Region:Middle East

Author(s):Rebecca

Product Code:KRAD2898

Pages:88

Published On:November 2025

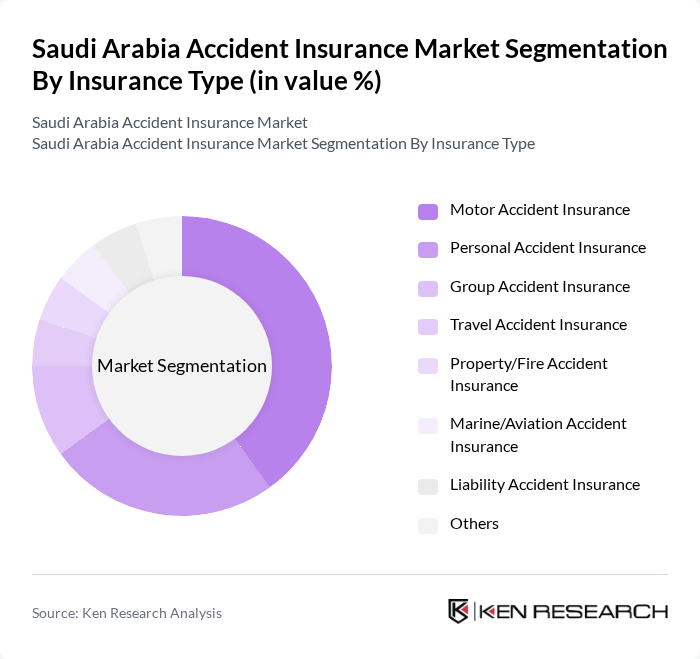

By Insurance Type:The major segments in this category include Motor Accident Insurance, Personal Accident Insurance, Group Accident Insurance, Travel Accident Insurance, Property/Fire Accident Insurance, Marine/Aviation Accident Insurance, Liability Accident Insurance, and Others. Among these, Motor Accident Insurance is the leading sub-segment due to the high number of vehicles and the mandatory nature of this insurance in the country. The increasing number of road accidents and the growing awareness of personal safety further drive the demand for this type of insurance. Personal Accident Insurance is also gaining traction due to rising demand for comprehensive coverage among individuals and families .

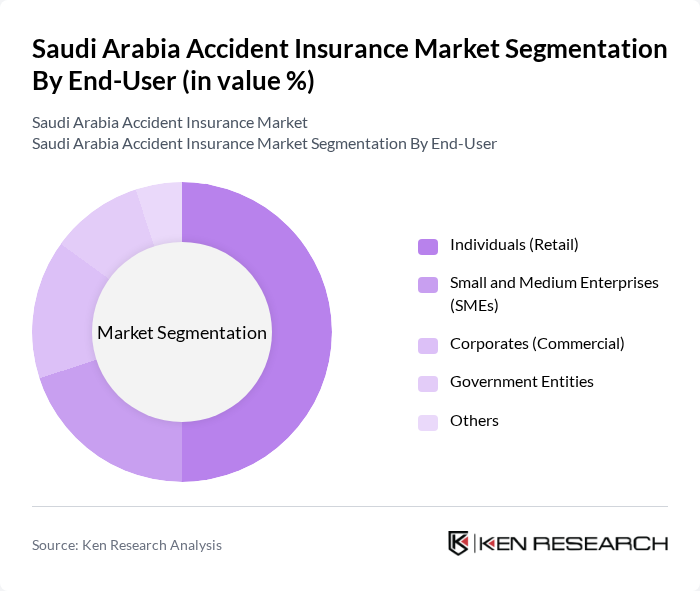

By End-User:This segmentation includes Individuals (Retail), Small and Medium Enterprises (SMEs), Corporates (Commercial), Government Entities, and Others. The Individuals (Retail) segment is the most significant due to the increasing number of personal insurance policies being purchased by the general public. The rise in disposable income and awareness of personal safety has led to a surge in demand for personal accident insurance among individuals. Corporates and SMEs are also showing increased interest in group accident insurance, driven by regulatory compliance and employee welfare initiatives .

The Saudi Arabia Accident Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tawuniya (The Company for Cooperative Insurance), Bupa Arabia for Cooperative Insurance, Al Rajhi Takaful, Gulf Insurance Group (GIG Saudi), Allianz Saudi Fransi Cooperative Insurance Company, Medgulf (The Mediterranean & Gulf Cooperative Insurance & Reinsurance Company), Alinma Tokio Marine, United Cooperative Assurance Company (UCA), Malath Cooperative Insurance Co., Al-Etihad Cooperative Insurance Co., Saudi Arabian Cooperative Insurance Company (SAICO), Aljazira Takaful Taawuni Company, Walaa Cooperative Insurance Company, Al-Sagr Cooperative Insurance Co., Arabian Shield Cooperative Insurance Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia accident insurance market appears promising, driven by technological advancements and evolving consumer preferences. As digital platforms gain traction, insurers are expected to enhance their service delivery through streamlined claims processing and personalized offerings. Additionally, the increasing demand for comprehensive coverage plans reflects a shift in consumer behavior, indicating a potential for growth in tailored insurance products that meet diverse needs in the market.

| Segment | Sub-Segments |

|---|---|

| By Insurance Type | Motor Accident Insurance Personal Accident Insurance Group Accident Insurance Travel Accident Insurance Property/Fire Accident Insurance Marine/Aviation Accident Insurance Liability Accident Insurance Others |

| By End-User | Individuals (Retail) Small and Medium Enterprises (SMEs) Corporates (Commercial) Government Entities Others |

| By Distribution Channel | Insurance Agency Bancassurance Brokers Direct Sales Online Platforms Other Distribution Channels |

| By Coverage Type | Comprehensive Coverage Limited Coverage Accidental Death Coverage Disability Coverage Others |

| By Policy Duration | Short-Term Policies Long-Term Policies Annual Policies Others |

| By Customer Segment | High Net-Worth Individuals Middle-Class Families Low-Income Groups Expatriates Others |

| By Claims Process | Manual Claims Processing Automated Claims Processing Hybrid Claims Processing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Accident Insurance | 60 | Policyholders, Insurance Agents |

| Workplace Accident Insurance | 50 | HR Managers, Safety Officers |

| Motor Vehicle Accident Insurance | 55 | Insurance Brokers, Vehicle Owners |

| Travel Accident Insurance | 40 | Travel Agents, Frequent Travelers |

| Public Liability Insurance | 45 | Business Owners, Risk Managers |

The Saudi Arabia Accident Insurance Market is valued at approximately USD 2.2 billion, reflecting a significant growth driven by increased awareness of personal safety, government regulations mandating insurance coverage, and a rise in vehicle numbers on the road.