Region:Middle East

Author(s):Rebecca

Product Code:KRAE0838

Pages:84

Published On:December 2025

By Type:The amino acids market in Saudi Arabia is segmented into various types, including L-Amino Acids, D-Amino Acids, Branched-Chain Amino Acids (BCAAs), Essential Amino Acids, Non-Essential Amino Acids, and Others. Among these, L-Amino Acids are the most dominant due to their extensive application in food and beverage products, pharmaceuticals, and dietary supplements. The increasing consumer awareness regarding health and nutrition has led to a surge in demand for L-Amino Acids, making them a preferred choice for manufacturers. Additionally, the growing trend of protein supplementation in sports nutrition has further bolstered the market for L-Amino Acids.

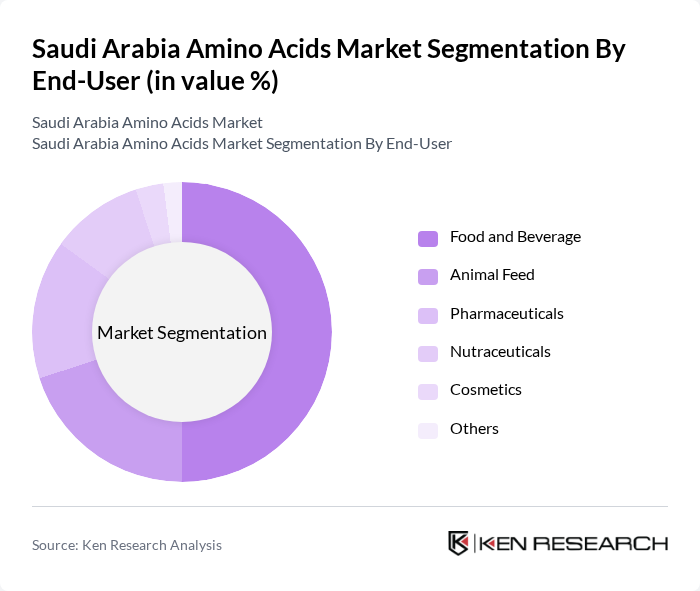

By End-User:The end-user segmentation of the amino acids market includes Food and Beverage, Animal Feed, Pharmaceuticals, Nutraceuticals, Cosmetics, and Others. The Food and Beverage sector holds the largest share, driven by the increasing incorporation of amino acids in functional foods and beverages. The rising trend of health and wellness among consumers has led to a growing demand for fortified food products, which utilize amino acids for their nutritional benefits. Additionally, the pharmaceutical industry is also a significant contributor, as amino acids are essential for various medical applications, including parenteral nutrition.

The Saudi Arabia Amino Acids Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ajinomoto Co., Inc., Evonik Industries AG, Archer Daniels Midland Company, Cargill, Incorporated, DSM Nutritional Products, Amino GmbH, Kyowa Hakko Bio Co., Ltd., BASF SE, Fufeng Group Company Limited, Zhejiang Medicine Co., Ltd., Ningxia Eppen Biotech Co., Ltd., Shandong Jincheng Pharmaceutical Group, Huaheng Biologics Co., Ltd., Shanghai Freemen Lifescience Co., Ltd., Global Bio-Chem Technology Group Company Limited contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia amino acids market is poised for significant growth, driven by increasing consumer demand for health-oriented products and advancements in production technologies. The shift towards plant-based amino acids and sustainable practices is expected to reshape the market landscape. Additionally, the expansion of the nutraceuticals sector and rising investments in research and development will likely create new avenues for innovation, enhancing the market's resilience against challenges and fostering long-term growth.

| Segment | Sub-Segments |

|---|---|

| By Type | L-Amino Acids D-Amino Acids Branched-Chain Amino Acids (BCAAs) Essential Amino Acids Non-Essential Amino Acids Others |

| By End-User | Food and Beverage Animal Feed Pharmaceuticals Nutraceuticals Cosmetics Others |

| By Application | Dietary Supplements Functional Foods Sports Nutrition Clinical Nutrition Others |

| By Source | Plant-Based Animal-Based Synthetic Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Product Form | Powder Liquid Tablets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dietary Supplements Market | 100 | Product Managers, Nutritionists |

| Pharmaceutical Applications | 80 | Pharmaceutical Developers, Regulatory Affairs Specialists |

| Animal Feed Sector | 70 | Feed Formulators, Livestock Nutritionists |

| Food and Beverage Industry | 90 | Food Technologists, Quality Assurance Managers |

| Research and Development | 60 | R&D Managers, Laboratory Technicians |

The Saudi Arabia Amino Acids Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing demand across various sectors, including food and beverage, pharmaceuticals, and animal feed.