Region:Middle East

Author(s):Dev

Product Code:KRAA9703

Pages:95

Published On:November 2025

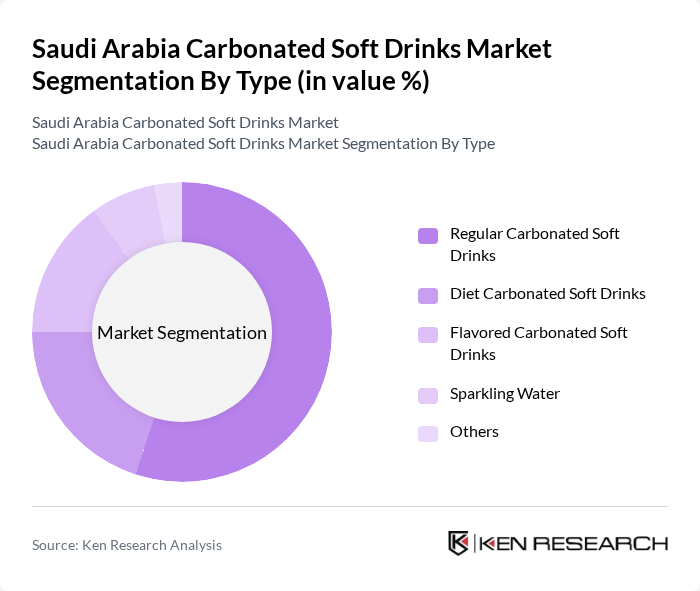

By Type:The market is segmented into various types of carbonated soft drinks, including Regular Carbonated Soft Drinks, Diet Carbonated Soft Drinks, Flavored Carbonated Soft Drinks, Sparkling Water, and Others. Among these, Regular Carbonated Soft Drinks dominate the market due to their widespread popularity and brand loyalty among consumers. The increasing trend of health consciousness has also led to a rise in Diet Carbonated Soft Drinks, although they still hold a smaller share compared to regular options. Flavored Carbonated Soft Drinks and Sparkling Water are gaining traction as consumers seek variety and healthier alternatives.

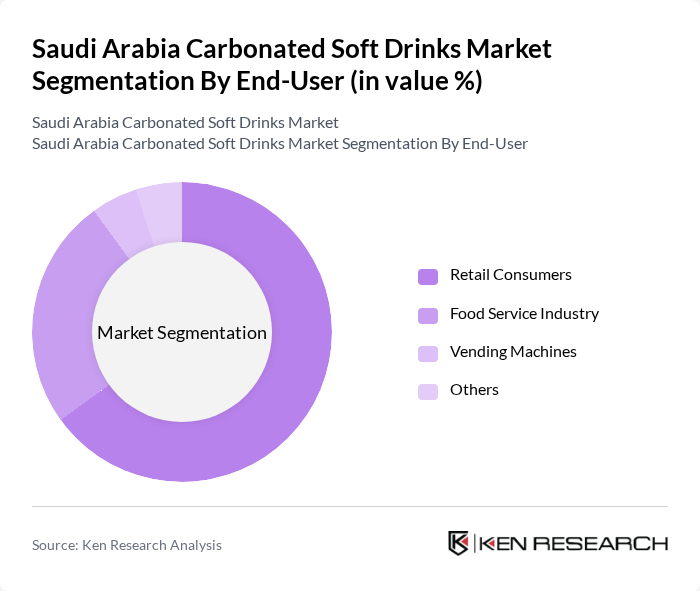

By End-User:The end-user segmentation includes Retail Consumers, Food Service Industry, Vending Machines, and Others. Retail Consumers represent the largest segment, driven by the increasing availability of carbonated soft drinks in supermarkets and convenience stores. The Food Service Industry is also significant, as restaurants and cafes contribute to a substantial portion of sales. Vending Machines are becoming more popular in public spaces, providing easy access to beverages, while the 'Others' category includes various niche markets.

The Saudi Arabia Carbonated Soft Drinks Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Coca-Cola Company, PepsiCo, Inc., Almarai Company, Aujan Group Holding, Al-Nasr Beverages, Al-Faisal Beverage Company, Al-Jazeera Beverage Company, Al-Muhaidib Group, Al-Watania for Industry and Trade, Al-Baik Food Systems, Al-Safi Danone, Al-Hokair Group, Al-Mansour Group, Al-Jomaih Bottling Plants Co., Gulf Union Food Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia carbonated soft drinks market appears promising, driven by evolving consumer preferences and innovative product offerings. As health-conscious trends continue to rise, manufacturers are likely to focus on low-calorie and sugar-free alternatives. Additionally, the expansion of e-commerce platforms will facilitate greater market penetration, allowing brands to reach untapped demographics. Strategic partnerships with local distributors will also enhance distribution efficiency, ensuring that products are readily available to consumers across various regions.

| Segment | Sub-Segments |

|---|---|

| By Type | Regular Carbonated Soft Drinks Diet Carbonated Soft Drinks Flavored Carbonated Soft Drinks Sparkling Water Others |

| By End-User | Retail Consumers Food Service Industry Vending Machines Others |

| By Distribution Channel | Supermarkets and Hypermarkets Convenience Stores Online Retail Direct Sales Others |

| By Packaging Type | Cans Bottles Tetra Packs Others |

| By Flavor Profile | Citrus Berry Cola Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Gender Income Level Others |

| By Occasion | Everyday Consumption Special Occasions Sports and Events Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Carbonated Soft Drinks | 120 | Regular Consumers, Health-Conscious Shoppers |

| Retail Distribution Insights | 90 | Retail Managers, Beverage Category Buyers |

| Market Trends and Innovations | 60 | Product Development Managers, Marketing Executives |

| Health Impact Perceptions | 50 | Nutritionists, Health Advocates |

| Regulatory Compliance and Industry Standards | 40 | Compliance Officers, Industry Regulators |

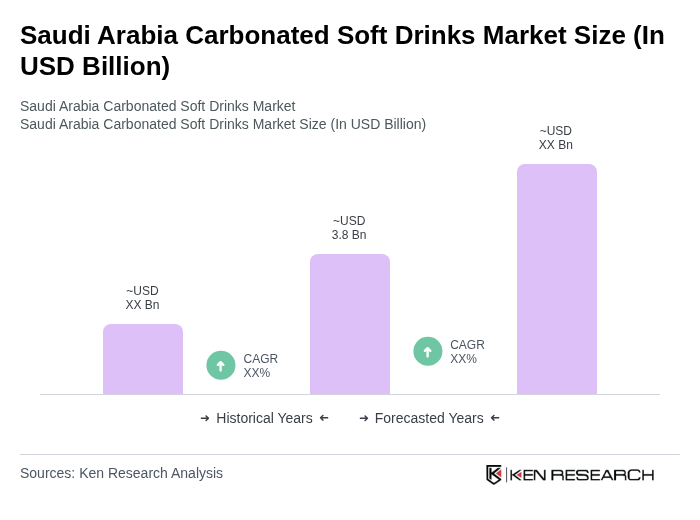

The Saudi Arabia Carbonated Soft Drinks Market is valued at approximately USD 3.8 billion, reflecting a significant growth driven by urbanization, a young population, and rising disposable incomes, which have increased the consumption of carbonated beverages.