Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3790

Pages:90

Published On:November 2025

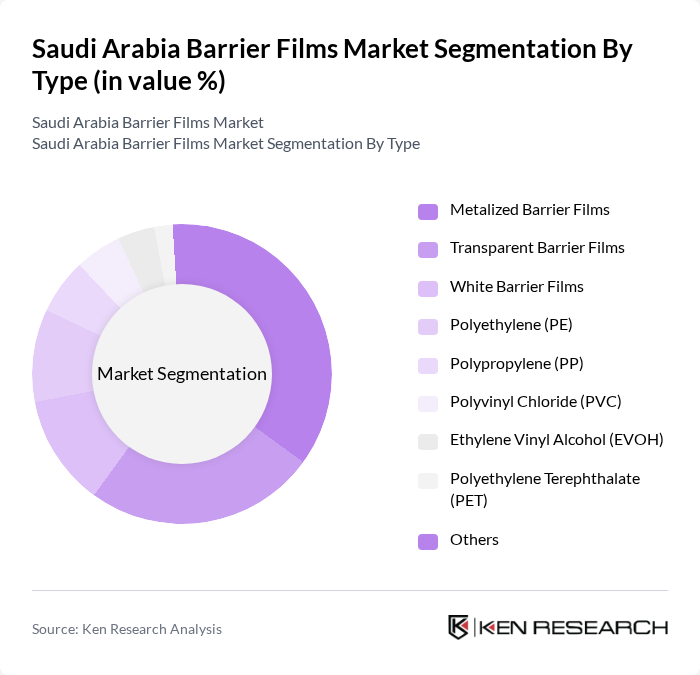

By Type:The market is segmented into Metalized Barrier Films, Transparent Barrier Films, White Barrier Films, Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Ethylene Vinyl Alcohol (EVOH), Polyethylene Terephthalate (PET), and Others.Metalized Barrier Filmsare the leading segment, favored for their superior barrier properties and cost-effectiveness, especially in food packaging and consumer goods.Transparent Barrier Filmsare widely adopted for their versatility and ability to showcase product visibility, with both segments experiencing increased demand due to the shift toward sustainable and recyclable materials .

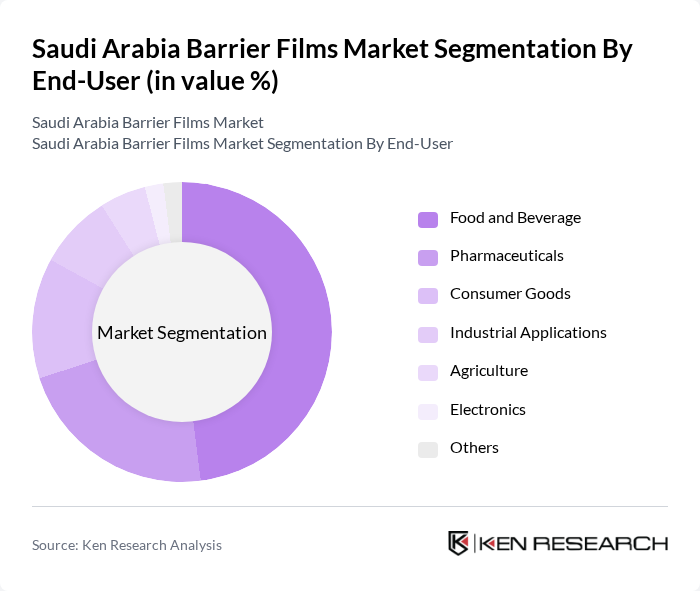

By End-User:The end-user segmentation includes Food and Beverage, Pharmaceuticals, Consumer Goods, Industrial Applications, Agriculture, Electronics, and Others. TheFood and Beveragesector is the largest consumer of barrier films, driven by the need for extended shelf life, food safety, and regulatory compliance. ThePharmaceuticalssector is also a significant contributor, as barrier films are essential for maintaining the integrity and safety of medical products. Both sectors are experiencing increased adoption of recyclable and high-performance barrier films in response to evolving sustainability standards .

The Saudi Arabia Barrier Films Market is characterized by a dynamic mix of regional and international players. Leading participants such as Napco National, Rowad National Plastic Company, Takween Advanced Industries, Arabian Plastic Industrial Company (APICO), 3P Gulf Group, Obeikan Flexible Packaging, Saudi Printing and Packaging Company (SPPC), Al Watania Plastics, Al Bayader International, Gulf Packaging Industries Limited (GPIL), Al Amer Packaging, Al Jabr Holding Co., Al Kifah Holding Company, Al-Jazira Factory for Plastic Products, and Saudi Plastic Factory Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia barrier films market appears promising, driven by technological advancements and a shift towards sustainable practices. As manufacturers invest in research and development, innovations such as biodegradable films are likely to gain traction. Additionally, the growth of e-commerce is expected to further boost demand for customized packaging solutions, enhancing product appeal and functionality. These trends indicate a dynamic market landscape with significant potential for growth and adaptation.

| Segment | Sub-Segments |

|---|---|

| By Type | Metalized Barrier Films Transparent Barrier Films White Barrier Films Polyethylene (PE) Polypropylene (PP) Polyvinyl Chloride (PVC) Ethylene Vinyl Alcohol (EVOH) Polyethylene Terephthalate (PET) Others |

| By End-User | Food and Beverage Pharmaceuticals Consumer Goods Industrial Applications Agriculture Electronics Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Application | Food Packaging Medical Packaging Industrial Packaging Retail Packaging Agricultural Packaging Electronics Packaging Others |

| By Material Composition | Multi-layer Films Single-layer Films Coated Films Laminated Films Recyclable Mono-material Films Others |

| By Thickness | Thin Films (<25 microns) Medium Films (25–70 microns) Thick Films (>70 microns) Others |

| By Customization Level | Standard Films Customized Films Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Packaging Sector | 100 | Packaging Managers, Quality Assurance Officers |

| Pharmaceutical Packaging | 80 | Regulatory Affairs Specialists, Production Supervisors |

| Consumer Electronics Packaging | 70 | Product Managers, Supply Chain Analysts |

| Industrial Applications | 60 | Operations Managers, Procurement Specialists |

| Research & Development Insights | 40 | R&D Managers, Innovation Leads |

The Saudi Arabia Barrier Films Market is valued at approximately USD 520 million, driven by the increasing demand for advanced packaging solutions across various sectors, including food and beverage, pharmaceuticals, and consumer goods.