Region:Middle East

Author(s):Geetanshi

Product Code:KRAE4383

Pages:85

Published On:December 2025

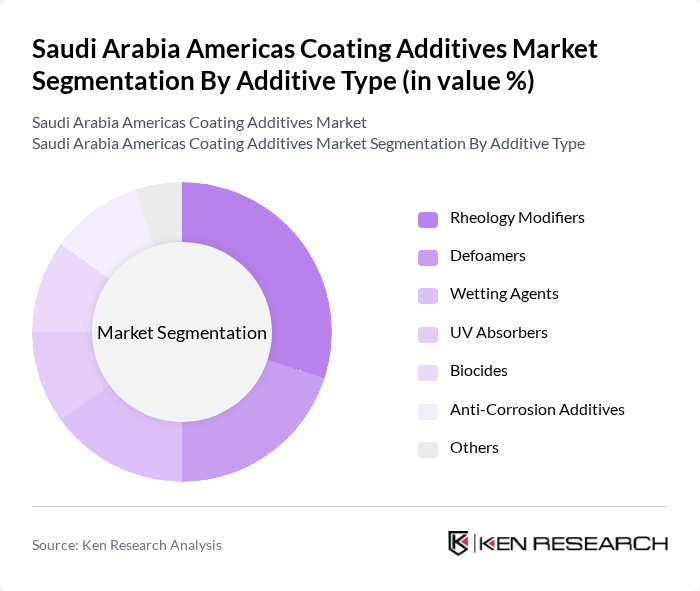

By Additive Type:The additive type segmentation includes various subsegments such as Rheology Modifiers, Defoamers, Wetting Agents, UV Absorbers, Biocides, Anti-Corrosion Additives, and Others. Among these, Rheology Modifiers are leading the market due to their essential role in enhancing the flow properties and stability of coatings. The demand for high-quality finishes in automotive and architectural applications drives the growth of this subsegment.

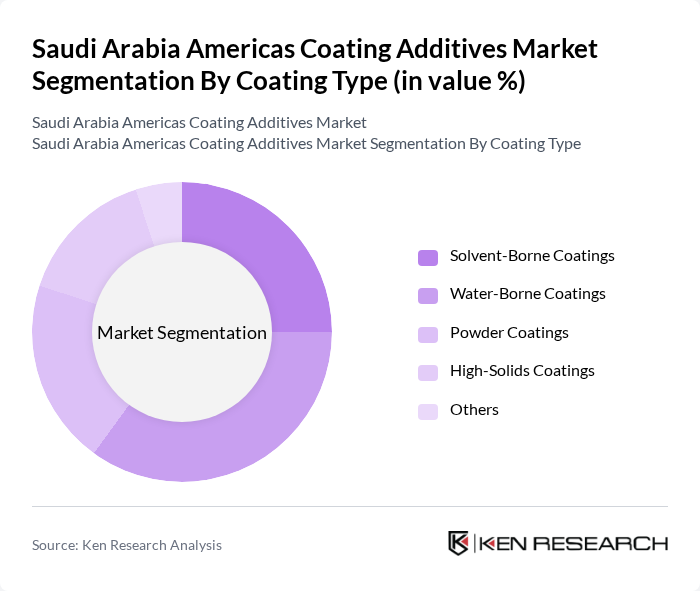

By Coating Type:The coating type segmentation encompasses Solvent-Borne Coatings, Water-Borne Coatings, Powder Coatings, High-Solids Coatings, and Others. Water-Borne Coatings are currently dominating the market due to their lower environmental impact and compliance with stringent regulations. The shift towards sustainable practices in the construction and automotive sectors is significantly boosting the demand for water-borne solutions.

The Saudi Arabia Americas Coating Additives Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, AkzoNobel N.V., Dow Inc., Evonik Industries AG, Huntsman Corporation, Clariant AG, Eastman Chemical Company, Solvay S.A., Arkema S.A., Sherwin-Williams Company, PPG Industries, Inc., RPM International Inc., 3M Company, Celanese Corporation, Momentive Performance Materials Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia Americas coating additives market appears promising, driven by a combination of technological advancements and increasing environmental awareness. As manufacturers adapt to stringent regulations, the focus on sustainable and high-performance coatings will intensify. Additionally, the integration of digital technologies in production processes is expected to enhance efficiency and reduce costs. Overall, the market is poised for growth, with innovative solutions catering to evolving consumer preferences and regulatory demands.

| Segment | Sub-Segments |

|---|---|

| By Additive Type | Rheology Modifiers Defoamers Wetting Agents UV Absorbers Biocides Anti-Corrosion Additives Others |

| By Coating Type | Solvent-Borne Coatings Water-Borne Coatings Powder Coatings High-Solids Coatings Others |

| By End-User Industry | Automotive Construction & Architectural Industrial & Protective Oil & Gas Consumer Goods & Appliances Others |

| By Application | Decorative Coatings Industrial Coatings Protective & Marine Coatings Automotive Coatings Others |

| By Distribution Channel | Direct Sales Distributors & Wholesalers Online Retail Specialty Retailers Others |

| By Region | Central Region (Riyadh) Eastern Region Western Region (Jeddah) Southern Region |

| By Product Form | Liquid Additives Powder Additives Paste Additives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Coating Additives | 100 | Product Managers, R&D Directors |

| Architectural Coating Additives | 80 | Architects, Construction Project Managers |

| Industrial Coating Additives | 90 | Manufacturing Engineers, Quality Control Managers |

| Consumer Goods Coating Additives | 70 | Brand Managers, Product Development Specialists |

| Specialty Coating Additives | 60 | Technical Sales Representatives, Application Engineers |

The Saudi Arabia Americas Coating Additives Market is valued at approximately USD 340 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for high-performance coatings across various industries, including automotive and construction.