Region:Asia

Author(s):Geetanshi

Product Code:KRAD4160

Pages:89

Published On:December 2025

By Product Type:The product type segmentation includes various categories such as Individual Personal Accident Insurance, Group Personal Accident Insurance, Travel Accident Insurance, Motor Passenger Accident & Driver PA Riders, Credit-linked / Loan Protection Personal Accident, Personal Accident & Health (PA&H) Combined Products, and Others. Among these, Individual Personal Accident Insurance is the most dominant segment, driven by the increasing number of individuals seeking personal coverage for accidents and the widespread familiarity with protection products created by the national health and social security schemes. The growing trend of online purchasing via insurer apps, aggregators, and digital wallets, along with embedded accident covers in e-commerce, ride-hailing, and travel platforms, and heightened awareness of personal safety and medical inflation has further fueled the demand for this segment.

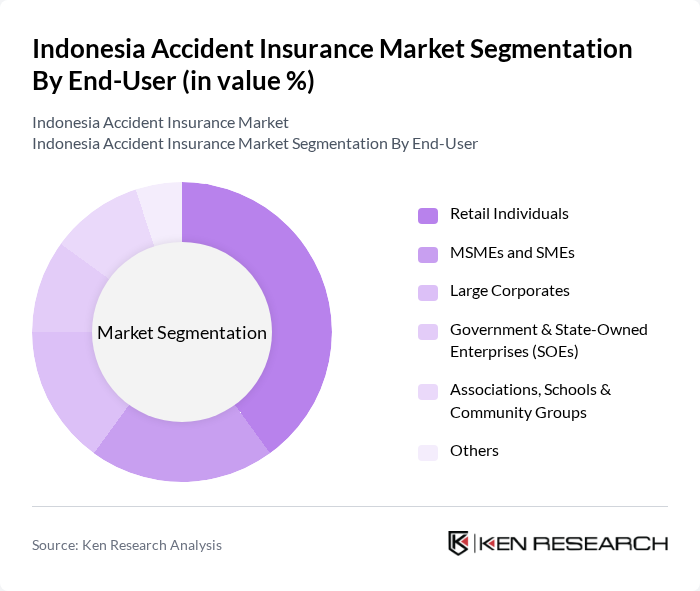

By End-User:The end-user segmentation encompasses Retail Individuals, MSMEs and SMEs, Large Corporates, Government & State-Owned Enterprises (SOEs), Associations, Schools & Community Groups, and Others. Retail Individuals represent the largest segment, as increasing awareness of personal safety, rising healthcare expenses, and greater familiarity with insurance through public schemes drive individuals to seek dedicated accident insurance to complement social security coverage. The rise in disposable income, wider use of mobile banking and fintech platforms for policy purchase, and the growing trend of online insurance buying and micro-coverage offered through digital ecosystems have also contributed to the growth of this segment.

The Indonesia Accident Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Asuransi Allianz Life Indonesia (Allianz Indonesia), PT AXA Mandiri Financial Services (AXA Mandiri), PT Prudential Life Assurance (Prudential Indonesia), PT Asuransi Jiwa Manulife Indonesia (Manulife Indonesia), PT Asuransi Sinar Mas, PT Asuransi Tokio Marine Indonesia, PT Asuransi BRI Life (BRI Life), PT AIA FINANCIAL (AIA Financial Indonesia), PT Asuransi Cigna (Cigna Indonesia), PT Zurich Asuransi Indonesia Tbk, PT FWD Insurance Indonesia, PT Asuransi Jiwa Sequis Life (Sequis Life), PT Great Eastern Life Indonesia, PT Zurich Asuransi Indonesia Tbk (formerly Adira Insurance General Business), PT Asuransi Jiwa Sinarmas MSIG (Sinarmas MSIG Life) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the accident insurance market in Indonesia appears promising, driven by increasing digitalization and evolving consumer preferences. As technology continues to reshape the insurance landscape, companies are expected to leverage digital platforms for policy distribution and customer engagement. Additionally, the growing emphasis on personalized insurance solutions will likely cater to diverse consumer needs, enhancing market appeal. With these trends, the accident insurance sector is set to experience significant transformation, fostering greater accessibility and customer satisfaction in the years ahead.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Individual Personal Accident Insurance Group Personal Accident Insurance Travel Accident Insurance Motor Passenger Accident & Driver PA Riders Credit-linked / Loan Protection Personal Accident Personal Accident & Health (PA&H) Combined Products Others |

| By End-User | Retail Individuals MSMEs and SMEs Large Corporates Government & State-Owned Enterprises (SOEs) Associations, Schools & Community Groups Others |

| By Distribution Channel | Agency Network Bancassurance Brokers Digital Channels (Insurtech, Online Platforms, Mobile Apps) Direct Sales (In-house & Telemarketing) Corporate & Affinity Partnerships Others |

| By Policy Duration | Short-term Policies (? 1 year) Long-term / Multi-year Policies Single-trip / Event-based Policies Others |

| By Benefit Structure | Accidental Death Only Death & Permanent Disability (TPD) Cover Death, TPD & Partial Disability Cover Medical Expense Reimbursement (Accident-only) Hospital Cash & Income Protection (Accident-only) Riders & Add-ons (e.g., AD&D, Funeral Benefit) Others |

| By Customer Demographics | Age Group Gender Income Level Occupation Risk Class (Low / Medium / High Risk) Urban vs Rural Customers Others |

| By Policy Type | Standalone Personal Accident Policies Riders to Life / Health / Motor Policies Microinsurance & Mass-market Accident Schemes Corporate Group Accident Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Accident Insurance Policyholders | 120 | Individuals aged 18-65 with active policies |

| Commercial Accident Insurance Clients | 90 | Business owners and risk managers |

| Insurance Brokers and Agents | 70 | Licensed insurance brokers with experience in accident insurance |

| Regulatory Bodies and Government Officials | 40 | Officials involved in insurance regulation and policy-making |

| Industry Experts and Analysts | 60 | Market analysts and consultants specializing in insurance |

The Indonesia Accident Insurance Market is valued at approximately USD 2.3 billion, reflecting a significant growth trend driven by increasing awareness of personal safety, rising disposable incomes, and a growing middle class seeking financial protection against unforeseen accidents.