Region:Middle East

Author(s):Rebecca

Product Code:KRAD2937

Pages:95

Published On:November 2025

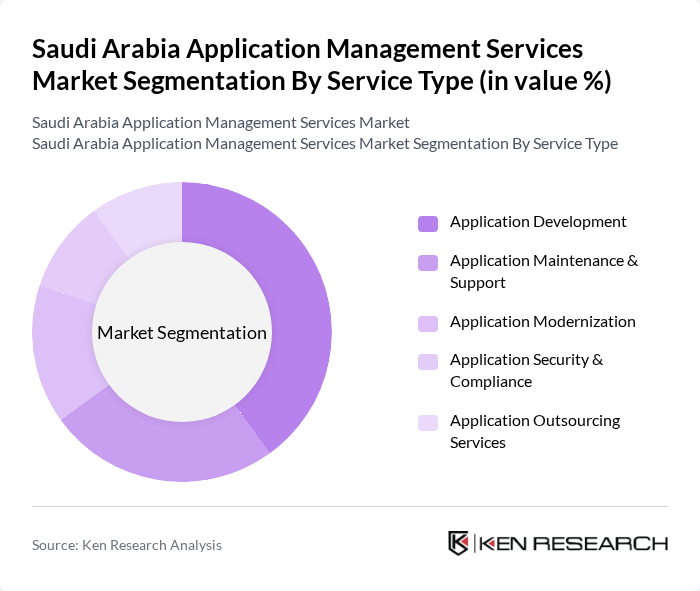

By Service Type:The service type segmentation includes various offerings that cater to the diverse needs of businesses in managing their applications effectively. The subsegments include Application Development, Application Maintenance & Support, Application Modernization, Application Security & Compliance, and Application Outsourcing Services. Among these, Application Development is currently the leading subsegment, driven by the increasing need for custom software solutions that align with specific business requirements. The demand for tailored applications is fueled by the rapid digital transformation across industries, making this subsegment crucial for businesses aiming to enhance their operational capabilities.

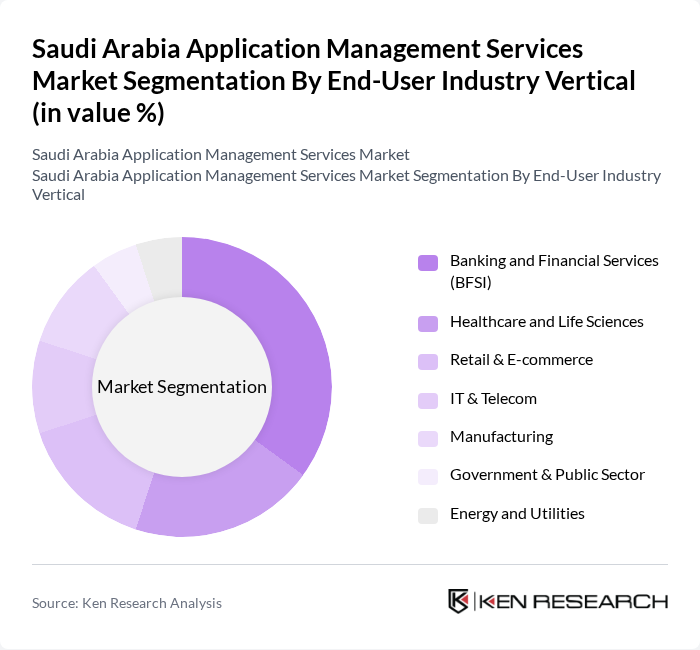

By End-User Industry Vertical:The end-user industry vertical segmentation encompasses various sectors that utilize application management services to optimize their operations. This includes Banking and Financial Services (BFSI), Healthcare and Life Sciences, Retail & E-commerce, IT & Telecom, Manufacturing, Government & Public Sector, and Energy and Utilities. The BFSI sector is currently the dominant segment, driven by stringent regulatory requirements and the need for secure, efficient transaction processing systems. The increasing reliance on digital banking solutions further propels the demand for application management services in this sector.

The Saudi Arabia Application Management Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Accenture Saudi Arabia, IBM Saudi Arabia, Microsoft Saudi Arabia, Oracle Saudi Arabia, SAP Saudi Arabia, Capgemini Saudi Arabia, Infosys Saudi Arabia, Wipro Saudi Arabia, Tata Consultancy Services (TCS) Saudi Arabia, HCL Technologies Saudi Arabia, Tech Mahindra Saudi Arabia, Atos Saudi Arabia, NTT Data Saudi Arabia, Fujitsu Saudi Arabia, CGI Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabian application management services market appears promising, driven by ongoing digital transformation initiatives and increased government investment in IT infrastructure. As organizations prioritize operational efficiency and customer experience, the integration of AI and automation technologies will become more prevalent. Additionally, the rise of subscription-based service models will reshape service delivery, allowing providers to offer more flexible and scalable solutions tailored to client needs, fostering long-term partnerships and innovation.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Application Development Application Maintenance & Support Application Modernization Application Security & Compliance Application Outsourcing Services |

| By End-User Industry Vertical | Banking and Financial Services (BFSI) Healthcare and Life Sciences Retail & E-commerce IT & Telecom Manufacturing Government & Public Sector Energy and Utilities |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Organization Size | Large Enterprises Medium Enterprises Small and Medium-Sized Enterprises (SMEs) |

| By Geographic Region | Riyadh Jeddah Eastern Province Makkah Madinah Tabuk Rest of Saudi Arabia |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Application Management | 120 | IT Managers, CIOs, Application Architects |

| Cloud Application Services | 100 | Cloud Service Providers, IT Consultants |

| Mobile Application Management | 80 | Mobile Developers, Product Managers |

| Application Support Services | 100 | Support Managers, Service Delivery Managers |

| Consulting Services in Application Management | 90 | Business Analysts, Strategy Consultants |

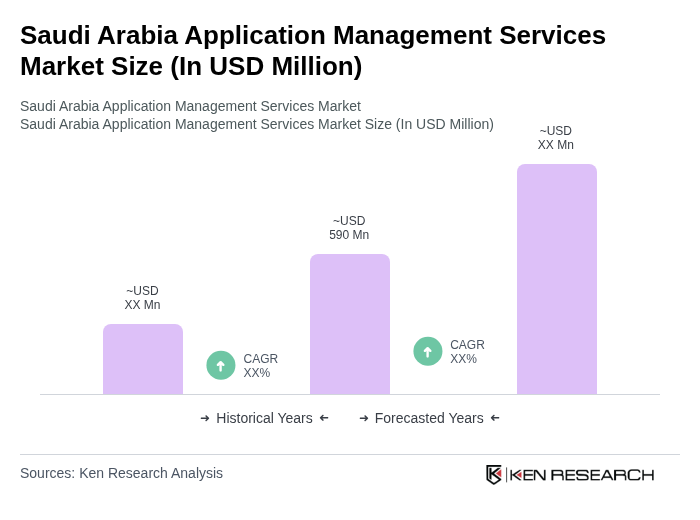

The Saudi Arabia Application Management Services Market is valued at approximately USD 590 million, reflecting a significant growth driven by the increasing adoption of digital transformation initiatives across various sectors and the demand for efficient application management solutions.