to 2030 and for the Future up to 2035," issued by the Government of the Russian Federation. This regulation mandates the adoption of digital technologies in logistics operations, requiring companies to integrate tracking systems and automated processes to improve service delivery and transparency. The strategy aims to streamline operations, enhance digitalization, and reduce delays in the transportation sector by setting operational standards for digital document flow, real-time cargo tracking, and multimodal logistics integration .

Russia Transportation Outsourcing Market Segmentation

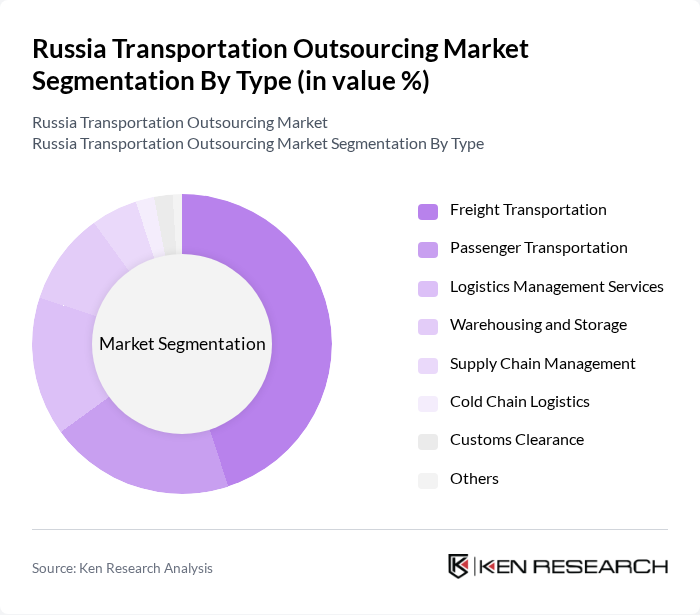

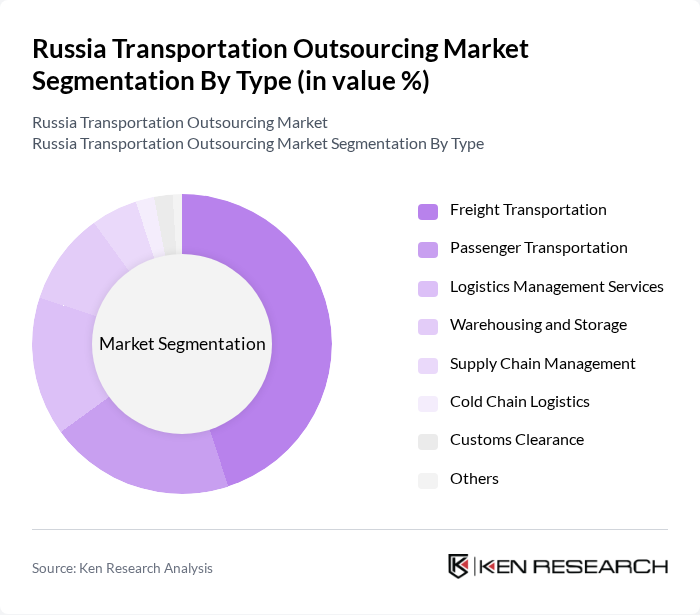

By Type:The market is segmented into various types, including Freight Transportation, Passenger Transportation, Logistics Management Services, Warehousing and Storage, Supply Chain Management, Cold Chain Logistics, Customs Clearance, and Others. Among these, Freight Transportation is the leading segment, driven by the increasing demand for goods movement across the vast Russian territory. The rise of e-commerce and the growth of domestic industries have further fueled the need for efficient freight solutions, making it a critical component of the transportation outsourcing landscape .

By End-User:The end-user segmentation includes Retail, Manufacturing, E-commerce, Automotive, Pharmaceuticals, Food and Beverage, Energy, Agriculture, Construction, and Others. The E-commerce sector is currently the dominant end-user, as the rapid growth of online shopping has necessitated efficient logistics and transportation solutions. Retail and Manufacturing also play significant roles, but the surge in online sales has positioned E-commerce as the leading driver of demand in the transportation outsourcing market .

Russia Transportation Outsourcing Market Competitive Landscape

The Russia Transportation Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Russian Railways (RZD), RZD Logistics, DPD Russia, CDEK, Eurosib, STS Logistics, Nienshants Logistics, DHL International GmbH, Kuehne + Nagel, DB Schenker, UPS, DP World Russia, Pochta Rossii (Russian Post), Yandex.Taxi, Ozon Logistics, Aliexpress Russia, Vezet contribute to innovation, geographic expansion, and service delivery in this space.

Russia Transportation Outsourcing Market Industry Analysis

Growth Drivers

- Increasing Demand for Cost-Effective Logistics Solutions:The Russian logistics sector is experiencing a surge in demand for cost-effective solutions, driven by a 15% increase in operational costs over the past year. Companies are seeking to optimize their supply chains, with outsourcing becoming a strategic choice. The World Bank reported that logistics costs in Russia accounted for approximately 12% of GDP, highlighting the need for efficient logistics management to enhance competitiveness and profitability.

- Expansion of E-Commerce and Online Retail:The e-commerce sector in Russia is projected to reach a market value of USD 40 billion in future, reflecting a 20% annual growth rate. This rapid expansion is driving demand for transportation outsourcing, as retailers require efficient logistics solutions to meet consumer expectations for fast delivery. The increasing penetration of internet access, which reached 85% in urban areas, further supports this trend, creating a robust environment for logistics service providers.

- Government Investments in Infrastructure Development:The Russian government allocated USD 30 billion for infrastructure projects in future, focusing on enhancing transportation networks. This investment aims to improve road and rail connectivity, which is crucial for logistics efficiency. Enhanced infrastructure is expected to reduce transit times by 25%, making outsourcing more attractive for businesses looking to streamline operations and reduce costs associated with delays and inefficiencies in the supply chain.

Market Challenges

- Regulatory Compliance Complexities:The transportation outsourcing market in Russia faces significant challenges due to complex regulatory frameworks. In future, over 60% of logistics companies reported difficulties in navigating compliance with new regulations, including safety and environmental standards. This complexity can lead to increased operational costs, as companies must invest in legal expertise and compliance systems to avoid penalties, ultimately impacting their competitiveness in the market.

- Fluctuating Fuel Prices Impacting Operational Costs:Fuel prices in Russia have seen a 30% increase over the past year, significantly affecting transportation costs. This volatility creates uncertainty for logistics providers, as they struggle to maintain profitability while managing fluctuating expenses. Companies are forced to adjust their pricing strategies, which can lead to reduced margins and challenges in securing long-term contracts with clients who seek stable pricing models.

Russia Transportation Outsourcing Market Future Outlook

The future of the Russia transportation outsourcing market appears promising, driven by technological advancements and a growing emphasis on sustainability. As companies increasingly adopt AI and automation, operational efficiencies are expected to improve significantly. Additionally, the shift towards sustainable transportation solutions will likely gain momentum, aligning with global trends. The integration of digital platforms for logistics management will further enhance service delivery, enabling companies to respond swiftly to market demands and consumer expectations.

Market Opportunities

- Growth in Urban Logistics and Last-Mile Delivery:The urban logistics segment is projected to grow rapidly, with last-mile delivery services expected to increase by 35% in future. This growth presents significant opportunities for logistics providers to develop specialized services tailored to urban environments, enhancing efficiency and customer satisfaction in densely populated areas.

- Adoption of Technology in Logistics Management:The increasing adoption of technology, such as IoT and blockchain, in logistics management is set to revolutionize the industry. It is anticipated that 50% of logistics companies will implement advanced technologies in future, improving transparency and efficiency in supply chains. This trend offers substantial opportunities for service providers to differentiate themselves through innovative solutions.