Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3763

Pages:84

Published On:October 2025

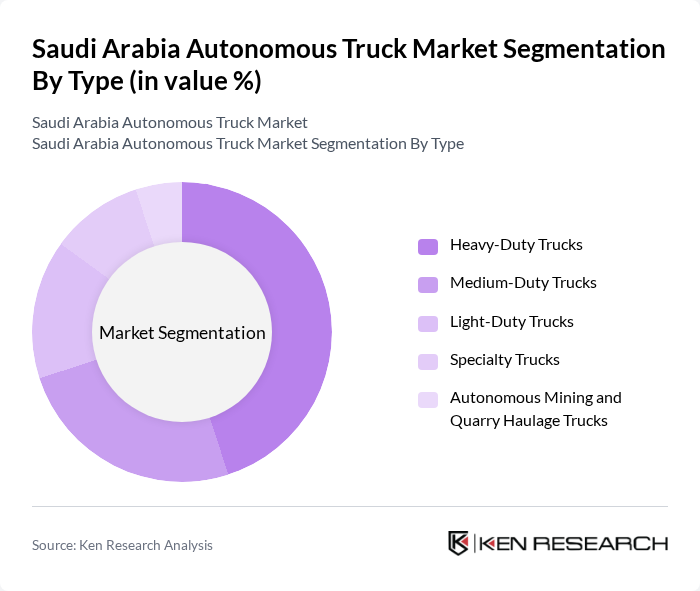

By Type:The market is segmented into Heavy-Duty Trucks, Medium-Duty Trucks, Light-Duty Trucks, Specialty Trucks (including mining, port, and construction autonomous trucks), and Autonomous Mining and Quarry Haulage Trucks. Heavy-Duty Trucks hold the largest share, reflecting their extensive use in long-haul logistics and freight movement across the country. Specialty and mining trucks are gaining traction due to increased automation in industrial and resource extraction operations.

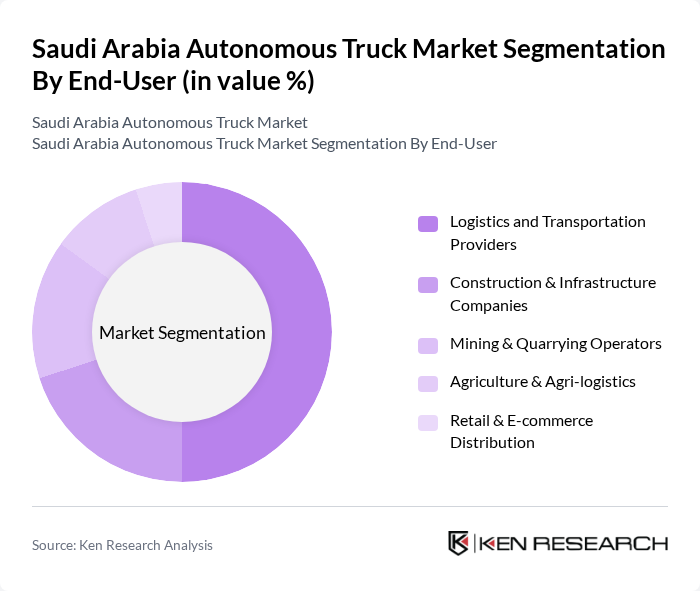

By End-User:The end-user segmentation includes Logistics and Transportation Providers, Construction & Infrastructure Companies, Mining & Quarrying Operators, Agriculture & Agri-logistics, and Retail & E-commerce Distribution. Logistics and Transportation Providers lead the market, driven by the surge in e-commerce and the need for efficient, cost-effective delivery solutions. Mining and infrastructure sectors are rapidly adopting autonomous trucks to enhance safety and productivity in resource-intensive operations.

The Saudi Arabia Autonomous Truck Market features a dynamic mix of regional and international players. Leading participants such as Volvo Group, Daimler Truck AG, Scania AB, MAN Truck & Bus SE, Tesla, Inc., Navistar International Corporation, PACCAR Inc., Einride AB, Aurora Innovation, Inc., Waymo LLC, TuSimple Holdings Inc., Embark Trucks, Inc., Freightliner Trucks (a division of Daimler Truck AG), Xos, Inc., Bahri Logistics (The National Shipping Company of Saudi Arabia), Saudi Public Transport Company (SAPTCO), Almarai Company (logistics fleet operator), and Almajdouie Logistics drive innovation, geographic expansion, and service delivery. These companies are actively involved in pilot deployments, technology partnerships, and scaling autonomous fleet operations in Saudi Arabia’s logistics corridors.

The future of the Saudi Arabia autonomous truck market appears promising, driven by technological advancements and government support. As logistics companies increasingly adopt automation, the integration of IoT and AI technologies will enhance operational efficiency. Furthermore, the shift towards sustainable transportation solutions will likely accelerate the adoption of autonomous trucks, aligning with global trends. The development of dedicated infrastructure and regulatory frameworks will be crucial in facilitating this transition, ensuring a robust market environment for innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Heavy-Duty Trucks Medium-Duty Trucks Light-Duty Trucks Specialty Trucks (e.g., mining, port, and construction autonomous trucks) Autonomous Mining and Quarry Haulage Trucks |

| By End-User | Logistics and Transportation Providers Construction & Infrastructure Companies Mining & Quarrying Operators Agriculture & Agri-logistics Retail & E-commerce Distribution |

| By Payload Capacity | Up to 5 tons to 15 tons to 30 tons Above 30 tons |

| By Application | Long-Haul Freight Transport Port-to-Warehouse Logistics Construction Material Transport Mining & Quarry Haulage Waste Management |

| By Distribution Channel | Direct Sales (OEMs to Fleets) Online Sales Platforms Authorized Distributors Leasing & Rental Services |

| By Fleet Size | Small Fleets (1-10 trucks) Medium Fleets (11-50 trucks) Large Fleets (51+ trucks) |

| By Region | Central Region (including Riyadh) Eastern Region (including Dammam, Jubail) Western Region (including Jeddah, Mecca) Southern Region Northern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics and Transportation Companies | 100 | Fleet Managers, Operations Directors |

| Technology Providers for Autonomous Vehicles | 50 | Product Development Managers, R&D Heads |

| Government Regulatory Bodies | 40 | Policy Makers, Transportation Officials |

| Industry Associations and Advocacy Groups | 50 | Executive Directors, Research Analysts |

| End-Users of Autonomous Trucking Solutions | 60 | Supply Chain Managers, Procurement Officers |

The Saudi Arabia Autonomous Truck Market is valued at approximately USD 1.0 billion, reflecting significant growth driven by advancements in technology and increasing demand for freight automation in logistics.