Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4839

Pages:92

Published On:December 2025

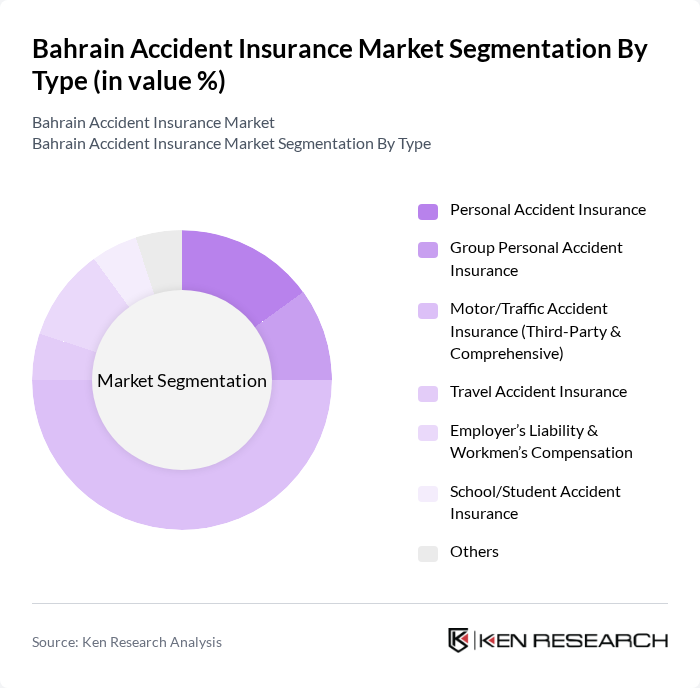

By Type:The market is segmented into various types of accident insurance products, including Personal Accident Insurance, Group Personal Accident Insurance, Motor/Traffic Accident Insurance (Third-Party & Comprehensive), Travel Accident Insurance, Employer’s Liability & Workmen’s Compensation, School/Student Accident Insurance, and Others. This structure is aligned with the broader Bahrain general insurance market, where personal accident, motor vehicle, travel, casualty, and employer’s liability covers are key non-life classes. Among these, Motor/Traffic Accident Insurance is the most dominant segment due to the high number of vehicles on the road, the mandatory third-party liability requirement, and the strong contribution of motor premiums within Bahrain’s non-life portfolio.

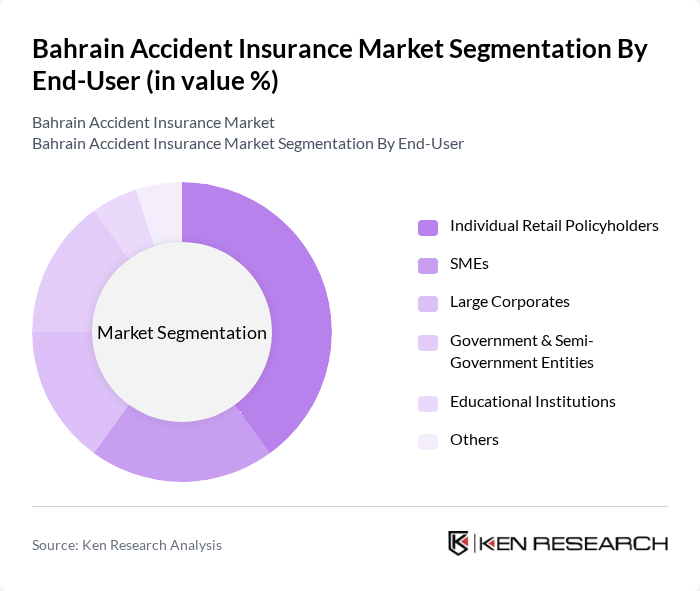

By End-User:The end-user segmentation includes Individual Retail Policyholders, SMEs, Large Corporates, Government & Semi-Government Entities, Educational Institutions, and Others. This aligns with the broader Bahrain general insurance market, where individuals, SMEs, large corporations, and government entities form the primary customer base for motor, personal accident, travel, and employer’s liability products. Individual Retail Policyholders represent the largest segment, driven by the increasing number of personal motor and personal accident policies purchased by individuals seeking financial protection against accidents and medical expenses associated with injury.

The Bahrain Accident Insurance Market is characterized by a dynamic mix of regional and international players, consistent with the broader non-life insurance landscape in the kingdom. Leading participants such as Bahrain Kuwait Insurance Company (BKIC), Bahrain National Insurance (Bahrain National Holding – BNH), Takaful International Company B.S.C., Solidarity Bahrain B.S.C., GIG Bahrain (Gulf Insurance Group – Bahrain), Arab Insurance Group (ARIG), Medgulf Takaful B.S.C., AXA Cooperative Insurance Company (servicing Bahrain via regional platforms), MetLife Gulf (servicing Bahrain), Qatar Insurance Company (QIC) – Bahrain Branch, Trust International Insurance & Reinsurance Company B.S.C. (Trust Re), Allianz Global Corporate & Specialty (regional operations covering Bahrain), Oman Insurance Company – Regional Operations, National Life & General Insurance Company – GCC Operations, Bupa Arabia for Cooperative Insurance (regional health & accident cover) contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain accident insurance market is poised for transformation, driven by technological advancements and evolving consumer preferences. As digital platforms gain traction, insurers are expected to enhance their online services, making policy purchases more accessible. Additionally, the focus on customer-centric models will likely lead to tailored insurance solutions that address specific consumer needs. These trends indicate a shift towards a more dynamic and responsive market, positioning insurers to better serve the evolving demands of Bahraini consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Accident Insurance Group Personal Accident Insurance Motor/Traffic Accident Insurance (Third-Party & Comprehensive) Travel Accident Insurance Employer’s Liability & Workmen’s Compensation School/Student Accident Insurance Others |

| By End-User | Individual Retail Policyholders SMEs Large Corporates Government & Semi-Government Entities Educational Institutions Others |

| By Policy Duration | Single-Trip / Event-Based Policies Annual Renewable Policies Multi-Year (2–5 Years) Policies Others |

| By Distribution Channel | Direct Sales (Insurer Branch & Call Center) Insurance Brokers Corporate Agents & Affinity Partners Bancassurance Online & Mobile Platforms Others |

| By Customer Demographics | Age Group Income Level Occupation / Risk Class (e.g., blue-collar, high-risk occupations) Nationality (Bahraini vs Expatriate) Others |

| By Claim Type | Medical Expense Claims Accidental Death Claims Permanent Disability Claims Temporary Disability & Loss of Income Claims Others |

| By Geographic Coverage | Manama & Capital Governorate Muharraq Governorate Northern Governorate Southern Governorate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Individual Policyholders | 140 | Accident Insurance Policyholders, General Consumers |

| Corporate Clients | 100 | HR Managers, Risk Management Officers |

| Insurance Brokers | 80 | Insurance Brokers, Financial Advisors |

| Regulatory Bodies | 60 | Regulatory Officials, Policy Analysts |

| Claims Adjusters | 70 | Claims Adjusters, Underwriters |

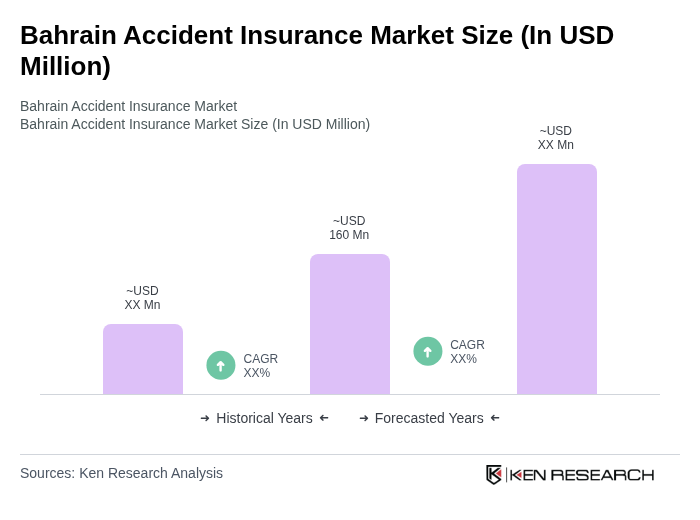

The Bahrain Accident Insurance Market is valued at approximately USD 160 million, reflecting growth driven by increased awareness of personal safety, rising disposable incomes, and the expansion of the automotive sector.