Region:Middle East

Author(s):Rebecca

Product Code:KRAC9780

Pages:83

Published On:November 2025

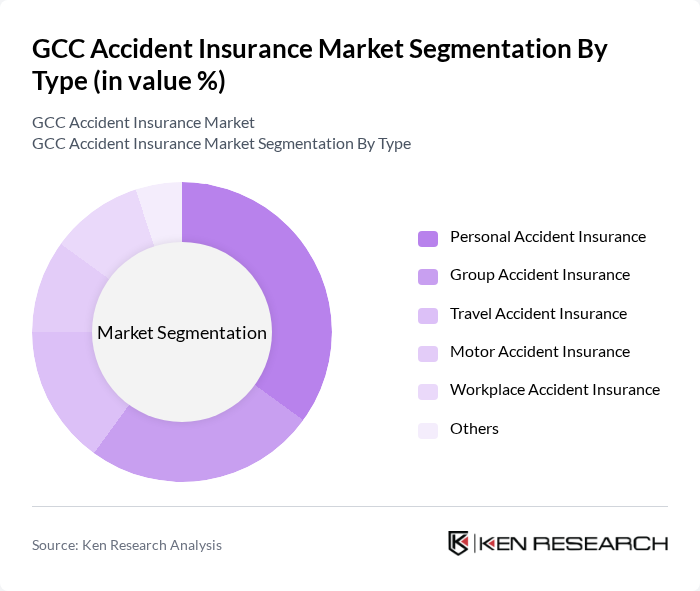

By Type:The market is segmented into various types of accident insurance products, including Personal Accident Insurance, Group Accident Insurance, Travel Accident Insurance, Motor Accident Insurance, Workplace Accident Insurance, and Others. Each of these segments caters to different consumer needs and preferences, with Personal Accident Insurance being particularly popular due to its comprehensive coverage options and flexibility for both individuals and families .

ThePersonal Accident Insurancesegment dominates the market due to its wide acceptance among individuals seeking financial protection against unforeseen accidents. This segment appeals to consumers who prioritize personal safety and financial security, especially in a region with a high expatriate population. The increasing number of travel activities, workplace incidents, and regulatory mandates for employee coverage further drive the demand for this type of insurance, making it a preferred choice for many .

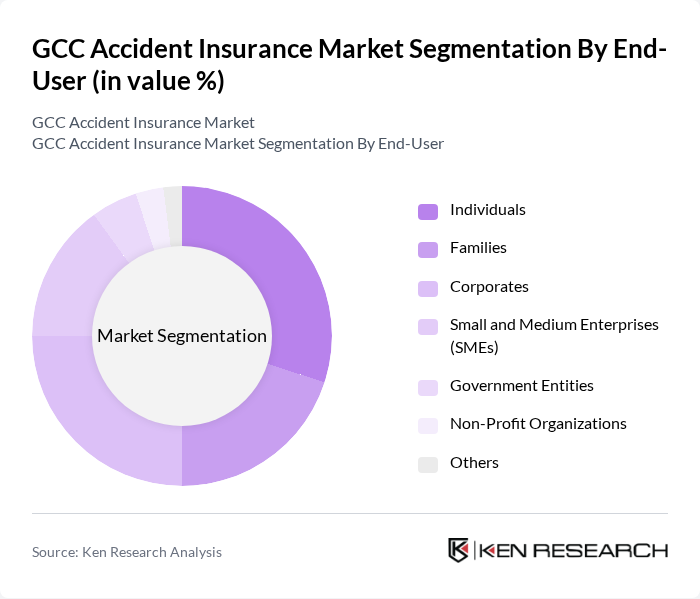

By End-User:The market is segmented by end-users, including Individuals, Families, Corporates, Small and Medium Enterprises (SMEs), Government Entities, Non-Profit Organizations, and Others. Each segment has unique requirements and purchasing behaviors, with Corporates and SMEs showing significant interest in group insurance plans, especially as regulatory compliance and employee welfare become more critical .

Corporatesare a leading end-user segment, driven by the need to provide comprehensive insurance coverage for employees as part of their benefits package. This trend is reinforced by government regulations mandating accident insurance for workers, which has led to increased adoption among businesses. Additionally, the growing awareness of employee welfare and safety has prompted many companies to invest in accident insurance, solidifying their position as a dominant segment in the market .

The GCC Accident Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allianz Gulf, AXA Gulf, Abu Dhabi National Insurance Company (ADNIC), Qatar Insurance Company (QIC), Dubai Insurance Company, Oman Insurance Company, National General Insurance Company (NGI), Gulf Insurance Group (GIG), Al Ain Ahlia Insurance Company, Emirates Insurance Company, Bahrain National Holding (BNH), Tawuniya (The Company for Cooperative Insurance, Saudi Arabia), Takaful Emarat, Al Sagr Cooperative Insurance Company, United Insurance Company contribute to innovation, geographic expansion, and service delivery in this space.

The GCC accident insurance market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of digital platforms is expected to streamline the purchasing process, making insurance more accessible. Additionally, the growing emphasis on personalized insurance solutions will cater to diverse consumer needs, enhancing customer satisfaction. As the market adapts to these trends, providers will likely focus on innovative products that align with the changing landscape of accident insurance in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Accident Insurance Group Accident Insurance Travel Accident Insurance Motor Accident Insurance Workplace Accident Insurance Others |

| By End-User | Individuals Families Corporates Small and Medium Enterprises (SMEs) Government Entities Non-Profit Organizations Others |

| By Coverage Type | Accidental Death Coverage Permanent Disability Coverage Temporary Disability Coverage Medical Expenses Coverage Others |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents Bancassurance Others |

| By Policy Duration | Short-Term Policies Long-Term Policies Others |

| By Premium Amount | Low Premium Medium Premium High Premium Others |

| By Customer Segment | Young Adults Families Senior Citizens Corporate Employees Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Accident Insurance Policies | 100 | Risk Managers, HR Directors |

| Individual Accident Insurance Holders | 90 | Policyholders, Financial Advisors |

| Small Business Accident Insurance | 70 | Business Owners, Insurance Brokers |

| Claims Processing Insights | 60 | Claims Adjusters, Underwriting Managers |

| Market Trends and Consumer Preferences | 50 | Insurance Analysts, Market Researchers |

The GCC Accident Insurance Market is valued at approximately USD 1.5 billion, reflecting a significant growth driven by increased awareness of personal safety, rising disposable incomes, and the expansion of the workforce across the region.