Region:Middle East

Author(s):Dev

Product Code:KRAE0185

Pages:81

Published On:December 2025

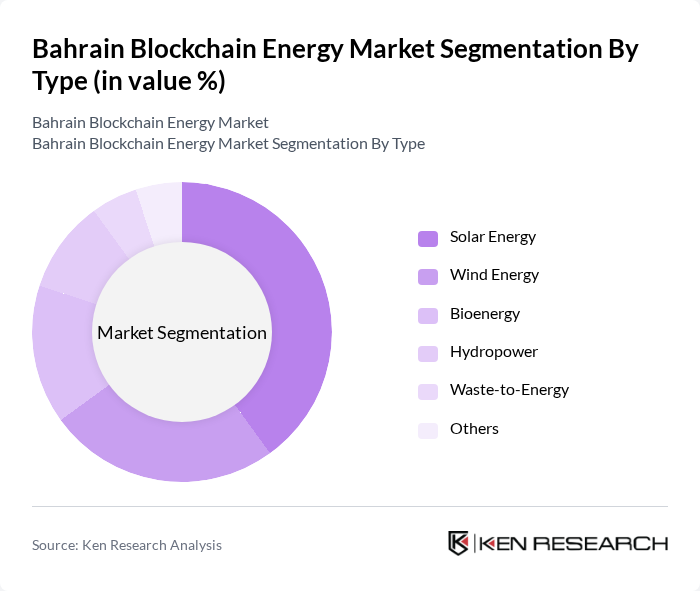

By Type:The market is segmented into various types of energy sources, including Solar, Wind, Bioenergy, Hydropower, Waste-to-Energy, and Others. Among these, Solar Energy is currently the leading segment due to its increasing adoption driven by government incentives and technological advancements. The growing awareness of renewable energy benefits and the declining costs of solar technology have made it a preferred choice for both residential and commercial applications.

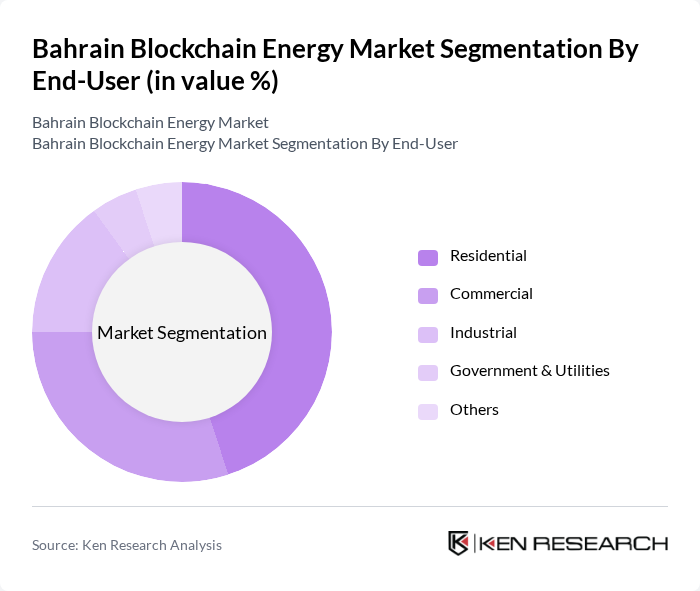

By End-User:The market is also segmented by end-users, which include Residential, Commercial, Industrial, Government & Utilities, and Others. The Residential segment is currently the most significant contributor to the market, driven by the increasing adoption of solar panels in homes and the growing trend of energy independence among consumers. This shift is further supported by government initiatives promoting renewable energy usage in residential settings.

The Bahrain Blockchain Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Petroleum Company (BAPCO), Gulf International Bank (GIB), National Oil and Gas Authority (NOGA), Bahrain National Gas Company (BNG), Bahrain Electricity and Water Authority (BEWAA), Al Baraka Banking Group, Bahrain Renewable Energy Company, Tamkeen, Bahrain Development Bank, EWA (Electricity and Water Authority), Bapco Energies, Almoayyed International Group, KPMG Bahrain, Deloitte Bahrain, PwC Bahrain contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain Blockchain Energy Market appears promising, driven by increasing government support and technological advancements. As the country aims to enhance its renewable energy capacity, blockchain technology is expected to play a crucial role in optimizing energy distribution and improving transaction transparency. The anticipated growth in smart grid technologies and decentralized energy systems will likely create a conducive environment for innovation, fostering collaboration between energy providers and tech startups to drive sustainable energy solutions.

| Segment | Sub-Segments |

|---|---|

| By Type (e.g., Solar, Wind, Bioenergy, Hydropower, Waste-to-Energy) | Solar Energy Wind Energy Bioenergy Hydropower Waste-to-Energy Others |

| By End-User (Residential, Commercial, Industrial, Government & Utilities) | Residential Commercial Industrial Government & Utilities Others |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| By Technology (Photovoltaic, CSP, Onshore/Offshore Wind, Biomass Gasification) | Photovoltaic Concentrated Solar Power (CSP) Onshore Wind Offshore Wind Biomass Gasification Others |

| By Application (Grid-Connected, Off-Grid, Rooftop Installations, Utility-Scale Projects) | Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects Others |

| By Investment Source (Domestic, FDI, PPP, Government Schemes) | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Others |

| By Policy Support (Subsidies, Tax Exemptions, RECs) | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Energy Sector Regulators | 50 | Government Officials, Policy Makers |

| Blockchain Technology Providers | 40 | CTOs, Product Managers |

| Energy Companies Implementing Blockchain | 60 | Operations Managers, Project Leads |

| Industry Experts and Consultants | 30 | Consultants, Analysts |

| Academic Researchers in Energy and Blockchain | 20 | Professors, Research Scholars |

The Bahrain Blockchain Energy Market is valued at approximately USD 3 billion, reflecting a significant growth driven by the demand for secure and transparent energy transactions, as well as the integration of renewable energy sources through blockchain technology.