Region:Middle East

Author(s):Geetanshi

Product Code:KRAE4384

Pages:104

Published On:December 2025

By Function:The market is segmented based on function into Wetting & Dispersion, Rheology Modification, Anti-Foaming, Biocides, and Others. Among these, Wetting & Dispersion is the leading sub-segment, driven by its essential role in enhancing the performance and stability of coatings. The increasing demand for high-quality finishes in various applications has led to a surge in the use of wetting and dispersion additives, making it a critical component in the formulation of modern coatings.

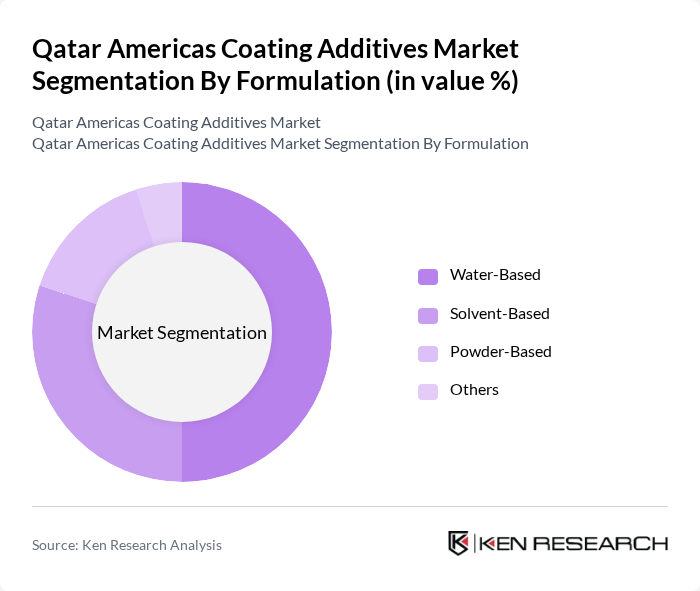

By Formulation:The market is also segmented by formulation into Water-Based, Solvent-Based, Powder-Based, and Others. Water-Based formulations are currently dominating the market due to their lower environmental impact and compliance with stringent regulations. The shift towards sustainable practices in the coatings industry has led to increased adoption of water-based additives, which are favored for their ease of application and reduced VOC emissions.

The Qatar Americas Coating Additives Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Evonik Industries AG, Dow Inc., Akzo Nobel N.V., Sherwin-Williams Company, PPG Industries, Inc., Huntsman Corporation, Clariant AG, Eastman Chemical Company, Solvay S.A., Arkema S.A., Momentive Performance Materials Inc., RPM International Inc., 3M Company, Wacker Chemie AG contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar Americas Coating Additives Market is poised for significant growth, driven by increasing investments in infrastructure and a strong focus on sustainability. As the construction sector expands, the demand for innovative and eco-friendly coating solutions will rise. Additionally, advancements in smart coatings and nanotechnology are expected to enhance product performance. Companies that adapt to these trends and invest in R&D will likely capture a larger market share, positioning themselves favorably in the evolving landscape of coating additives.

| Segment | Sub-Segments |

|---|---|

| By Function | Wetting & Dispersion Rheology Modification Anti-Foaming Biocides Others |

| By Formulation | Water-Based Solvent-Based Powder-Based Others |

| By End-User | Architectural Automotive Industrial Wood & Furniture Others |

| By Application | Decorative Coatings Protective Coatings Industrial Coatings Automotive OEM Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Coating Additives | 100 | Project Managers, Architects, Contractors |

| Automotive Coating Solutions | 80 | Product Development Engineers, Quality Assurance Managers |

| Industrial Coatings Market | 70 | Operations Managers, Procurement Specialists |

| Architectural Coatings Segment | 90 | Interior Designers, Facility Managers |

| Specialty Coating Applications | 60 | Research Scientists, Technical Sales Representatives |

The Qatar Americas Coating Additives Market is valued at approximately USD 1.1 billion, reflecting a robust growth trajectory driven by increasing demand for high-performance coatings across various industries, including automotive and construction.