Region:Middle East

Author(s):Geetanshi

Product Code:KRAC0004

Pages:86

Published On:August 2025

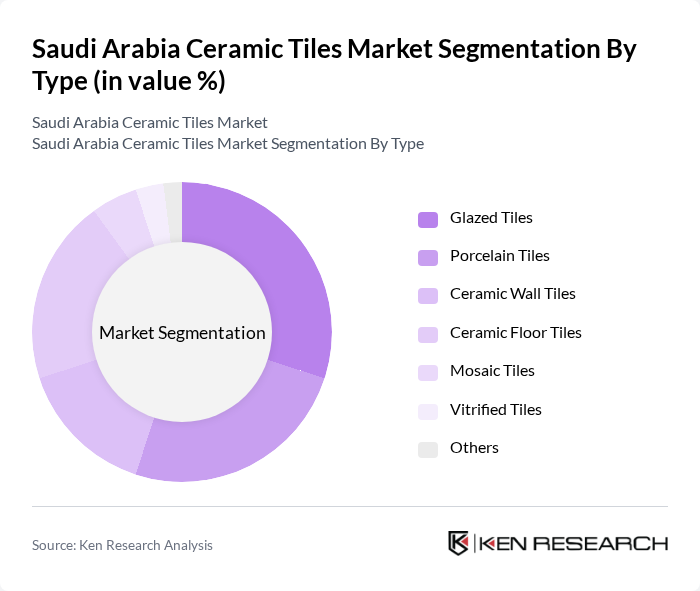

By Type:The ceramic tiles market can be segmented into various types, including Glazed Tiles, Porcelain Tiles, Ceramic Wall Tiles, Ceramic Floor Tiles, Mosaic Tiles, Vitrified Tiles, and Others. Each type serves different aesthetic and functional purposes, catering to diverse consumer preferences and applications.

The Glazed Tiles segment leads the market due to their versatility and aesthetic appeal, making them a popular choice for both residential and commercial applications. Their ability to mimic natural materials and come in various designs caters to consumer preferences for stylish interiors. Porcelain Tiles follow closely, known for their durability and water resistance, making them ideal for high-traffic areas. The demand for Ceramic Wall and Floor Tiles is also significant, driven by ongoing construction and renovation projects.

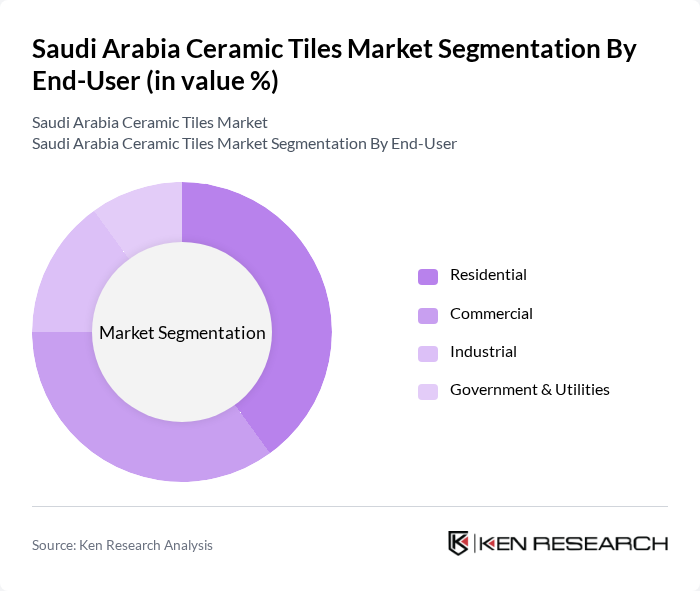

By End-User:The market can be segmented based on end-users into Residential, Commercial, Industrial, and Government & Utilities. Each segment has unique requirements and preferences, influencing the types of ceramic tiles used.

The Residential segment dominates the market, driven by increasing housing projects and consumer preferences for stylish and durable flooring options. The Commercial segment follows, with significant demand from retail spaces, offices, and hospitality sectors. Industrial applications also contribute to the market, although to a lesser extent, while Government & Utilities projects are focused on public infrastructure, which requires specific tile types for durability and maintenance.

The Saudi Arabia Ceramic Tiles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Ceramic Company, RAK Ceramics, Arabian Ceramic Manufacturing Company, Al-Jazira Factory for Ceramics, Alfanar Ceramics, Future Ceramic Company, Al-Saif Ceramics, Al-Muhaidib Group, Al-Fouzan Trading & General Construction Company, Al-Hazm Industrial Company, Al-Rajhi Group, Al-Babtain Group, Al-Suwaidi Industrial Services, Al-Saeed Group, Al-Mansour Group contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi ceramic tiles market is poised for significant growth, driven by urbanization and construction activities. As the government continues to invest in infrastructure and housing projects, the demand for ceramic tiles will likely increase. Additionally, the trend towards aesthetic interiors and eco-friendly products will shape consumer preferences. Companies that leverage technological advancements and digital marketing strategies will be well-positioned to capitalize on these trends, ensuring sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Glazed Tiles Porcelain Tiles Ceramic Wall Tiles Ceramic Floor Tiles Mosaic Tiles Vitrified Tiles Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Flooring Wall Cladding Countertops Outdoor Spaces Ceiling & Decoration |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Distributors |

| By Price Range | Economy Mid-Range Premium |

| By Design | Traditional Modern Rustic Contemporary |

| By Material | Natural Clay Recycled Materials Composite Materials Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Tile Market | 120 | Homeowners, Interior Designers |

| Commercial Tile Applications | 90 | Facility Managers, Architects |

| Export Market Insights | 60 | Export Managers, Trade Analysts |

| Retail Distribution Channels | 80 | Retail Managers, Sales Executives |

| Construction Industry Stakeholders | 50 | Contractors, Project Managers |

The Saudi Arabia Ceramic Tiles Market is valued at approximately USD 1.65 billion, driven by growth in the construction sector, urbanization, and demand for durable flooring solutions across residential, commercial, and hospitality projects.