Region:Middle East

Author(s):Rebecca

Product Code:KRAC1683

Pages:92

Published On:January 2026

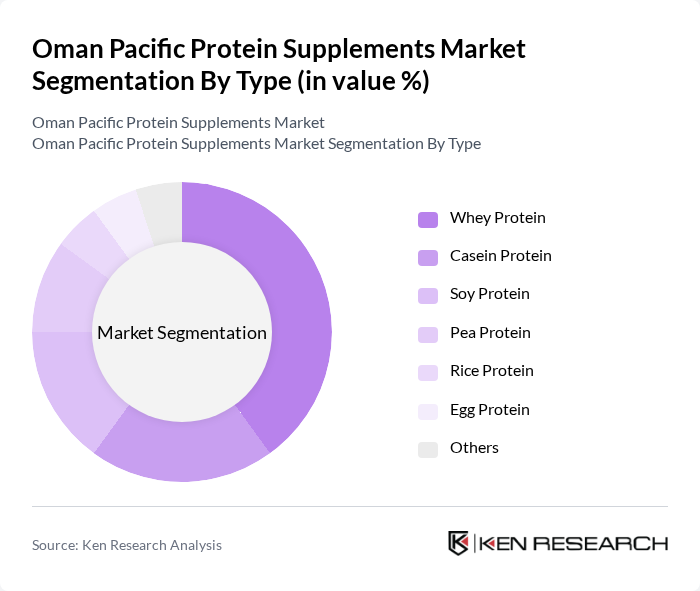

By Type:The protein supplements market is segmented into various types, including whey protein, casein protein, soy protein, pea protein, rice protein, egg protein, and others. Among these, whey protein is the most dominant segment due to its high bioavailability and popularity among athletes and fitness enthusiasts. The increasing trend of protein supplementation for muscle recovery and weight management has further propelled the demand for whey protein, making it a preferred choice among consumers.

By End-User:The end-user segmentation includes athletes, bodybuilders, health-conscious consumers, the elderly population, and others. Athletes and bodybuilders represent the largest consumer base, driven by their need for protein supplementation to enhance performance and recovery. The growing awareness of health and fitness among the general population has also led to an increase in demand from health-conscious consumers, further diversifying the market.

The Oman Pacific Protein Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Optimum Nutrition, BSN (Bio-Engineered Supplements and Nutrition), MusclePharm Corporation, MyProtein, Dymatize Nutrition, Quest Nutrition, EAS (Energy Athletic Science), Isagenix International, Garden of Life, Vega, Orgain, ProMix Nutrition, Klean Athlete, Sunwarrior contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman Pacific protein supplements market appears promising, driven by increasing consumer awareness of health and fitness. Trends such as personalized nutrition and the demand for clean-label, plant-based products are expected to shape the market landscape. As consumers seek tailored solutions that align with their dietary preferences, brands that innovate and adapt to these trends will likely capture significant market share. The ongoing expansion of e-commerce will further facilitate access to diverse protein supplement offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Whey Protein Casein Protein Soy Protein Pea Protein Rice Protein Egg Protein Others |

| By End-User | Athletes Bodybuilders Health-Conscious Consumers Elderly Population Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies Others |

| By Packaging Type | Bottles Pouches Tubs Sachets Others |

| By Flavor | Chocolate Vanilla Strawberry Unflavored Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Region | Muscat Salalah Sohar Nizwa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Protein Supplements | 150 | Health-conscious individuals, Fitness enthusiasts |

| Retail Distribution Channels | 100 | Retail Managers, Store Owners |

| Online Purchase Behavior | 80 | eCommerce Shoppers, Digital Marketing Specialists |

| Impact of Fitness Trends | 70 | Personal Trainers, Gym Owners |

| Brand Loyalty and Awareness | 90 | Regular Users of Protein Supplements, Nutritionists |

The Oman Pacific Protein Supplements Market is valued at approximately USD 120 million, reflecting a significant growth trend driven by increasing health consciousness and demand for dietary supplements among consumers.