Region:Middle East

Author(s):Shubham

Product Code:KRAD3632

Pages:92

Published On:November 2025

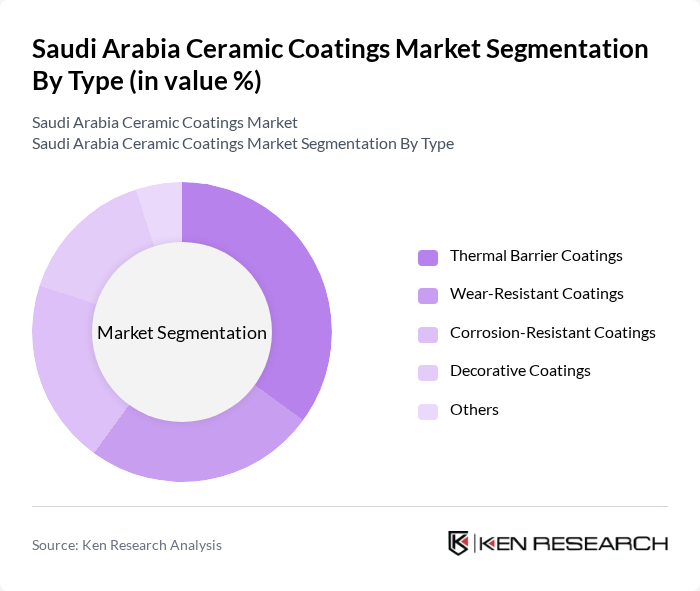

By Type:The ceramic coatings market can be segmented into various types, including Thermal Barrier Coatings, Wear-Resistant Coatings, Corrosion-Resistant Coatings, Decorative Coatings, and Others. Among these, Thermal Barrier Coatings are gaining traction due to their ability to withstand high temperatures, making them ideal for applications in the aerospace and automotive sectors. The increasing focus on energy efficiency and performance enhancement in these industries is driving the demand for thermal barrier coatings. Recent developments in nano-ceramics for aerospace applications have improved heat resistance and mechanical strength by up to 25%, further accelerating adoption in high-performance applications.

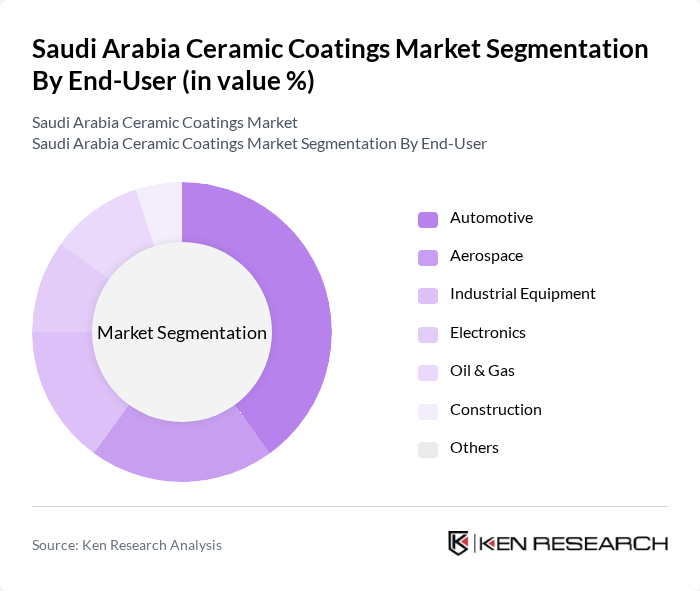

By End-User:The end-user segmentation of the ceramic coatings market includes Automotive, Aerospace, Industrial Equipment, Electronics, Oil & Gas, Construction, and Others. The Automotive sector is the leading end-user, driven by the increasing demand for lightweight and durable materials that enhance vehicle performance and fuel efficiency. The trend towards electric vehicles and stringent emission regulations are further propelling the adoption of ceramic coatings in this sector. Aerospace and defense sectors also represent significant growth drivers, where materials like alumina and silicon carbide are prized for their strength and heat resistance in components such as turbine blades and missile systems.

The Saudi Arabia Ceramic Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Ceramics Company, Al-Jazeera Paints Company, National Paints Factories, Jotun Saudi Arabia, BASF Saudi Arabia, AkzoNobel Saudi Arabia, PPG Industries, Sherwin-Williams, Hempel A/S, Dow Chemical Company, 3M Saudi Arabia, Henkel AG, RPM International Inc., Sika AG, Clariant AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia ceramic coatings market appears promising, driven by technological advancements and a shift towards sustainable practices. As industries increasingly adopt eco-friendly solutions, the demand for innovative ceramic coatings is expected to rise. Furthermore, the integration of smart technologies in coatings will enhance their functionality, catering to the evolving needs of various sectors. This trend, coupled with government support for green initiatives, positions the market for significant growth in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Thermal Barrier Coatings Wear-Resistant Coatings Corrosion-Resistant Coatings Decorative Coatings Others |

| By End-User | Automotive Aerospace Industrial Equipment Electronics Oil & Gas Construction Others |

| By Application | Automotive Coatings Aerospace Coatings Industrial Coatings Consumer Goods Coatings Infrastructure & Building Coatings Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Material Type | Inorganic Coatings Organic Coatings Composite Coatings Ceramic Matrix Coatings Others |

| By Technology | Sol-Gel Process Plasma Spraying Chemical Vapor Deposition Physical Vapor Deposition Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Coatings | 100 | Product Managers, Quality Assurance Engineers |

| Aerospace Applications | 80 | Materials Engineers, Procurement Specialists |

| Industrial Coatings | 90 | Operations Managers, Facility Maintenance Heads |

| Consumer Goods Coatings | 70 | Brand Managers, Product Development Teams |

| Construction Sector Coatings | 60 | Project Managers, Architects |

The Saudi Arabia Ceramic Coatings Market is valued at approximately USD 1.0 billion, reflecting a robust growth trajectory driven by increasing demand across various industries such as automotive, aerospace, and oil & gas.