Region:Middle East

Author(s):Geetanshi

Product Code:KRAE0542

Pages:94

Published On:December 2025

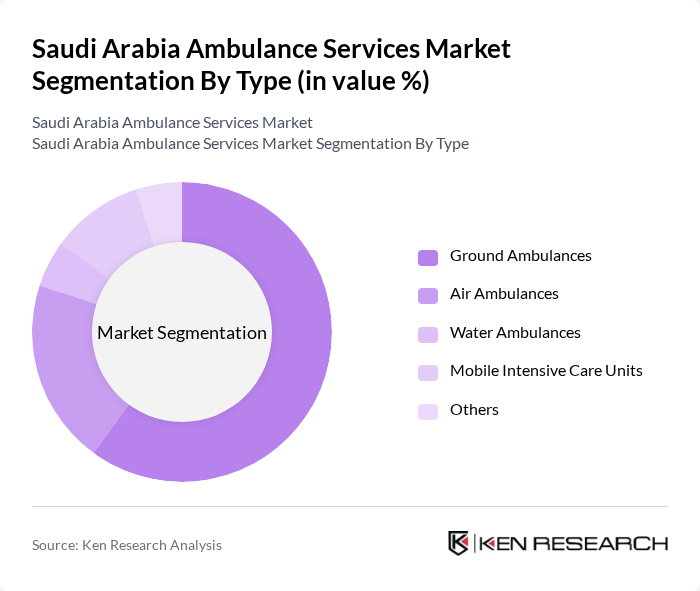

By Type:The ambulance services market is segmented into various types, including Ground Ambulances, Air Ambulances, Water Ambulances, Mobile Intensive Care Units, and Others. Ground ambulances dominate the market due to their widespread availability and essential role in emergency medical services. Air ambulances are gaining traction, particularly for remote areas, while water ambulances are utilized in coastal regions. Mobile Intensive Care Units are crucial for critical patient transport, reflecting the growing need for specialized medical care during transit.

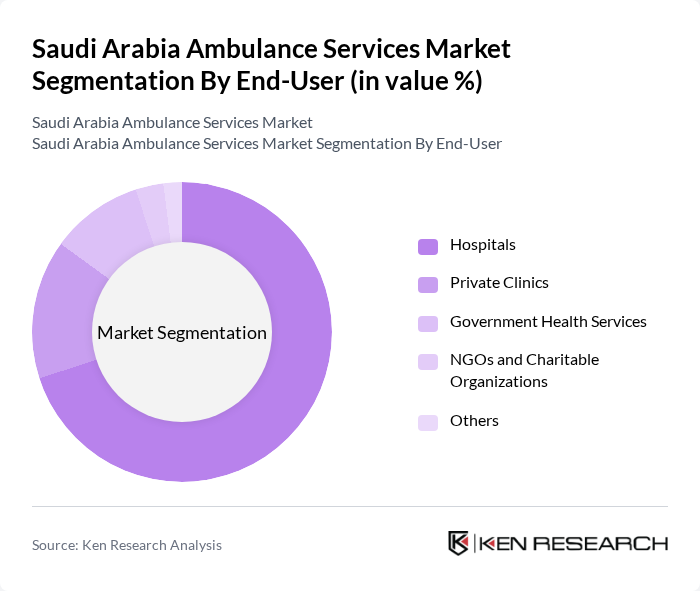

By End-User:The end-user segmentation includes Hospitals, Private Clinics, Government Health Services, NGOs and Charitable Organizations, and Others. Hospitals are the primary users of ambulance services, as they require timely patient transport for critical care. Private clinics also utilize ambulance services for patient transfers, while government health services play a significant role in providing emergency medical assistance. NGOs and charitable organizations contribute to the market by offering services in underserved areas, reflecting the diverse needs of the healthcare system.

The Saudi Arabia Ambulance Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Red Crescent Authority, Al Nahdi Medical Company, Al-Muhaidib Group, Al-Faisal Holding, Al-Jazeera Medical Services, Saudi Ambulance Services, Gulf Medical Projects, Al-Hokair Group, Al-Mansour Group, Al-Muhaidib Medical Services, Al-Salam Medical Services, Al-Bilad Medical Services, Al-Mawaddah Medical Services, Al-Muhaidib Healthcare, Al-Mansour Ambulance Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of ambulance services in Saudi Arabia appears promising, driven by ongoing government initiatives and technological advancements. With a projected increase in healthcare spending, the sector is expected to see enhanced infrastructure and service delivery. The integration of telemedicine and mobile health applications will likely improve patient outcomes and operational efficiency. Furthermore, the expansion of private ambulance services is anticipated to foster competition, leading to better service quality and accessibility for the population.

| Segment | Sub-Segments |

|---|---|

| By Type | Ground Ambulances Air Ambulances Water Ambulances Mobile Intensive Care Units Others |

| By End-User | Hospitals Private Clinics Government Health Services NGOs and Charitable Organizations Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Service Type | Emergency Medical Services Non-Emergency Medical Transport Patient Transfer Services Others |

| By Vehicle Type | Standard Ambulances Advanced Life Support (ALS) Ambulances Basic Life Support (BLS) Ambulances Others |

| By Technology | GPS Tracking Systems Communication Systems Medical Equipment Technology Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Ambulance Services | 100 | Operations Managers, Emergency Response Coordinators |

| Private Ambulance Providers | 80 | Business Development Managers, Fleet Managers |

| Healthcare Facilities Utilizing Ambulance Services | 70 | Hospital Administrators, Emergency Department Heads |

| Government Health Officials | 50 | Policy Makers, Health Program Directors |

| Emergency Medical Technicians and Paramedics | 90 | Field Paramedics, Training Coordinators |

The Saudi Arabia Ambulance Services Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing healthcare demands, urbanization, and government investments in emergency medical services.